Bitcoin Stalls as Diamond Rockets, LTC and ETH, Market Analysis Sep. 5

Sep 05, 2018, 2:37pm

Bitcoin has stalled on its slow creep higher but the real action this week has been in its namesake Bitcoin Diamond, which has blasted higher.

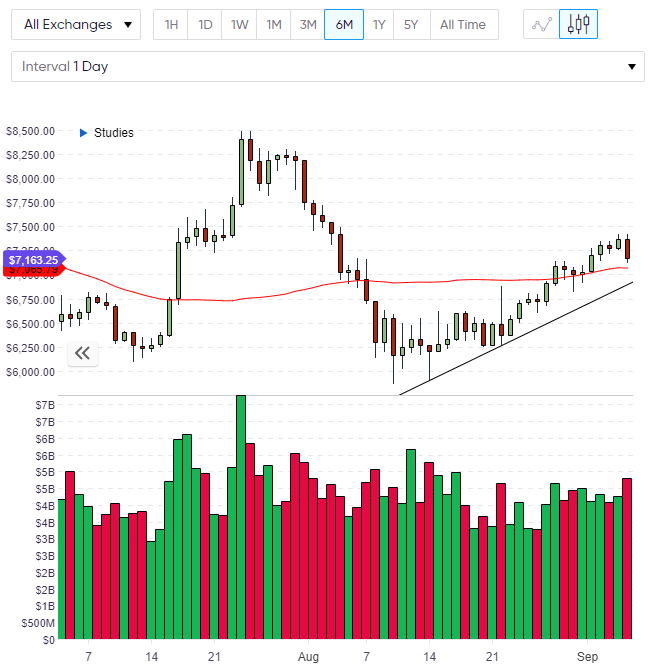

BTC

The price of Bitcoin continued its slow creep higher against the shorts with a solid close on Tuesday, but the market has turned bearish today with a move lower by over 2% and currently trades at the $7,160 level. I noted in a previous article that Bitcoin’s positive close on the monthly level could set the stage for another push higher,

The monthly close marks the third-straight month of holding the $6,000 support level and looks to be the basis for another move higher to the key resistance of $8,500 where the previous rally failed in July.

The bulls were still in control of Bitcoin and we were looking to make a play for higher levels this week, although there has been little in the way of a news catalyst. We do have the upcoming meeting of EU Finance Ministers in Vienna on Friday, where they are planning to discuss cryptocurrency regulations once more. Ministers will study a wide range of topics and we may get some direction once the statements are released.

The levels to watch on Bitcoin remain the same, with $8,500 being the key level for resistance. We are still trading above the 50 moving average on the daily chart and this would be the first target for the pullback, with a trendline from the early August bounce coming into play near $7,000.

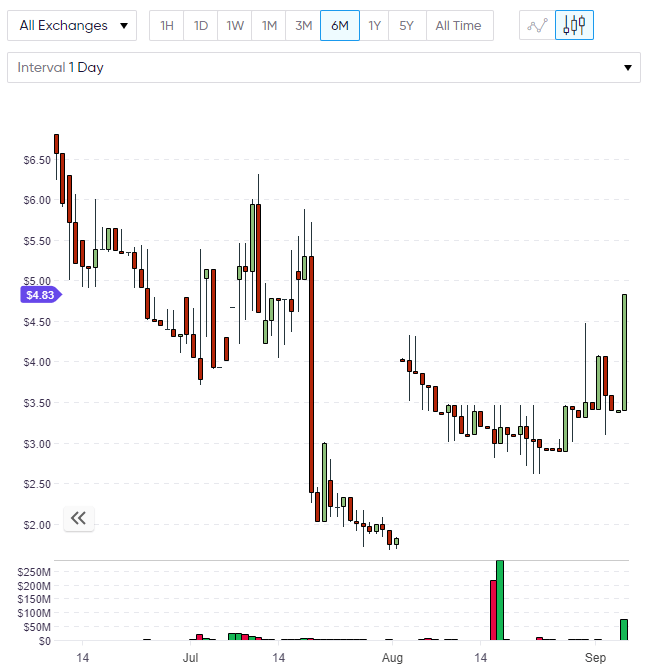

BCD

The real action in Bitcoin this week was actually in its namesake, Bitcoin Diamond. BCD is currently over 40% higher on the day, trading at $4.83 from a close of around $3.30 yesterday. The market has seen large spikes in volume recently and this caused a spike higher with some prints near the $10.00 level before retreating again to just under $5.00.

Bitcoin Diamond has been volatile over the last few weeks, which has left traders wary of a pump n’ dump trick. The price move over the last 24 hours is based on news that Binance has opened deposits and withdrawals for BCD. Bitcoin Diamond was created from another Bitcoin hard fork at block 495,866. The coin is developed by the Bitcoin Diamond Foundation based in Singapore and the goal of the fork was to improve on the privacy of Bitcoin. BCD encrypts the amount and balance in transactions to protect the privacy of investors. The project also improves on transactions and costs. One of the drawbacks for BCD was a lack of access as it is less widely accessible than BTC or its other forks, Bitcoin Cash and Bitcoin Gold. The Binance news may open the coin to a wider range of investors, but the price will always be tied to the path of Bitcoin in the future.

BCD currently has a resistance level near $5.30 and this is the obstacle towards the $10.00 level and then $20.00 if the coin can continue to see bullish action. The recent action in BCD has lifted the coin to number 23 in the list of coins by market cap with a value of $577 million. BCD would still need a further 30% gain if it wants to vault above ZCash into 20th spot.

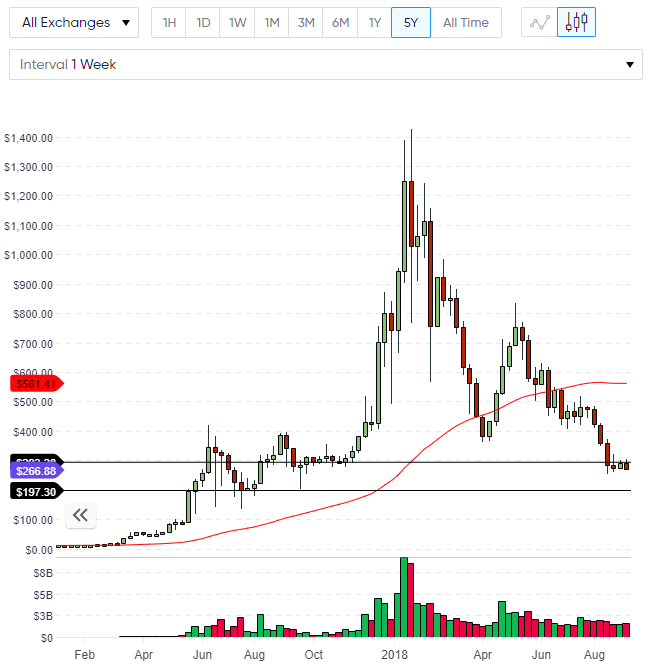

ETH

Ethereum continues to drift lower and has failed to get back above the $300 level, which hints at a further test of support. The price of Ethereum currently trades at $268.80 and the price action has likely not been helped by bearish comments from founder Vitalik Buterin.

Vitalik Buterin posted an agreeing response to a thought-provoking article by Jeremy Rubin, a regular contributor for the Bitcoin Core Project, who wrote that “the collapse of Ethereum is inevitable”. The article brought to attention the fact that Ethereum could eventually be superseded by an ERC-20 token within its own ecosystem. Buterin was quick to note his agreement on Reddit. Buterin did mention that the community was considering two proposals to rectify the issue, but both agreed that ETH would need to make changes to hold onto its value as the second-largest coin in the cryptocurrency world.

Ethereum on the weekly chart is in a danger zone of support and if we don’t see a rally back through $300 this week, then a bearish weekly close could see the price move towards the $200 level. The EU Ministers’ meeting may be a catalyst for that move lower and positive comments could spur another move up in ETH which in turn could spell the beginning of another rally.

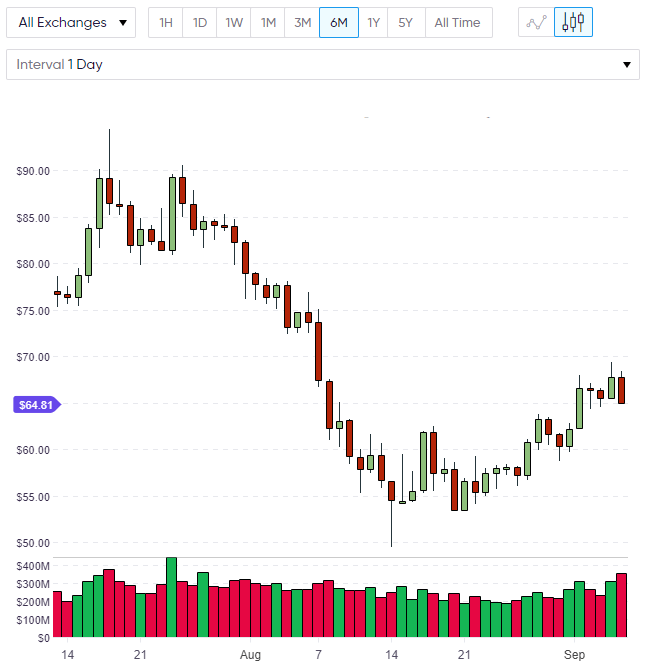

LTC

LTC has made a positive close higher on Tuesday but is threatening to give up those gains today. Despite the negative tone, LTC has been a strong performer in recent weeks after a bounce off the $50.00 level. LTC is currently trading at $64.80 and if buyers emerge into today’s close, we may see LTC continue its upward push towards the resistance at $75.00.