The Top Crypto Options Trading Platforms for 2022

Mar 01, 2022, 5:17pm

The influx of platforms with several trading features has made it a hassle for traders to pick the best crypto options trading platform.

This piece will discuss some of the top crypto options trading platforms based on certain factors—ease of use, security, fees, trading features, etc.

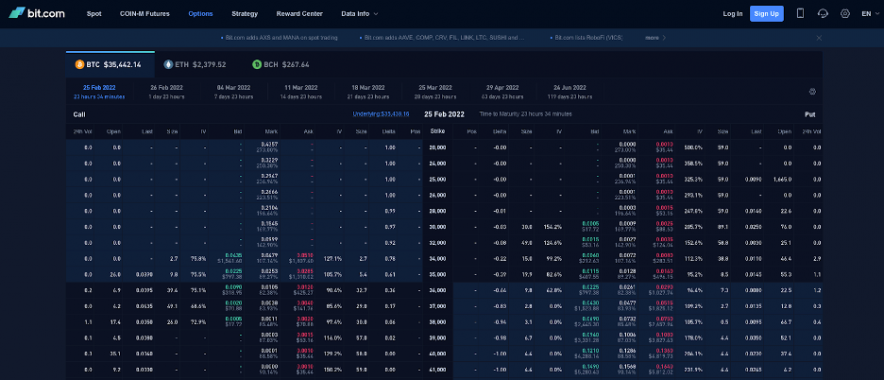

1. Bit.com

Described as one of the leading high-performance crypto trading platforms, Bit.com is a rewarding and secure platform. Offering a ton of retail-friendly features, one of which includes portfolio management—a facet that rewards users for providing a significant margin benefit to their well-maintained, low-risk portfolio—Bit.com has integrated the cutting-edge system Cactus Custody for global user security.

Another impressive feature of this crypto options trading platform is Unified Margin. It is an upgraded risk management system that adopts a singular stop solution to facilitate spot, margin, perpetual, futures, and options trade. According to the exchange, all of the collateral cryptocurrencies in the unified account are shared as USDT margins, therefore improving capital utilization as well as lowering the risk of liquidation.

Bit.com offers 50x leverage for futures and 10x leverage for options trading.

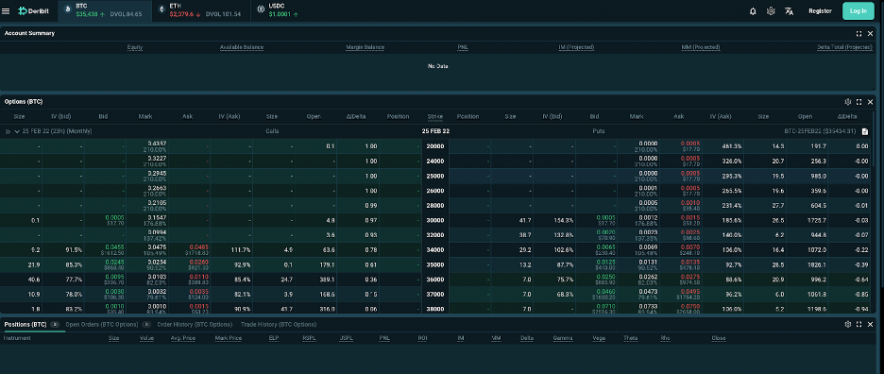

2. Deribit

Based in Amsterdam, Netherlands, Deribit is one of the largest crypto options trading platforms in 2022. Offering the European style options trading which means they can only be used at expiration, and not before, Deribit offers lower reduced fees for market makers.

Deribit is available in a variety of countries, the United States included. Unlike a few of the other trading platforms, Deribit had a more relaxed know-your-customer [KYC] requirement, and according to the team, KYC is not mandatory on all accounts.

One stand-out feature of this platform is its user-friendliness. It is remarkably separated into Futures and Options sections, thus making it easy for users to buy and sell options in a maximum of three clicks. A secure and safe trading platform, Deribit, however, does not offer the Unified Margin feature; a distinguishing factor between it and Bit.com.

3. FTX

FTX stands out for its wide trading options offerings, some of which include options, cryptocurrencies, spot, futures, leveraged tokens, etc.

While existing competing trading platforms list a meager number of order books, FTX offers unending strike prices and expiration time through its unique feature, Request For Quote. With this feature, FTX as an options trading platform for 2022 does not have to list hundreds of order books, rather, traders can simply fill out a simple form with the options they are interested in.

The MOVE contract is another essential feature of FTX. It gives traders the ability to bet on the value of a move at a specific time. Charging a flat rate of 0.05% for all trades on the platform, users can have this fee reduced when they buy and use the exchange’s native token, FTT.

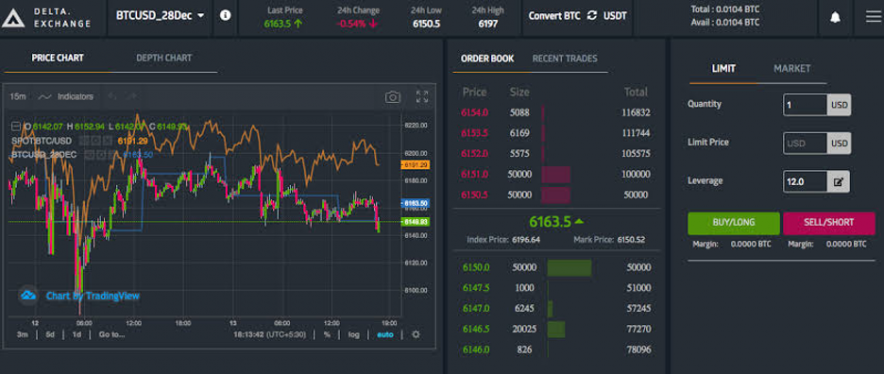

4. Delta Exchange

Launched in 2018 and based in Singapore, Delta Exchange is backed by a couple of big names in the crypto space. Delta offers a plethora of trading products in its derivatives section, including futures on Bitcoin and 50 other altcoins.

Delta has also incorporated European Options and MOVE contract features. With 100x leverage, Delta is one of the very few options trading platforms to offer several options trades.

Delta has a fixed 0.05% taker and maker fee for transactions and options trading.

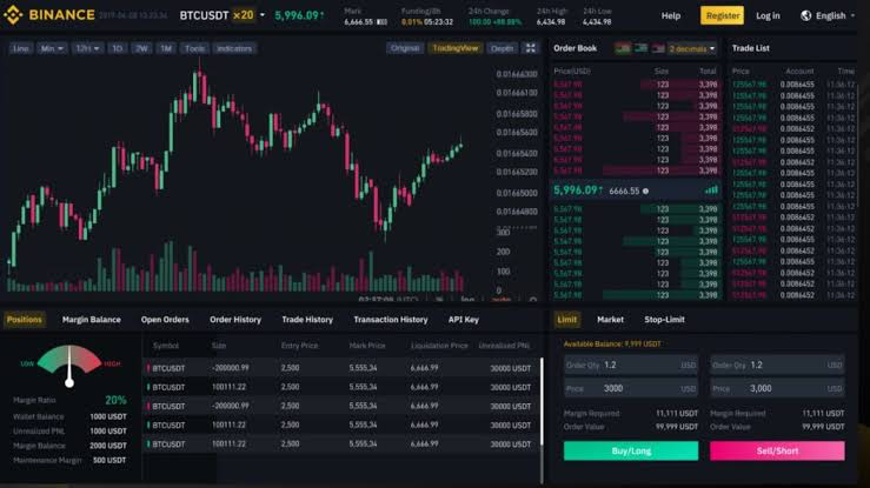

5. Binance

The leading crypto exchange based on trading volume, Binance offers a wide range of crypto assets. It also has the most liquid asset for both spot and derivative markets.

Through the Binance Futures platform, users can trade options while leveraging over 125x. Binance enables the buying and selling of European Bitcoin options which can be used at the expiration of the contract, not before.

All options contracts are settled in USDT on the Binance crypto options trading platform.