Intuit Awarded Patent For Processing Bitcoin Transactions Via Text Message

Aug 9, 2018, 4:14PMIntuit has been awarded a patent for processing Bitcoin transactions via SMS, making payments easy, but will the public trust their security?

The San Francisco Bay Area’s leading financial software company, Intuit, has secured a patent for processing Bitcoin transactions using text messages. The patent was awarded on August 7th, over four years after the application was filed. Manu Chikkanna from Bangalore, India is credited with the initial invention.

The patent filing describes the invention as follows,

[T]he invention relates to a method for processing payment. The method includes receiving, by a payment service from a payer mobile device of a payer, a payment text message comprising a payment amount and an identifier of a payee mobile device of a payee, validating the payment text message.

Validation of the payment text message can be done in various ways. Two such ways are “by matching an unanswered voice call with the identifier of the mobile device that is extracted from a text message”, and by requesting a “text message comprising an identifier of the mobile device and a password associated with an account of the user”. This system for processing payments involves sending a text message through a payer’s mobile device to the payment service. This service then sends a notification to the payee’s mobile device to inform them of the new balance in their virtual account. Payees do not have to even create this account as the payment service takes care of this task.

Other Developments at Intuit

Intuit has been exploring the potential for integrated services in the cryptocurrency space since 2014 when it launched the QuickBooks Bitcoin Payment. This service was aimed at helping non-tech-savvy small businesses accept Bitcoin payments without actually having to deal with Bitcoins at all. Last year, blockchain payment provider Veem was integrated into QuickBooks to give users a low-cost alternative for making international payments in 24 countries instead of having to rely on traditional wire transfers.

Earlier this month, Dash Text was heralded as the first SMS-based cryptocurrency wallet, albeit exclusively for the Dash network. This project was specifically geared towards affecting widespread adoption in countries like Venezuela where the economic situation has been crippled due to hyperinflation of their fiat currency. Dash’s large user base and SMS payment technology make it a potentially viable option to replace internet banking which is not even available to large portions of the population in Venezuela now.

Encouragement to Innovate or Invitation to Monopoly?

Intuit has over 46 million users for its three most popular products: TurboTax, QuickBooks, and Mint. The integration of the new patent could in itself be a huge opportunity for greater adoption for cryptos within many corporate structures and to clients who utilize Intuit products. However, is the U.S. Patent and Trademark Office completely missing the memo when it begins awarding blockchain payment patents to big firms? Will this not stifle innovation within the industry in the long run?

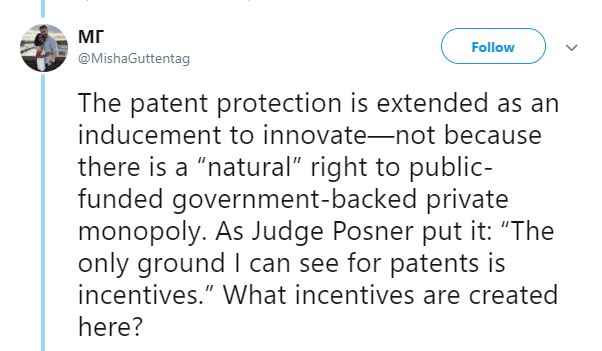

A twitter user summarized this well when he said,

Security VS Ease of Use

Perhaps two of the greatest challenges preventing widespread adoption of cryptocurrency are fears about security and the lack of convenience/ease of access for their daily use. But what happens when these two issues are pitted against each other? While Intuit offers a solution to the latter problem, many people don't see SMS as a particularly secure medium.

Bitcoin is suffering from massive trust issues in the current bear market, with frauds, hacks, and scams still taking up a lot of the news cycle. Text messaging is also much maligned for attracting all sorts of scams and fraudulent activities. For this reason, it remains to be seen whether crypto transactions via text message will take off or whether the public will resist this potential solution to ease of use out of security fears.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.