Bitcoin Flat in Another Slow Week for the Crypto Market, OKB, SOL, AAVE, Dec. 26

Dec 26, 2022, 4:57PM by Kevin George

by Kevin George

BTC up by only 0.6% for the week. OKB boosted by the Musk effect. SOL weak after another recent hack. AAVE boosts network security.

BTC

Bitcoin could only return a gain of 0.6% in another quiet week for crypto markets.

Continued pressure on the Binance exchange and its finances have blighted the outlook for the market over the last seven days. Stock markets have also been weak over the last few weeks as markets see continued interest rate increases by central banks and that has also weighed on crypto values.

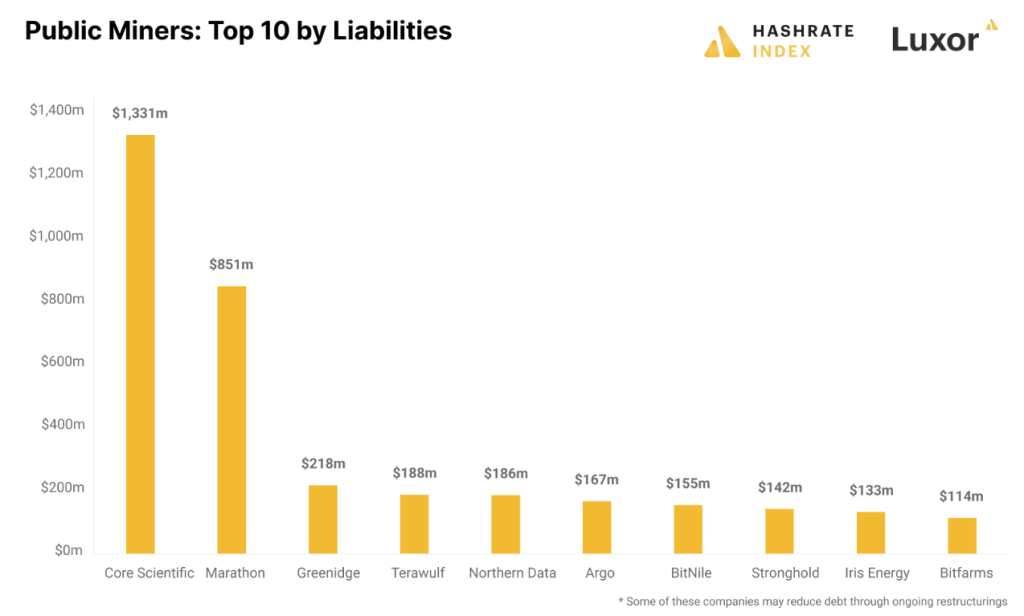

The ongoing bear market has hurt the Bitcoin mining industry after taking on sizeable debt loads during the bull market of 2021. The top 10 cryptocurrency mining debtors are said to owe more than $2.6 billion, according to Hashrate Index, while the collective debt of all miners is $4bn.

Due to falling sales and the slump in BTC, miner Core Scientific has filed for Chapter 11 bankruptcy protection. The majority of convertible note liabilities totaling $851 million belong to Marathon, the second-largest debtor. If other firms in the mining space go bankrupt then it could affect the price of crypto tokens via forced selling to meet liabilities.

Miners across the U.S. also halted operations over the weekend due to the storms sweeping across North America. The Bitcoin mining hash rate, a measure of computing power on the blockchain, was lower by around 100 exahash per second (EH/s), or 40% according to BTC.com.

It returned to about 250 EH/s as of Dec. 25. The price of ETH was trading at $1,183 but the last week’s bearish action could be a negative for the token. The support comes in at $1,100 and $1,000 for the coming weeks.

The price of Bitcoin on the weekly chart is trading at $16,858 and the resistance at $17,605 is a worry if the market cannot get back above that level.

OKB

Elon Musk is still having an unintended influence on cryptocurrency projects after a rally in the price of the OKB token.

Musk followed the Twitter account of the OKX crypto exchange and caused its native token to rally over 10% this week.

OKB is currently the seventh-largest crypto exchange by trading volume with a 24-hour volume of $487 million. That is small compared to Binance’s $6.25 billion, but close to the $575 million total for the second-placed Coinbase. Binance is also under threat because of its finances as market participants question the safety of their funds.

It was also noted that similar to FTX’s native exchange token, the BNB token does not have any listings on other major exchanges. Lucas Outumuro, head of research at IntoTheBlock, told CoinDesk:

Exchanges probably do not list BNB as they see it as a security given the centralization of their network. It's probably not worth U.S. exchanges risking listing a security especially if it's a competitor's token.

Binance CEO Changpeng Zhao has been trying to reassure staff and users that the exchange is in good health. That followed $1.14 billion of withdrawals from the exchange in just 12 hours as traders feared negative attention. Zhao said the large withdrawals were "handled with ease" and "things seem to have stabilized".

The price of the OKB token is $22.99 and the token has held up well compared to other coins in the bear market. There could be further gains ahead if Musk looks to use the exchange for a Twitter wallet or some other collaboration.

SOL

Solana was one of the weaker coins in the top twenty this week after another recent hacking problem.

Solana’s DeFi protocol Raydium announced recently that a hacker had overtaken the organization’s “owner authority,” and used it to drain Raydium’s liquidity pools. The hacker was able to steal over $2.2 million worth of tokens, including $1.6 million worth of SOL.

For Solana, it is another embarrassing breach of its architecture after previous hacks and security problems, which have caused damage to the project’s market capitalization. Raydium is one of the largest decentralized finance protocols on Solana, and is considered to be one the stars of the Solana DeFi ecosystem.

Back in August, $8 million was taken from Solana hot wallets in another hack. That followed a late-July attack on a Solana-based stablecoin NIRV losing 85% of its value after a flash loan attack on its yield protocol Nirvana Finance.

Solana will be hoping for a better 2023 after losing 93% of the SOL token value year-to-date. The price of Solana is trading at $11.33 but there is potential to drop below the $10 mark with the chart looking weak.

AAVE

The AAVE lending platform could see a positive week after moving to enhance the security of its own network.

The project will use Chainlink’s Proof of Reserves tool to protect tokens on its Ethereum-based network and also bridged assets on Avalanche, as exchanges seek to enhance their security in the wake of the FTX collapse.

Max Melcher, go-to-market lead of proof of reserve at Chainlink Labs, told CoinDesk that proof of reserves allow decentralized technologies to accurately report on reserve values, rather than trusting a single party to do so.

Leveraging Chainlink Proof of Reserve, Aave can verify that bridged assets accepted on the platform are fully collateralized before allowing users to borrow against them.

AAVE currently trades around the $55 mark and could build on that as the market absorbs this latest development to boost security. The project is currently ranked at number 45 in the list of coins with a market cap of $784 million.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.