The Crypto Bloodbath Continues With No End in Sight

Jun 14, 2018, 12:32am

The cryptocurrency market crash continues, and today is even worse than yesterday. Almost all of the top 100 assets are down by single digits.

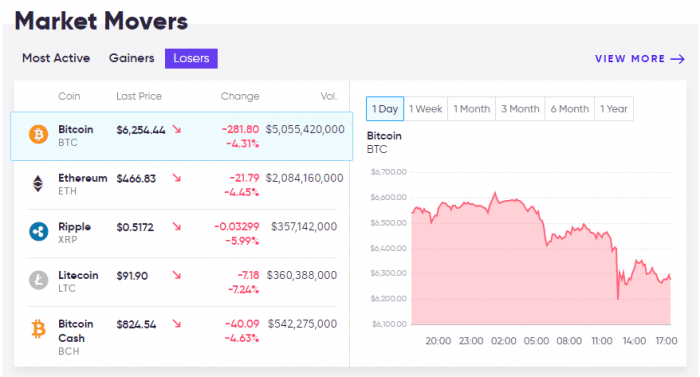

The cryptocurrency market crash continues, and today is even worse than yesterday. Almost all of the top 100 assets are down by high single digits with several assets down by low double-digits in the last 24 hours. In the top ten, TRON (TRX) leads the decline, followed by IOTA (MIOTA), and Litecoin (LTC). Bitcoin is also down, but it is holding up slightly better than the other assets. All the top ten remain highly correlated in price action.

The total crypto market cap has fallen to around $270 billion with Bitcoin dominance finally returning to 40% of the total. Investors can expect Bitcoin dominance to rise steadily as this market correction continues. In times like this, money typically flows to more established assets – either as a flight to safety or as an intermediary between fiat.

Bitcoin Technical Analysis

Bitcoin (and the crypto market in general) is still reeling from the Coinrail Exchange hack several days ago – but there is probably more to the decline. The technical setup remains negative, and big traders are known to hold large short positions on the asset. Right now, Bitcoin prices hover around $6,200-6,350 after failing to break through a resistance point at $6,400 earlier in the day. The technicals remain negative and investors can expect further declines.

Ethereum remains closely correlated with Bitcoin. Prices now sit at the $450-470 level, according to the latest data from Coinmarketcap. The asset is down approximately 5.60% to a total market cap of $471 billion.