Tether Recovers to USD Parity, IOST and BNT Analysis Oct. 29

Oct 29, 2018, 12:14PM by Kevin George

by Kevin George

The price of Tether has recovered to trade near the $1 USD parity again. Analysis of the IOST project and BancorX platform is released.

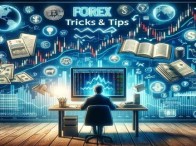

USDT

The price of Tether has recovered to trade near the $1 USD parity again. The move comes after tether announced it had burned 500 million coins. Tether’s website confirmed,

Over the course of the past week, Tether has redeemed a significant amount of USDT from the circulating supply of tokens.

The move by Tether is likely an attempt to reinstate the parity after the 14th October sell-off saw the stablecoin trading as low as 86 cents. Both tether and Bitfinex, which has close ties with the coin, have been fending off criticism regarding the number of reserves that the project has for meeting the 1:1 dollar parity. Burning 500 coins reduces the number of reserves required to be held. In this instance, nearly $500 million dollars has been freed up to allocate elsewhere.

Tether now faces competition in the stablecoin market and has been criticized over a lack of transparency regarding the reserves and the lack of a stricter audit. A Bitrates writer noted that competitor coins are not offering this either:

While Tether has been berated by the community for failing to produce a full audit proving they have the USD reserves to back their stablecoin, none of the newer stablecoins, including TUSD (TrueUSD), GUSD (Gemini), PAX (Paxos), and USDC (Circle) have provided full audits either.

An article by the Financial Times today has stated that the major accountancy firms, including EY, PwC and KPMG are starting to move into the sector. This should help to bring further legitimacy to blockchain technology and the projects and ICOs that lack transparency.

The recent activity in tether has seen a recovery to the $0.987 level in USDT. The panic is over for now, yet it will be interesting to watch the actions of Tether in the coming weeks. If we see another coin burn, it may suggest that the project is under pressure to meet its stated reserves. With new stablecoins on the market, USDT’s dominance will be tested in the months ahead.

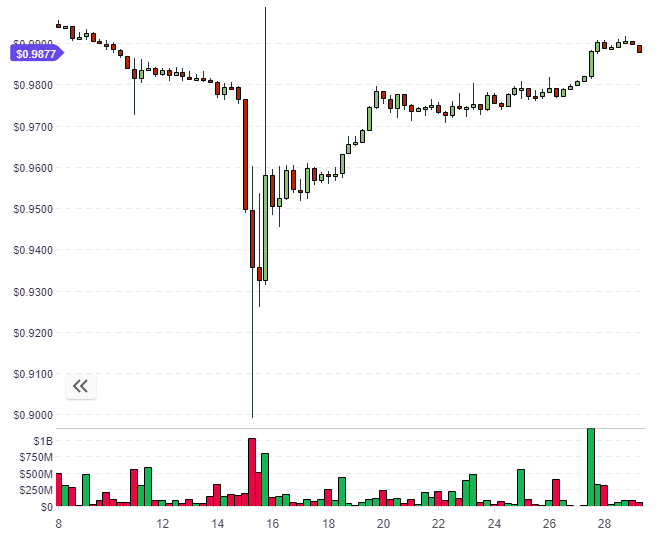

IOST

The price of IOST is up 6% in the last 24 hours and currently trades at $0.0130. The weekly chart is showing that this is a potential bottom in the coin if we can see a stronger rally to close above $0.0150.

IOST states that its mission is,

to be the underlying architecture for the future of online services.

IOST has its roots in China but now has a global presence with office locations including Berlin and San Francisco. Among the project’s investors are Huobi and the Silicon Valley firm Sequoia. The venture fund were early investors in projects such as Airbnb, Linkedin and Instagram. Sequoia has a history of spotting early stage growth companies and their involvement could hint at a bright future for IOST.

The weekly tech updates provided by the project’s developers are in-depth and help to track the progress against the roadmap. The current outline for Q4 2018 includes a release of the V2.0 Everest public testnet and an external security audit of the network. This sets the project up for a full launch of the IOST mainnet (V1.0 Himalaya) in Q1 of 2019. Sidechain support will follow in the next quarter. IOST is building a decentralized network with scalability.

Another plus for the project is the experience of its core team, which hails from top universities such as Harvard, Princeton, Brown and Berkeley; as well as tech the firms, Uber, Google and LinkedIn.

Currently ranked at number 63 in the list of coins by market cap, the IOST token has a value of $150 million. One drawback for the valuation of IOST is the large supply of coins. The project currently has 8.4 billion coins in circulation, with total supply potential of 21 billion. This certainly helps their scalability goals but it may keep a lid on the token’s future price. Despite this, IOST’s current circulation is the 13th largest, yet it still sees them listed below some key projects such and Tron, XRP and Cardano. If IOST meets its full supply it would still have less circulation than nine other coins and would be lower than the competitors noted.

As a rough estimate, we can therefore expect IOST’s price to meet the valuation of its competitors if the project can find traction and solid use cases or big-name partnerships. Cardano’s 25 billion circulation and $0.07 would be a fair target to aim for and would represent a 460% increase from the current level.

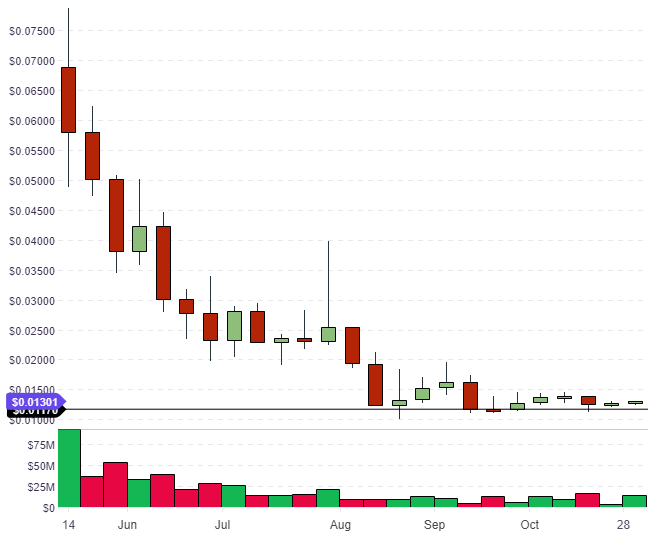

BNT

Bancor’s token BNT is still struggling from a July hack that saw $13.5 million stolen from the platform. The price at the time of the breach was $3.00 and this collapsed by 50% in August and September. The market still trades lower at $1.33 with the $1.50 level now showing a clear resistance target. If BNT can get above this level then it’s possible that it can reclaim its previous valuation.

Bancor is a blockchain protocol that allows users to convert between different tokens directly, rather than exchanging them on cryptocurrency markets. The project aims to support liquidity in smaller tokens with less volume.

Bancor has recently announced a bug bounty on Twitter where users can find issues in the code for its upcoming BancorX platform. Winners can receive up to 500,000 BNT.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.