BitGo Co-Founder Argues “HODLing” Is 720x More Effective than Coin Utility

Jun 26, 2018, 12:00pm

Ben Davenport, co-founder of BitGo, believes “Hodling” is 720x more effective than coin utility when driving demand for digital assets.

Ben Davenport, co-founder of BitGo and well-known crypto-guru believes “Hodling” is 720x more effective than coin utility at driving the demand, and therefore the value, of a digital asset. His assessment comes as a response to a recent tweet by Vinny Lingham, founder of the blockchain identity platform Civic and a well-known TV personality from the South African version of the “Dragons Den” reality TV series.

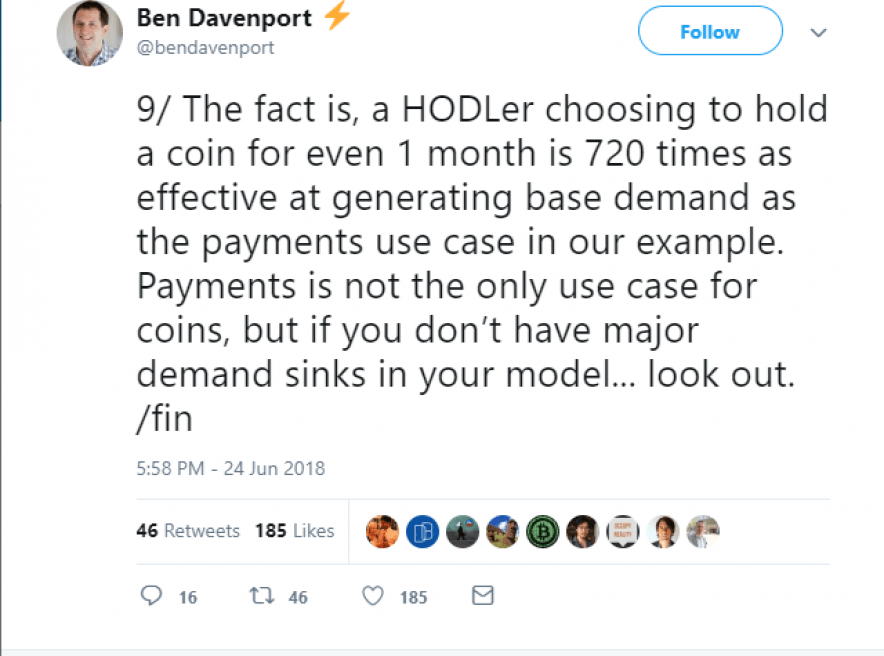

In his 9-part tweet, Davenport counters Lingham’s earlier statements regarding the necessity of practical usage (utility) for crypto tokens.

In Lingham’s view, crypto tokens must find a practical utility other than that of a speculative asset in order to establish a solid baseline of demand. This, in turn, will support the price of the asset when speculative markets cool.

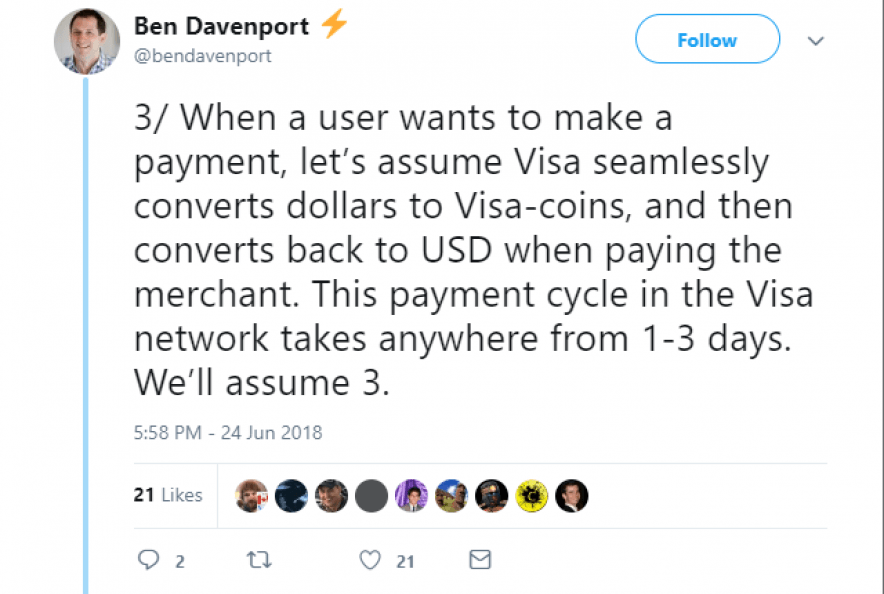

Davenport dissects Lingham’s argument using Visa, which, being an existing global payment processor, serves as a useful hypothetical example. Davenport describes the economics behind the hypothetical “Visa Coin”, a payment coin used to exchange USD between consumers and merchants.

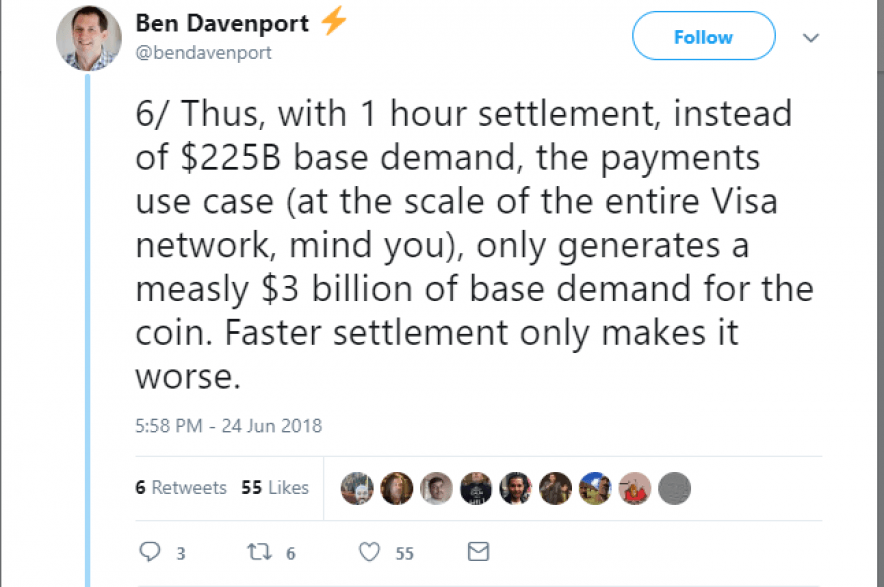

Because of the 3-day payment cycle, Davenport calculates the market cap (base demand) of Visa Coin to be $225 Billion. A 3-day payment cycle is not an ideal turnaround time for payment processing. Davenport suggests Visa Coin would be more widely adopted and used with a 1-hour turnaround time. Somewhat counterintuitively, Davenport shows that this increase in utility actually drives the price down.

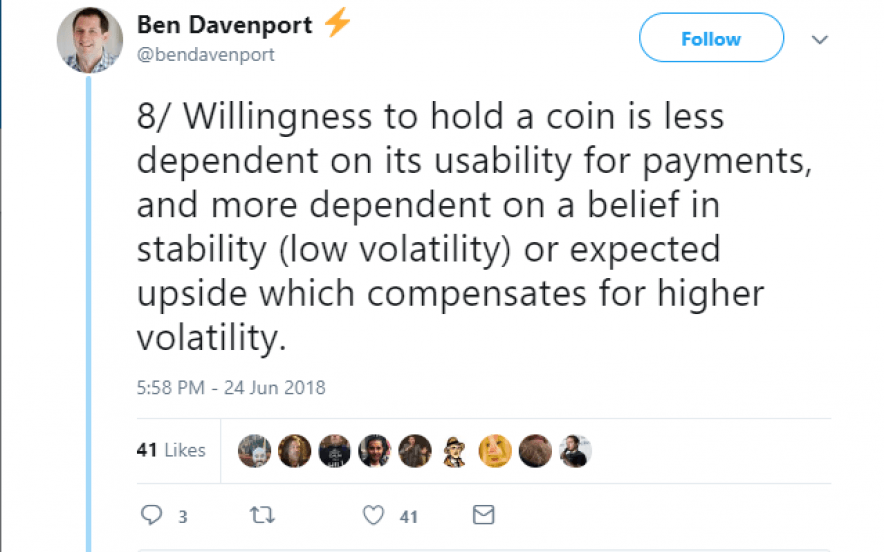

Ultimately, Davenport concludes that utility and usage are not as effective at driving base demand when compared to long-term holding, and he suggests that speculation and stability are better incentives for “HODLing” than practical use cases.

Using numerous examples, Davenport shows that “HODLing” is actually 720x more effective at driving demand than an effective payment use-case is.

While Davenport’s examples are somewhat simplistic, his overall message is clear, digital assets do not need to serve a purpose in order to be valuable, they can retain value simply as speculative assets or stores-of-value. Many believe this to be true, but cryptocurrencies remain elusive as regulators continue to struggle to define what crypto really is. Until all cryptos can be defined as securities, currencies or utility tokens, crypto-pundits will continue to argue and discuss over the underlying value of today’s digital assets.