Bitcoin, Ethereum, and Major Altcoin Analysis February 27th

Feb 27, 2018, 10:23pm

Most cryptocurrencies showing an upswing today led by NEO at 20%. Bitcoin and BitcoinCash is showing volatility, Ethereum showing more stability.

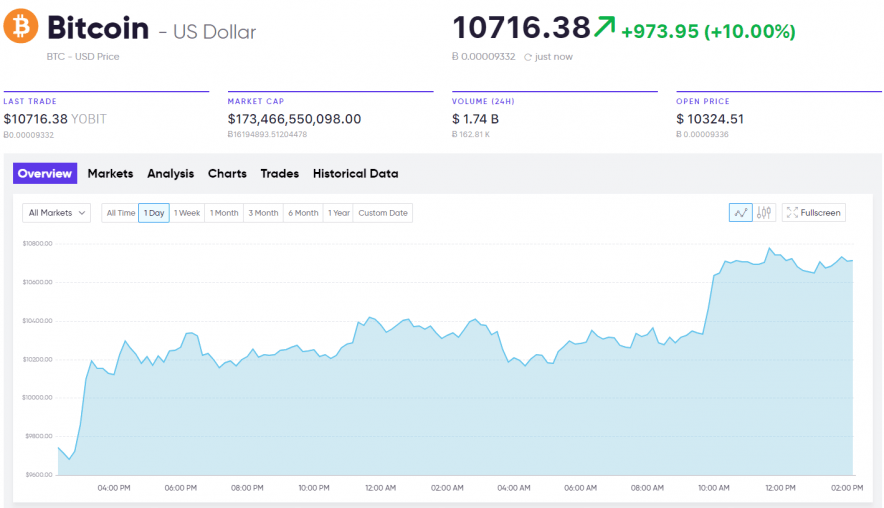

The total cryptocurrency market is now worth approximately $464 billion following an overnight rally in several major assets. Out of the 10 largest cryptocurrencies, NEO leads the pack with a 20% surge in just 24 hours. Bitcoin and Bitcoin Cash are up 12% and 11% respectively, and Bitcoin dominance rests at just under 40% of the market.

Bitcoin and Bitcoin Cash

2/27/2018 sees Bitcoin bounce back from a weeklong decline that saw prices drop from a recent high of approximately $11,700 to $9,500. Bitcoin now sits at a little under $10,800 per coin, but technical investors may want to wait and see if momentum pushes prices past the $12,000 mark before considering a long position.

Bitcoin cash displays similar price action, with prices bouncing back from recent lows and showing a promising surge in momentum. Trade volume in both assets remains healthy.

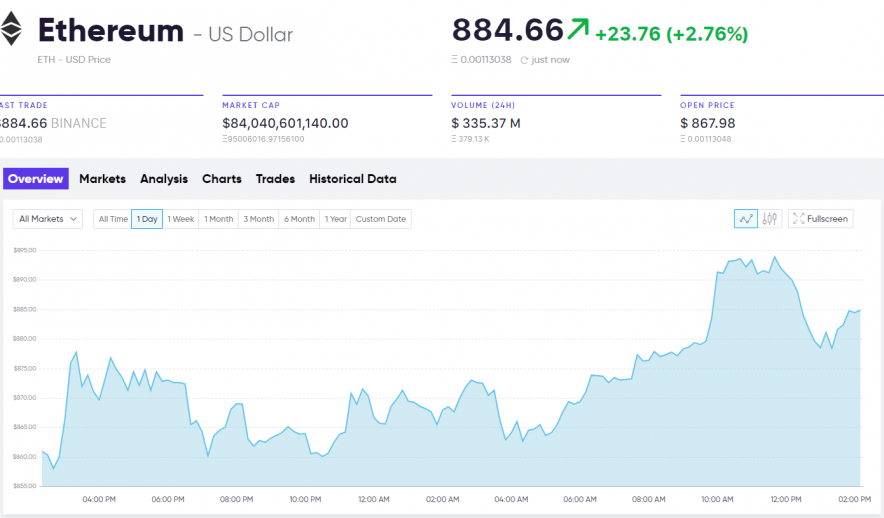

Ethereum

Ethereum prices have recovered from recent lows and now sit close to the important psychological level of $900. Nevertheless, while Ethereum prices have been on a positive trajectory since 2/24/2018, volatility remains low relative to Bitcoin and the other major assets. The single-digit movement is lackluster compared to today’s double-digit surge in several other coins.

Altcoins

The altcoin sector has seen some explosive positive moves, with several little-known assets surging in value. Today’s biggest gainer is an asset called EA Coin which more than doubled in value after months of consistent decline. Better-known assets like Ripple and NEO have also performed positively with rallies of around 4% and 20%, respectively.

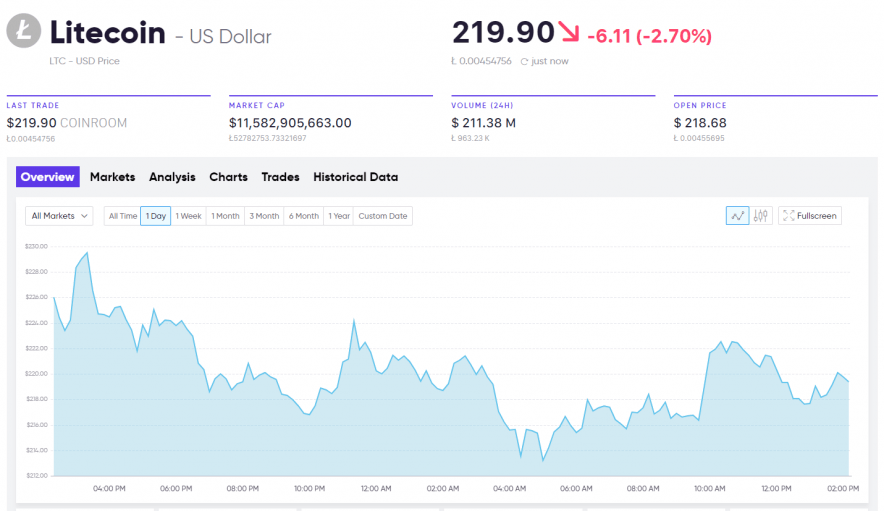

Litecoin is the only major coin to start 2/27/2018 in the red – down almost 2% at the time of writing.