Crypto Market Analysis March 9th 2018

Mar 09, 2018, 9:34pm

Cryptocurrency price markets saw huge losses at the end of March 8th with Bitcoin losing significant value in a number of hours.

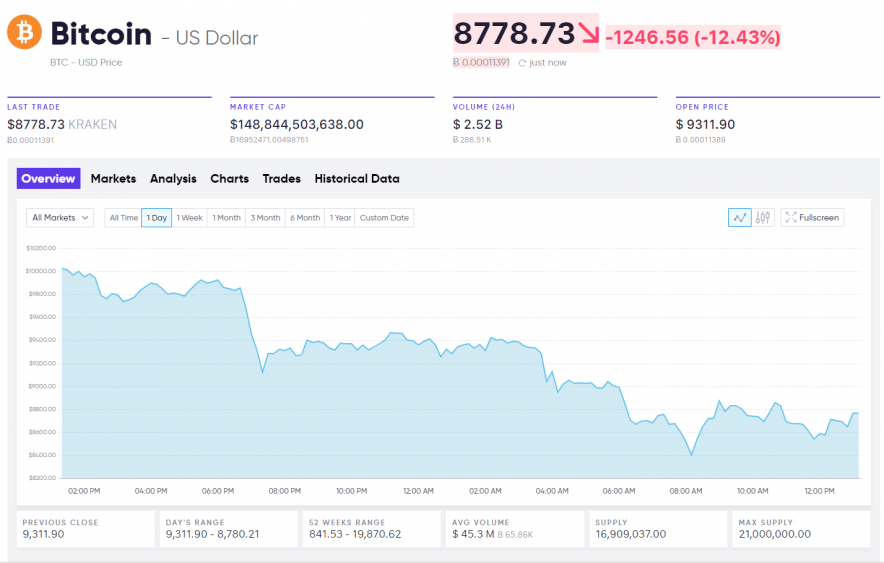

Bitcoin

Bitcoin prices were stable for most of Thursday before swiftly plummeting at approximately 11:30 a.m EST with heavy volume. This movement was mirrored by Bitcoin Cash, Ethereum, and Litecoin and seems to be the result of sector-wide headwinds and a negative technical setup.

Technical support levels have been breached on most major coins signaling a widening market sell-off going into Friday, 3/9/18. Bitcoin currently trades at around $8,500 and is seeing support at this level.

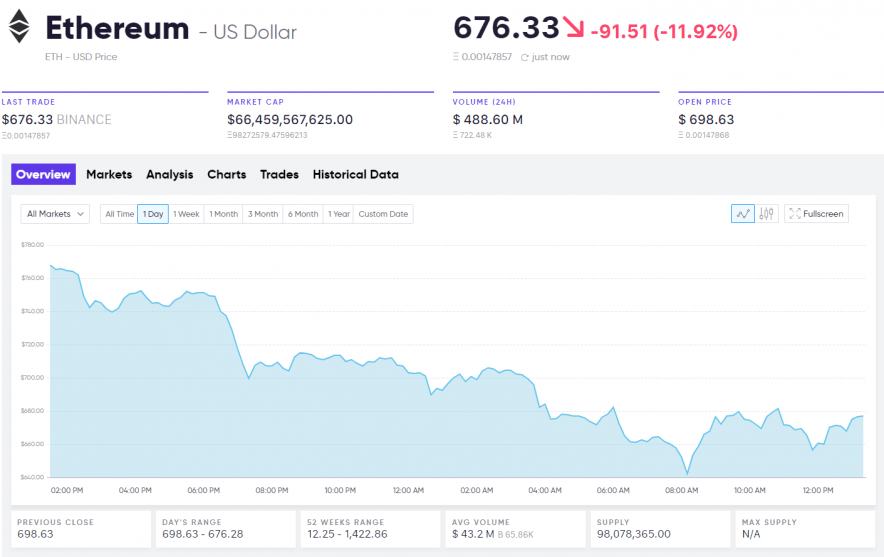

Ethereum

Ethereum prices were unable to break past resistance at $800 and entered a freefall through the 700s. $650 is providing support in the early hours of Friday, but it is unclear how well support will hold. If Ethereum breaks past $650, investors can expect accelerating declines, perhaps to the $600 handle.

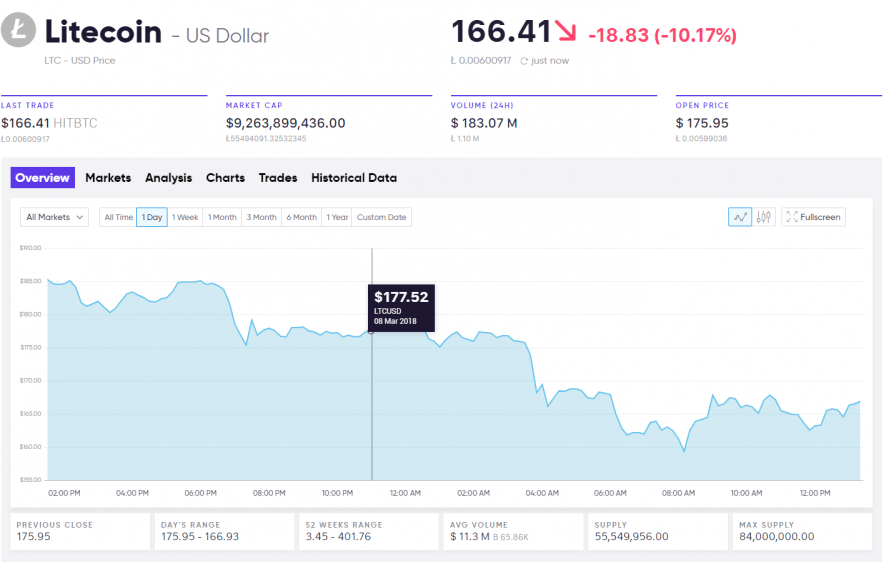

Litecoin

Litecoin prices have failed to hold above support at $200 and have formed a heavily bearish descending channel pattern. Prices seem to have found support at approximately $160, but if this level is breached, investors can expect continuing declines.

Altcoins

The total cryptocurrency market cap is around $350 billion with Bitcoin dominance stable at 42%. The majority of the market is posting double-digit declines today with several major coins having lost upwards of 20% of their market caps in the last 24 hours.

Among the ten largest assets, Monero leads the decline with losses of a little over 20%. Cardano and NEO are not far behind – down by 19.84% and 18.53, respectively.