Bitcoin Faces an Important Week While Stellar Looks to Overtake EOS: Market, Aug. 20

Aug 20, 2018, 1:59pm

Bitcoin was firm last week amidst a broader sell-off in the cryptocurrency market and awaits another ETF decision this Thursday.

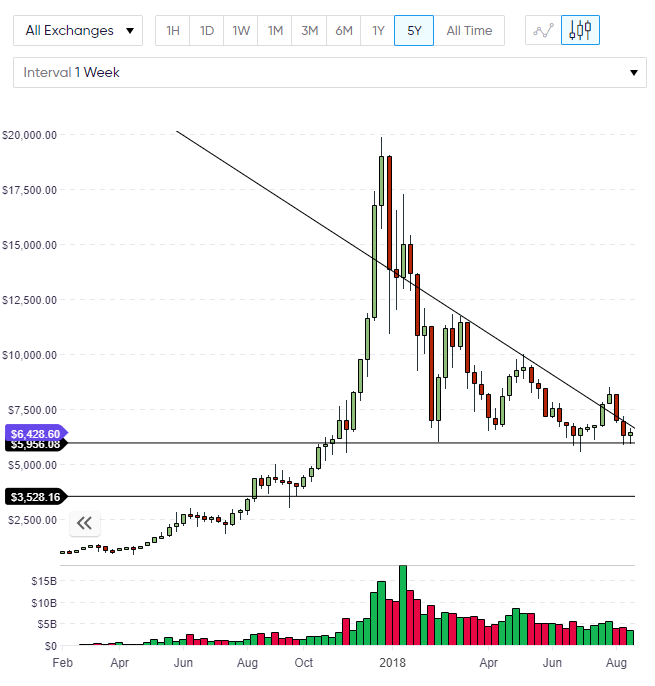

BTC

The price of Bitcoin was relatively firm last week, trading in a range between $6,000-6,500 despite some heavy selling in other coins. The relative strength in Bitcoin was down to another SEC decision this week on an Exchange Traded Fund. Boston-based ETF provider ProShares is the latest attempt to get a fund on the market, with a long and short Bitcoin instrument that could bring a wave of speculators in the retail and institutional space, which would add serious volume to Bitcoin and its futures contracts.

We are currently trading around $6,400 after the price failed to hold strength above the $6,500 level and its possible that BTC will stay in the same range as last week until the announcement. The second option is that traders attempt to anticipate the decision and we see a market move into Thursday. We will see how this plays out in the next few days. The quiet in BTC volatility highlights that large traders are holding off on any directional bets until further clarification.

If the ETF decision is negative, then we may see further selling in Bitcoin. The fall in other coins last week was due to the realization that Bitcoin is the cryptocurrency with the highest potential for large investment volume in the near-term and investors may have rotated from other coins to take positions in BTC. If Bitcoin breaks the $6,000 level from last week then there is a lack of support in the market to $3,500. This would see Bitcoin match the price action of Ethereum with a break of key April lows and a spike low. If the decision on Bitcoin is positive, then a strong rally is possible and $10,000 could not be ruled out.

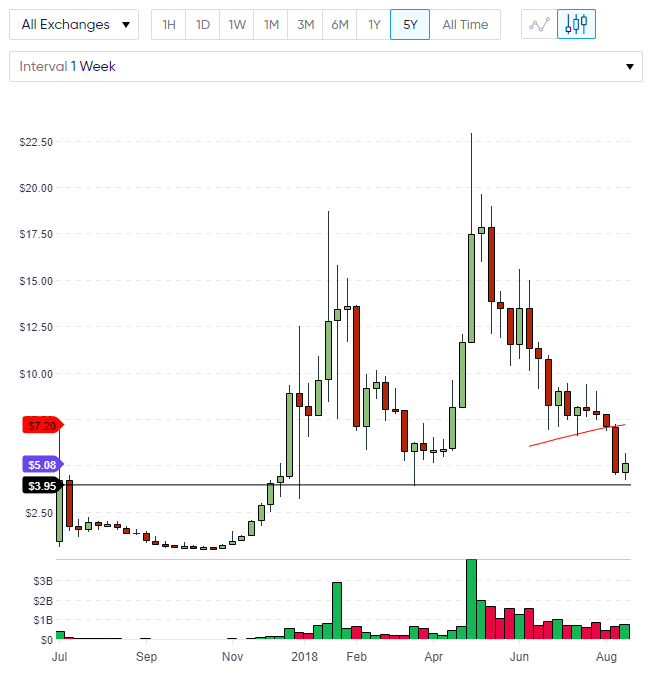

EOS

The price of EOS moved lower in recent weeks with a bearish close at the 50 moving average, leading to further selling to a current price of $5.00. We can see previous lows on the weekly chart at $4.00 so it’s possible that EOS could carve out a low here for another move higher.

EOS previously dethroned Litecoin from the number five position on the list of coins by market capitalization, although Stellar Lumens has since nudged LTC lower again and is closing on EOS for the number five spot. EOS has a market cap of 4.59bn to Stellar’s 4.18bn, but Stellar has a much larger coin supply with 18.7bn to the 906m of EOS.

If EOS is to hold onto the number five spot, then it will need to hold the support at current levels. The first target for a move higher would be the moving average at $7.20 and another attempt at the doubledigit levels, which were last seen in early June.

XLM

If EOS cannot mount a rally then it’s still possible that it can hold onto top five status but this would require a larger sell-off in Stellar Lumens. As the weekly chart highlights, XLM currently trades within a triangle formation and has found support last week on the uptrend line. A rally in XLM to the $0.300 level would likely see a test of the downtrend line and a breakout could see it dethrone EOS from the list of the top five cryptocurrencies.

A recent news story on Facebook executives meeting with the Stellar network developers brought a rally in XLM and if this turned out to be more than a rumor, then XLM would easily vault into the top five spot. Facebook has created a blockchain team and it’s possible that they could be creating an in-house token or payment system for advertising.

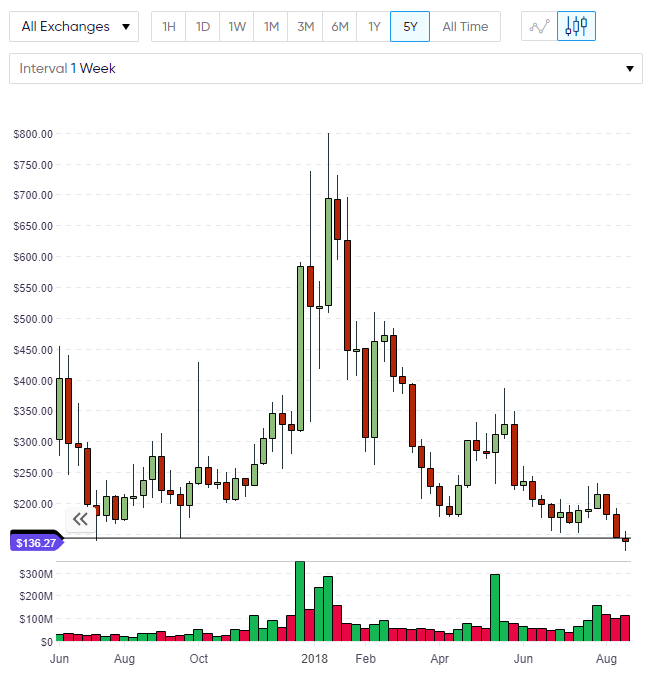

ZEC

ZCash has been disappointing in recent weeks as the July rally failed to hold the key $200 level and we sold off to $136. Looking at 2017 levels, this area has provided strong support previously and we will watch how ZEC performs here again.

ZCash has been getting ready for a major upgrade with the first release of network software compatible with the Sapling hard fork. Zcash version 2.0.0 was released Thursday, according to a blog post from one of its engineers, who noted that the company is “encouraging all users and miners” to upgrade to the new version “as soon as possible.” The hard fork is expected on October 28 and the previous Overwinter fork was seen as a trial run for Sapling.

If ZEC can find support at the current levels, then a move back to $200 is possible. That level would be key again if ZEC is to mount a serious rally once again, for a coin that touched $800 in early 2018.