The Cryptocurrency Market Posts Large Declines Amid Fears of Indian Regulation

Jun 22, 2018, 9:29PMThe cryptocurrency bear market continues with massive declines in almost all the top 100 assets. Many tokens have fallen by double digits.

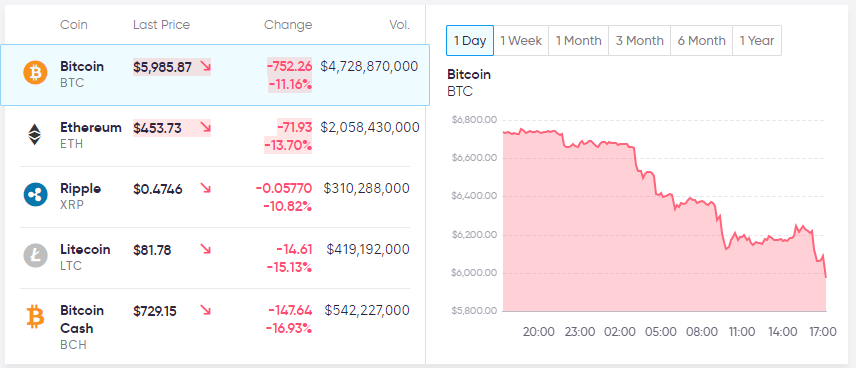

The cryptocurrency bear market continues with massive declines in almost all the top 100 assets. Many tokens have fallen by double digits in the last ten hours alone. In the top 10, the declines are led by EOS (EOS), Bitcoin Cash (BCH), and Litecoin (LTC) - down approximately 18%, 15%, and 14%, respectively. These declines coincide with the disintegration of price action correlations previously been seen this week and news of regulatory hurdles coming out of the Indian market.

Price action correlations are typically strongest when market transaction volume is low, so it is little surprise to see the correlations weaken when transaction volume picks up. Right now, transaction volume is significantly higher than the market average with around $15.7 billion worth of crypto changing hands in the last 24 hours. The volume is driven by heavy selling pressure, particularly in the altcoin sector. And this has sent the total crypto market cap to $261.5 billion with Bitcoin dominance rising slightly to 40.7% of the total.

India's Regulation Sends A Chill Through Bitcoin Market

Earlier in April, the Reserve Bank of India ruled that crypto exchanges in the country would lose access to banking services in July. Several Indian exchanges have warned customers of the upcoming deadline, and this may have led to a sell-off in the Bitcoin market that later spread to other assets. Bitcoin has fallen by over 11% to prices hovering around $6,000. Ether and Litecoin are down 12 - 14% while the altcoin market posts similar declines in the last 24 hours. As of this writing, the declines were only speeding up.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.