Why More Freelancers Are Getting Paid in Crypto in 2026: Top 10 Benefits of Using Crypto Wallets and Cards

Dec 20, 2025, 12:41am

Being a freelancer in 2026 means working globally but living locally. However, there is one weak link in this formula: the traditional banking system.

While your work crosses borders in seconds, getting paid for it can take days, losing up to 15% along the way to SWIFT fees, currency conversion, and predatory platform charges.

The old model of “Client → Correspondent Bank → Your Bank” is hopelessly outdated. It is too slow, expensive, and opaque for the modern gig economy.

That is why, in 2026, professionals are mass-migrating to a hybrid crypto-model. Using modern wallets with integrated cards is no longer a fringe alternative; it is the only way to preserve the value of your work, access your money instantly, and work with clients from anywhere without bureaucratic barriers. Below are 10 reasons why your next invoice should be paid in crypto.

Editor’s Note: In this breakdown, we use Trustee Plus as the primary functional benchmark. We chose this platform because it currently offers the most complete “Freelancer Toolkit” on the market: a seamless combination of crypto-storage, banking rails (IBAN), and direct card issuance. It serves as a prime example of how fintech can solve the specific pain points of digital nomads.

1. Global Payments in Seconds (No Borders)

A traditional SWIFT transfer can take 3–5 days, getting stuck over weekends or pending correspondent bank checks. In 2026, waiting a week for your own money is an unaffordable luxury.

- The Solution: Crypto transfers operate 24/7/365.

- Trustee Plus Benchmark: You receive your fee in USDC or Bitcoin from a client in the US or Asia instantly. Funds are available for spending immediately after network confirmation, regardless of banking holidays.

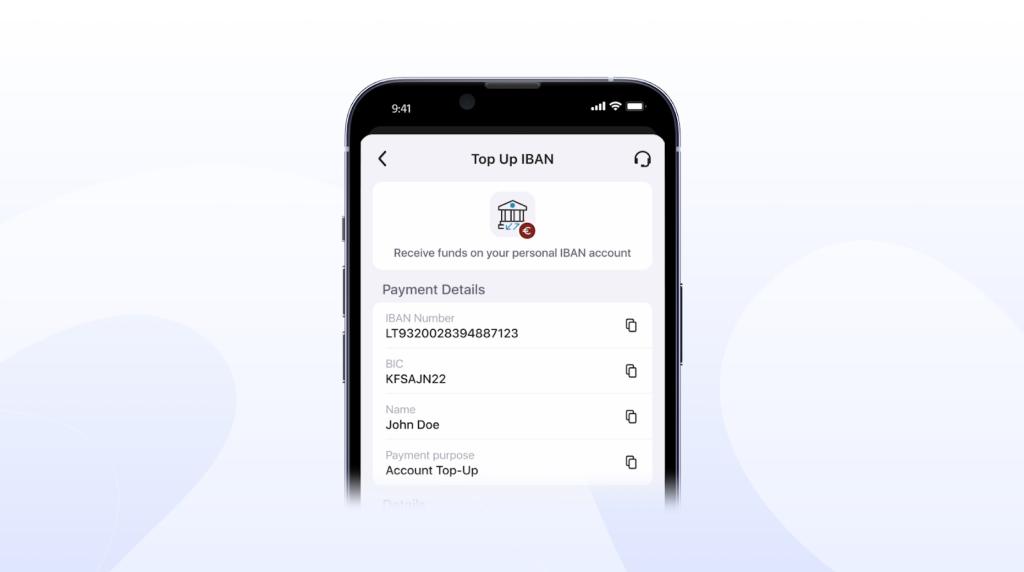

2. Personal IBAN for Corporate Clients

Many companies in the EU and US are willing to hire freelancers but cannot (or will not) pay to crypto wallet addresses due to accounting rigidity. They need a bank account number.

- The Solution: Hybrid wallets providing personal Euro account details.

- Trustee Plus Benchmark: You provide the client with your personal IBAN (embedded in the app). For the client, it’s a standard SEPA transfer in Euros; for you, it’s a direct deposit into your wallet, where you can instantly swap it to USDC or spend via crypto card.

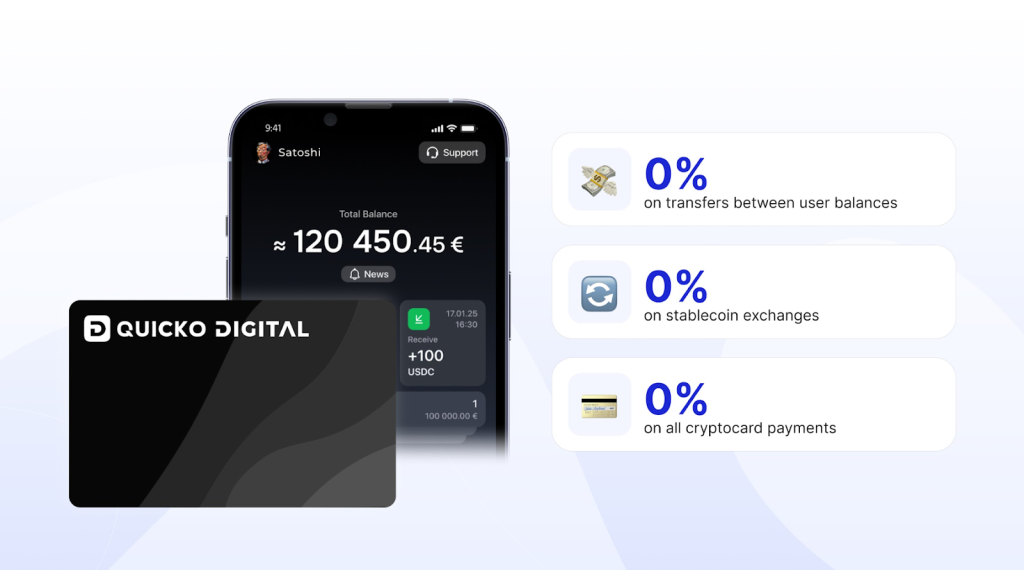

3. Cutting the “Middleman Tax” (Zero Waste)

Freelance platforms (Upwork, Fiverr) and payment processors (PayPal, Payoneer) can eat up 3% to 10% of your income through fees and poor exchange rates.

- The Solution: Direct stablecoin transfers minimize leakage.

- Trustee Plus Benchmark: Crypto deposits incur 0% fees. You receive exactly the amount the client sent, without sharing a cut with intermediaries.

4. Protection Against Devaluation (Stablecoin Salary)

Receiving a salary in the local currency of a developing nation is risky – inflation can wipe out 20% of your purchasing power in a year.

- The Solution: Fixing your rate in digital dollars (USDT/USDC).

- Trustee Plus Benchmark: The wallet allows you to hold your savings in stablecoins, shielding your capital from FX volatility. You only convert to fiat the exact amount needed to buy bread or gas at the moment of purchase.

5. Instant Cash Out

Previously, turning crypto into cash required sketchy P2P exchanges, risking scams or bank freezes.

- The Solution: Linking a crypto account directly to a physical card.

- Trustee Plus Benchmark: Using the card (virtual or plastic), you can withdraw cash from any ATM worldwide that supports NFC. Crypto is converted to local currency (EUR, PLN, etc.) automatically at the moment of dispensing.

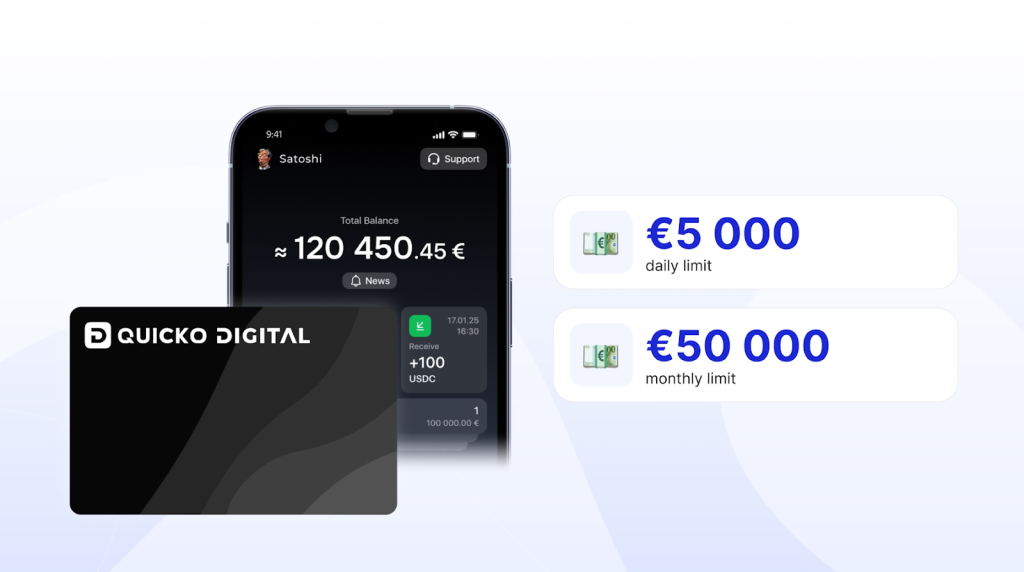

6. High Limits for High Earners

Traditional banks often flag accounts for “suspicious activity” if you try to make a large purchase (like a high-end laptop) or if your spending exceeds a low daily cap.

- The Solution: Crypto cards designed for the digital economy offer significantly higher thresholds.

- Trustee Plus Benchmark: With daily limits up to €5,000 and monthly limits of €50,000, the card accommodates the lifestyle of successful professionals who don’t want to call support to “ask permission” to spend their own money.

7. Borderless Work Environment

Freelancers often lose contracts simply because a client cannot send money to their specific country due to local banking restrictions or sanctions unrelated to the freelancer.

- The Solution: Cryptocurrency ignores political borders. The blockchain works wherever there is internet.

- Trustee Plus Benchmark: You can accept payment from a client in any region. As long as you have internet access, you are open for business.

8. Instant Digital Onboarding

Try opening a bank account in the EU as a non-resident without a residence permit and utility bills. It is a bureaucratic nightmare.

- The Solution: Fully digital verification in 10–15 minutes.

- Trustee Plus Benchmark: No paperwork binders or branch visits. You download the app, verify via Passport or ID (with Digital ID integration support), and instantly receive a working European IBAN and card.

9. Smart Invoicing & QR Payments

Dictating a long wallet address or bank number is friction that leads to errors.

- The Solution: Payment via QR code or phone number.

- Trustee Plus Benchmark: You can simply show a client a QR code from your screen, or if the client also uses Trustee, receive a transfer by phone number instantly and fee-free. It makes getting paid as easy as sending a Telegram message.

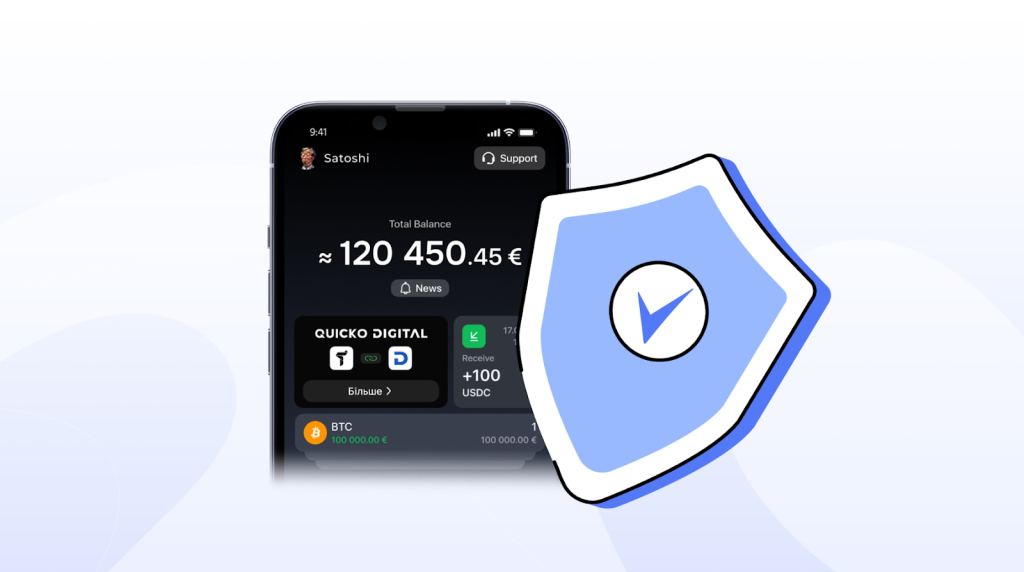

10. The Hybrid Security Model

Keeping all earnings on a card is unsafe, but keeping them in cold storage is inconvenient for spending.

- The Solution: A “Vault + Wallet” structure.

- Trustee Plus Benchmark: You can keep your main savings in the non-custodial Trustee Wallet, and transfer only the weekly budget to your Trustee Plus card. Transfers are instant. This isolates your main capital from card-related risks.

Conclusion: Upgrade Your Financial Infrastructure

In 2026, clinging to traditional banking for freelance work is like using a fax machine in the age of email. It works, but it costs you time, money, and opportunities.

The transition to a hybrid crypto-financial model gives you the best of both worlds: the speed and independence of Web3 combined with the spending power of a MasterCard. Platforms like Trustee Plus have removed the technical barriers – now, the only limit to your freedom is your own choice of tools.

Prominent crypto media Incrypted acknowledges Trustee Plus as one of the best crypto cards available on the market today.