CEO Believes Bitcoin ETF Is Around the Corner. BTC ETH, LTC and XLM Analysis: July 31

Jul 31, 2018, 11:55AMWhat are the possible Bitcoin trade setups? Get the Bitcoin strategies for the day as well as trade ideas for Ethereum, Litecoin and Stellar.

The US Securities and Exchange Commission may have rejected the application by the Winklevoss twins for the listing of their Bitcoin ETF for the second time, but there are other applications pending and new ones in the works. This has continued to stoke enthusiasm among cryptocurrency watchers that the long-awaited entrance of the institutional players into the cryptocurrency market may not be so far away.

One of those who believe that we shall soon see a Bitcoin ETF in the market in no distant time is Kin Wai Lau, CEO of venture capital firm Fatfish Internet Group. In an exclusive CNBC interview, Lau believes that institutional adoption is not far off and that this will drive a massive global interest in cryptocurrency-based products.

However, not all the cryptocurrencies are being buoyed by the enthusiasm of major voices in the market. But we do have some interesting setups presently. So as we head into the eighth month of the year, what is the outlook for 4 of the top cryptocurrencies?

BTC/USD

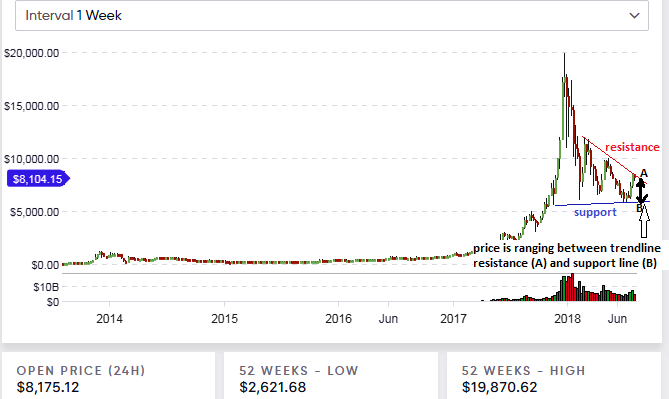

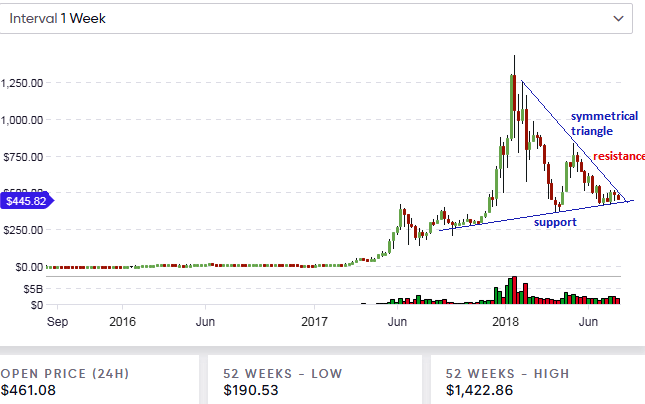

To understand why Bitcoin/USD has been unable to hit the $9000 major resistance after several attempts in the last two weeks we need to look at the weekly chart for a long-term view of what is happening to the BTC/USD pair.

We can see that long-term. Prices are presently at a trendline resistance, which is why the bulls have been unable to push the price of BTC/USD anywhere above the $8,300 to $8,500 mark. Unless there is a fundamental influence in the market (such as major announcements regarding institutional involvement in the market), it would be difficult for the bulls to push beyond this point. We will, therefore, see prices trading in the A-B range (see chart above) for some time to come.

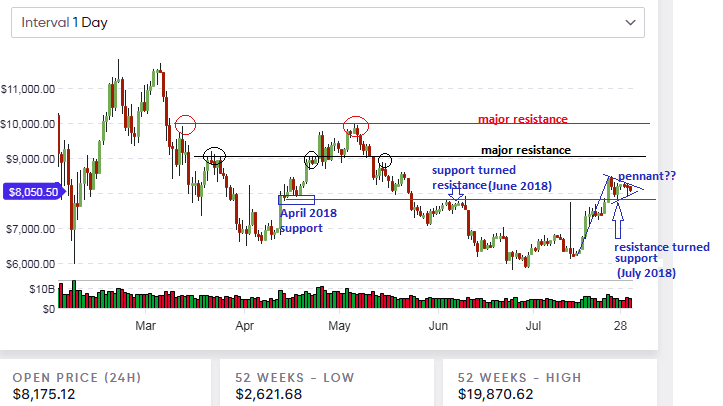

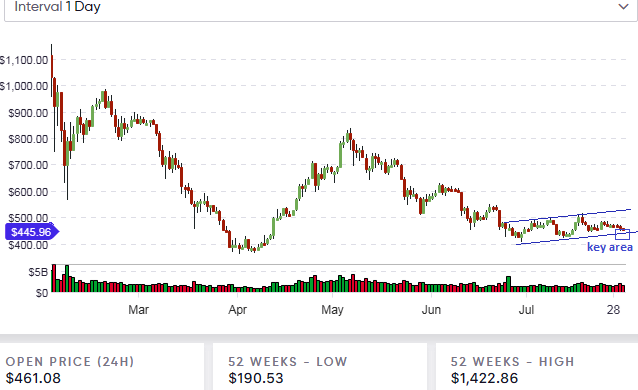

Medium term, Bitcoin is seeing the formation of what looks like a bullish pennant. So it is possible that we will see limited upside, but not by much. Price would have to break out of the pennant formation to the upside for this to happen.

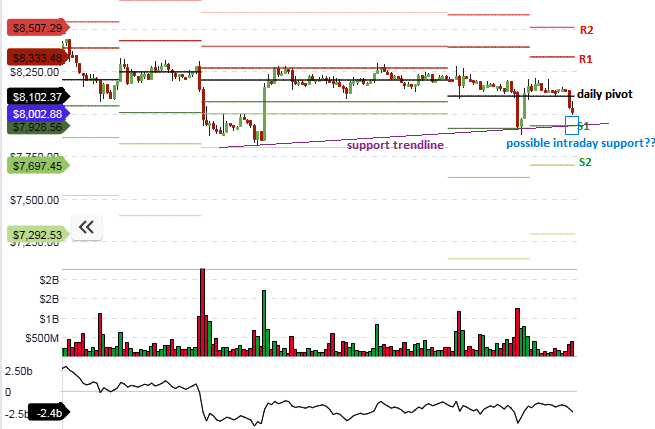

Presently, the price is in the consolidation stage in the pennant formation, with price action now pushing to the lower border of the pennant after being resisted at the upper border. This situation now opens the door for the intraday traders to fashion out day positions using the pivot points.

The On Balance Volume indicator is turning downwards, and the volume bars are showing gradually increasing reddish bars, which indicate some selling pressure in the market at the moment. This corresponds to the scenario seen on the daily charts, where prices are heading down from the upper border of the pennant. However, prices are expected to find support at the S1 pivot, which will correspond to the rising support trendline (purple line) that corresponds to the lower border of the pennant on the daily chart.

However, traders must watch out for the behavior of the price bars/candles as it approaches S1, the rising support line or the lower trendline bordering the pennant. If there is no closing penetration to the downside that invalidates the pennant, expect a quick bounce off the S1 support as prices maintain their ranging status within the pennant. Please note that if the pennant is broken to the upside then a short-term upside breakout situation will play out, but is not expected to breach the $9000 resistance.

ETH/USD

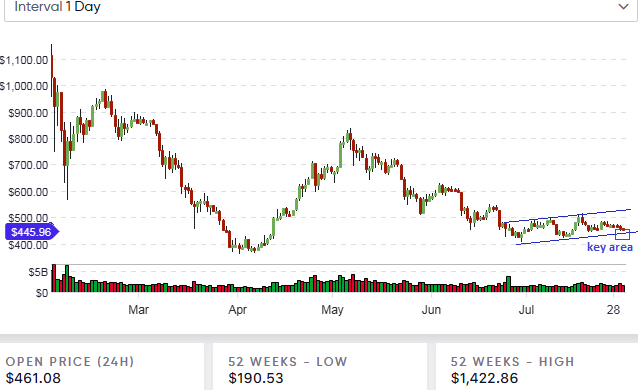

The ETH/USD pair is now at a very key point of decision. It is now quo vadis. To understand what is going on, take a look at the long-term chart (weekly) for ETH/USD.

A clear symmetrical triangle has formed, and with price so close to the point of convergence at the triangle’s apex, the market is waiting for something big to happen right here. Price will either have to break to the downside, or to the upside.

Shifting focus down to the medium term charts (daily), we see that the upside channel which we identified last week is still in play. But as stated in our last analysis for this pair, the price action has moved downwards and is now sitting on the lower channel trendline. This represents a point of decision. Will this line hold on to provide support for the ETH/USD pair, or will it give way for a downside break to occur?

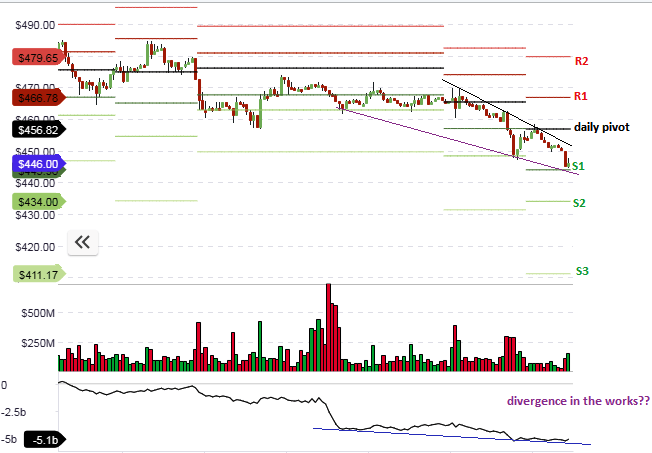

A look at the intraday charts will show that ETH/USD is presently in a downside move, but this move has found support at the S1 pivot.

Furthermore, there is a positive divergence which seems to be playing out, as the OBV indicator is now showing signs of moving upwards with higher lows while the price action is showing lower lows. We also see what looks like a falling wedge forming. This wedge is still in evolution though.

The pointers are for further upside on ETH/USD in the medium and short term. We need to see closing penetration of the symmetrical triangle in the weekly chart, a price bounce on the daily chart off the lower channel trendline as well as a price bounce off the S1 support (which will confirm the positive divergence for ETH/USD to hit another bullish run. Watch this pair closely.

LTC/USD

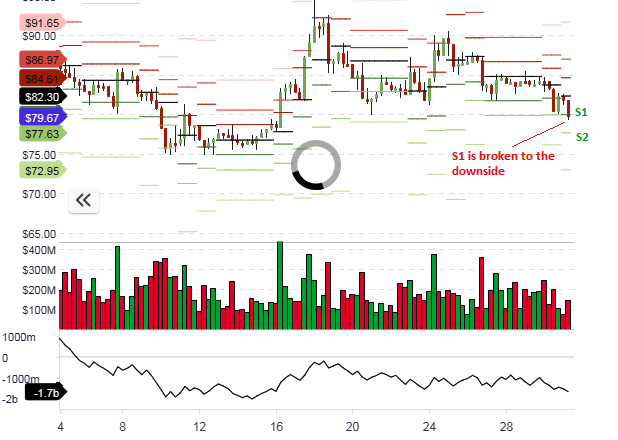

The general outlook for the LTC/USD pair is negative. A look at the daily chart will reveal that the price action has broken the lower trendline of the descending triangle with a double penetration move.

This will open the door for further downside on the LTC/USD as it struggles to shake off the negative sentiment that has seen it drop off from the highs of $90 - $92 seen earlier in July 2018.

The intraday outlook for Litecoin is negative. Price action has broken the S1 support to the downside at 77.63. This confirms the picture seen on the daily chart with a resolution of the descending triangle fully in the works.

It is very likely that if there is an upward pullback move to the broken S1 support, prices will head south from there, with the S2 support line as the next target.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.