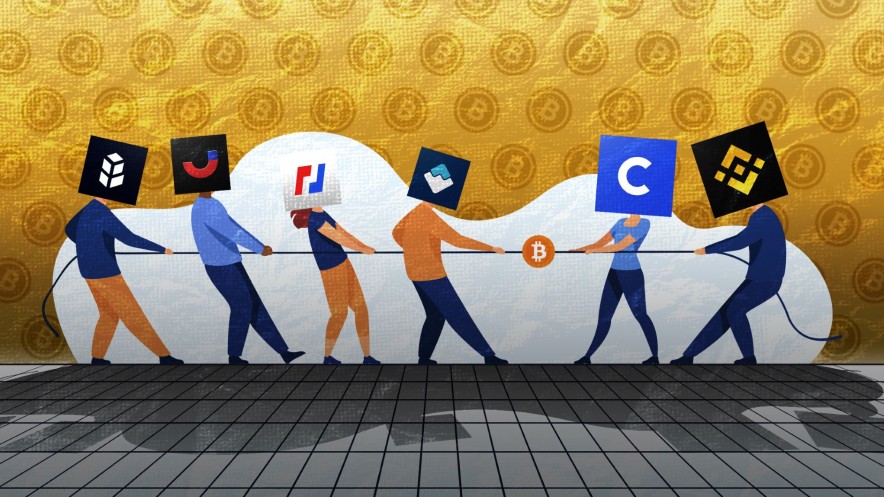

How Do Small Cryptocurrency Exchanges Fare Against Their Larger Competitors?

Aug 13, 2020, 8:38pm

Big exchanges like Binance and Coinbase are well-known, but small exchanges also have a place in the crypto ecosystem.

Just a few major crypto exchanges are responsible for much of the trading, buying, and selling that occurs in the cryptocurrency market.

Binance alone handles $2 billion in daily volume, equal to 5% of all trading volume. The next top ten exchanges handle another $2.8 billion, or 7%, of all trading volume.

The top exchanges are all centralized services: they maintain control over user funds and identities, just like banks do. This means that those exchanges can provide fast transactions, offer reliable service, and convert traditional currency quickly.

The leading exchanges attract plenty of users and handle large trading volumes. However, there are also many other niche exchanges—and they can go head-to-head with the big exchanges in their own way.

Decentralized Exchanges

Decentralized exchanges, or DEXes, are fully automated exchanges.

DEX operators have no control over user funds; instead, all trades are handled through blockchain scripts. Users always maintain control of their crypto. Furthermore, DEXes also offer excellent privacy, as they rarely collect user identities.

Decentralized exchanges usually support cryptocurrency-to-cryptocurrency trades only; they generally do not support traditional currencies.

“Coin swap” DEXes—including Uniswap, Bancor, and Kyber—are reasonably popular. Daily trading volumes typically range between $5 million to $25 million.

Hybrid Exchanges

Hybrid exchanges combine the qualities of centralized and decentralized exchanges.

Like decentralized exchanges, hybrid crypto exchanges generally allow users to keep control of their crypto. However, there is also some central authority: hybrid exchange operators have some control over trading and coin listings.

Though the category is loosely defined, Waves.Exchange and Switcheo are sometimes considered hybrid exchanges. Trading volumes vary greatly.

Peer-to-Peer Exchanges

Peer-to-peer (P2P) exchanges are “classified ad” sites that allow users to seek out a crypto trading partner and negotiate a trade manually.

P2P traders usually have low trading volumes, and they usually sell Bitcoin at above market prices. P2P exchanges are mainly useful in countries where standard trading is banned, or in situations where anonymity is important.

Notable P2P exchanges include LocalBitcoins, Paxful, Hodl Hodl, and LocalCoinSwap. Some of these exchanges handle up to $50 million per week.

Derivatives Exchanges

Derivatives exchanges allow users to invest in crypto contracts such as futures, options, and perpetual swaps.

The top derivatives exchanges have daily volumes as high as $3 billion. However, derivatives are not equivalent to actual cryptocurrency, so their volumes should not be directly compared to standard exchange volumes. Derivatives exchanges usually have low use rates despite their high volumes.

Notable derivatives exchanges include Huobi Futures, Bakkt, and BitMEX.

Regional Exchanges

Some major exchanges have separate sites aimed at a particular region.

Users in certain countries may not be able to use a popular exchange for regulatory reasons, and so that company may decide to operate a separate exchange through a partner or subsidiary. Regional exchanges often have very different features and listings compared to their parent exchange.

Exchanges of this type include Binance.US and Huobi Global, two American exchanges operated by Asia-based cryptocurrency exchanges.

NFT Marketplaces

NFT Marketplaces do not sell cryptocurrency; instead, they sell collectible crypto-tokens called non-fungible tokens.

CryptoKitties are one of the most famous varieties of non-fungible tokens. These tokens are similar to digital Beanie Babies or Neopets, stored on a blockchain. Other NFTs include virtual land, virtual sports cards, and video game items.

The most notable NFT market is OpenSea, which has a daily volume of $25,000.

Other Small Exchanges

Over 500 cryptocurrency exchanges exist, according to some estimates.

The smallest exchanges are often quite simple: some have a very basic trading interface, while others only support a handful of coins or have low trading volumes.

Nevertheless, these exchanges are just as functional as their larger counterparts. Small exchanges can provide focused customer service and convenience while major exchanges are burdened by the needs of a larger userbase.

Jubiter offers simple Bitcoin and Litecoin trading for users at all levels of experience.