Fidelity in Final Testing of Custody Platform, Bear Market Hits NEM

Feb 4, 2019, 6:18PM by Kevin George

by Kevin George

Fidelity Digital are in the final stages of testing for their much-awaited custody platform. The bear market has floored the NEM foundation.

Fidelity Digital

Fidelity Digital stated in a recent blog post that the investment group is in the final testing phase of its cryptocurrency custody platform.

Since our initial announcement in October we have continued to build the technical and operational capabilities needed for securing, trading and supporting digital assets with the exacting oversight required by institutional investors.

Our initial clients are an important part of our final testing and process refinement periods, which will eventually enable us to provide these services to a broader set of eligible institutions.

A report from Bloomberg last week said that Fidelity would launch in March. The company has since declined to commit to a specific date but their initial plans for Q1 look to be correct. The introduction of a secure custody platform has brought excitement to the market since it was first muted in October as it opens the door for professional investors to get involved without some of the typical risks.

Fidelity made an exciting statement in a previous blog post which recognized cryptocurrencies as a store of value:

Digital assets may soon become recognized as investable “stores of value,” tradable on global, licensed exchanges, and accessible to a broad swath of individuals and institutions across the globe.

The recent decision by the Bank of England to block Venezuelan President Nicolas Maduro’s request to withdraw $1.2 billion of the country’s gold, highlights the risks of centralized value stores and is another reason that governments have tried to resist the decentralized market.

It will be interesting to see what happens to market volumes and prices once the Fidelity platform is fully live and finally open to institutions.

XEM

The cryptocurrency bear market has claimed its first big name victim with the news that the NEM foundation is struggling and only has one month of money left. The foundation is considering a move to request $7.5 million from the community to avoid layoffs amongst its 150 staff.

It has since been noted that NEM has already applied for funding from an established venture capital firm. The foundation is going through an organizational restructuring in an attempt to create a more sustainable future.

The price of XEM has been struggling in recent months and this has accelerated as the awareness of the financial position at the foundation became clear. XEM is down almost 4% over the last 24 hours and the market cap is $350 million. The mild downward momentum on the recent news would suggest that investors expect NEM to find a solution to the current problems. For those who believe in the project, the coin is trading at a 50% discount from its price at the end of 2018.

LTC

Litecoin has been one of the better performers with a gain of over 8% on the week. Investors are looking ahead to the upcoming block rewards reduction. Although it is still six months away, the LTC community is buzzing about the prospect of price gains after similar events in the past saw a strong rally.

It will remain to be seen if this was simply a coincidence of a broader market rally.

Halving is where miners have their block rewards for mining split in half after a target number of coins have been mined, a process which is intended to protect the limited supply of coins.

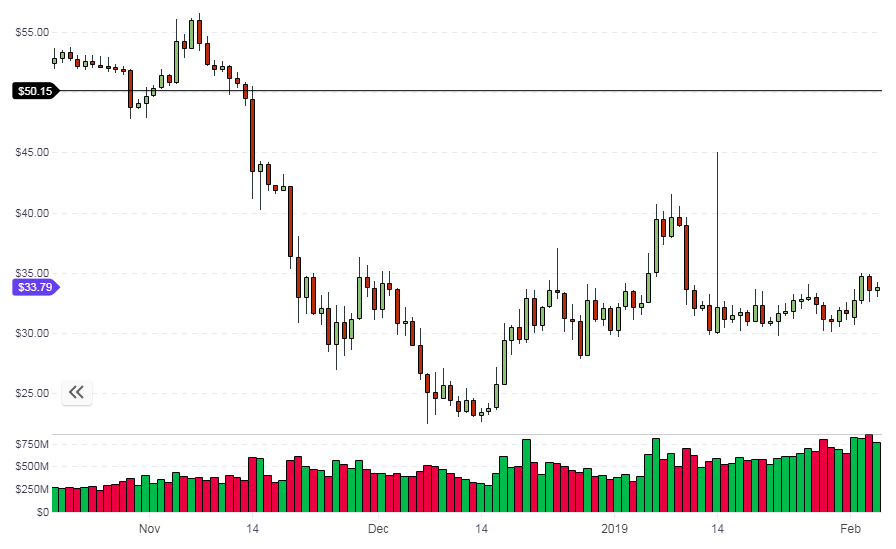

The price of LTC is currently trading at $33.79 and similar to Bitcoin, we are still in a range created from the mid-December bounce. LTC may look to test $40.00 next and attempt to take the $50.00 level once more if the overall market can rally.

REP

The price of Augur’s REP token has been another good performer in the last few days as the general market has been sluggish.

REP is still consolidating the recent rally and the latest bounce will see if it can hold these levels and continue higher. The price of REP is trading around $13.80 and the resistance ahead for REP is at the previous highs of $20 and the April lows of $25.00

Another Bitrates writer has provided a good write-up on the Augur prediction markets and protocol, which also discusses some possible use cases.

The overall market is still trading in a mixed fashion but the lows of December remain intact. We may only be four-to-six weeks away from institutional volumes and that would appear to be the next catalyst as the financial markets keep shrugging off risks and avoiding safe haven moves to cryptocurrencies.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.