The Outrageous Case of OneCoin, the Billion Dollar Scam Sold as a “Bitcoin Killer”

Jul 05, 2019, 8:50pm

OneCoin is among the most blatant, shocking, and fascinating crypto scams of them all and yet it has somehow managed to fly under the radar.

*The opinions expressed in this special editorial report does not necessarily reflect the opinion of Bitrates or its staff.

While Bitconnect has left its mark in the meme folklore as the paragon of the unabashed frauds that emerge from that murky period of crypto mooning driven by speculative frenzies, exaggerated promises, and opportunism, there is an even more outrageous Ponzi scheme that attempted to take advantage of the “success” of cryptocurrency, surpassing other scams in the surprising and unusual scope of its networks and scale of its operations. And yet, this massive fraud has been given much less media attention and has been largely allowed to go under the radar.

The massive fraud in question is OneCoin, an unoriginal and badly put together scam that’s fairly obvious for most people who have any clue about cryptocurrency, startups, or finance. OneCoin was organized and promoted by known fraudsters in the wake of the cryptocurrency craze as a private blockchain crypto coin and a “Bitcoin killer” but was running an SQL server in the back-end, basically consisting of little more than an Excel spreadsheet and a fugazi web portal displaying provably fake transactions.

Norwegian developer Bjorn Bjercke who OneCoin tried to hire at one point to somehow magically turn their SQL server into a blockchain describes the individuals behind it as “worse than criminals”. The Ponzi scheme had been running via two offshore companies (OneCoin Ltd. in Dubai and OneLife Network Ltd. in Belize) founded by self-entitled “doctor” Ruja Ignatova, together with sales con man and serial scammer Sebastian Greenwood in 2014. US prosecutors have alleged the scheme has brought in ~$4 billion worldwide from victims in its five-year history (to put that in perspective, Madoff’s scam – the biggest in history – is 65 billion). Much of the money has been siphoned into property deals and to a host of questionable individuals and companies in Ruja’s native Bulgaria and elsewhere, including former politicians, well connected businessmen and people with links to organized crime (including to alleged organized crime figures of the rank of Bulgarian “Cocaine King” Hristofos Amanatidis, who was charged in absentia with drug offenses by Bulgarian police).

As mentioned, the “founders” of the scheme originate from and are formally based in the small Balkan kleptocracy of Bulgaria, a rather bleak and depressing post-communist trainwreck of a state known for its levels of all-permeating corruption and organized crime as well as its status as the “poorest, most miserable” member state of the EU. After the collapse of the Soviet Union, most of Eastern Europe went through the turbulent transition times of the 1990’s when, following the institutional collapses and widespread political, economic and social crises, the line between legal and illegal was soon blurred or altogether wiped out, witnessing at times a merging of mafia and state.

British journalists Mischa Glenny (who also wrote “DarkMarket: Cyberthieves, Cybercops and You” in 2011, in which he documents the rise of cybercrime, identity theft, and credit card fraud in post-communist Eastern Europe) describes the rise of global organized crime in that period in his “McMafia: A Journey Through the Global Criminal Underworld” (which, coincidentally, begins with the case of Bulgaria as the archetypal example of its subject matter). Arguably, Bulgaria may be the only such post-communist country left which hasn’t yet managed to purge itself from these criminal undercurrents, which on their part have managed to completely usurp and colonize the state apparatus and government institutions in those 30 years since then.

All this provides some important background and context, since OneCoin and Ruja Ignatova recently re-surfaced in Bulgarian media with the transferring of Ruja’s company assets and real estate properties (she managed to acquire key and even historically emblematic properties in central Sofia, the country’s capital city) to the companies of Emil Hursev, known Bulgarian businessman and financier who was the deputy director of the Bulgarian National Bank during the financial and political crisis and sudden hyperinflation of 1996-1997 – a time well remembered in the country’s recent history and a turning point in the so-called “transition period” when people’s savings, along with the massive debts of so-called “credit millionaires” (privileged individuals at the time who took large loans from banks without ever intending to pay them back) were evaporated overnight in an allegedly (and very plausibly) orchestrated operation meant to enrich a selected few and help them seize the state’s assets and power mechanisms at the expense of the people. Hursev has since been eagerly servicing the interests of anybody willing to pay for them or for his public opinions and “expertise” on the country’s problems in grappling with getting capitalism “right” and purging itself from the old socialist mentality and habits.

Ruja Ignatova, who had already been convicted of 24 counts of fraud in Germany back in 2012, conveniently vanished in 2017 (having been last seen in Bangkok, since most of her operations targeted China, India and Southeast Asia) and was replaced by her brother Konstantin Ignatov near the time a quiet US warrant was filed for her arrest. The majority of the top leaders of the pyramid scheme around the world have now disappeared or have been arrested. Konstantin Ignatov himself was arrested in March this year, charged by the US Justice Department with wire fraud, securities fraud, and money laundering and Sebastian Greenwood was arrested in Thailand in 2018 and extradited to the US. Ignatov’s court hearing is scheduled for 26th of April and it’s interesting to mention who is to represent him. A check at PACER (Public Access to Court Electronic Papers) reveals this to be Jeffrey Lichtman, known criminal defense attorney famous for defending John Gotti and El Chapo.

A recording of Ignatov with another co-founder is said to have captured Ignatov saying that, “as you told me, the network would not work with intelligent people.” It is quickly evident that the scheme specifically targets “idiots” and people who are not “intelligent” or less educated or knowledgable about either the technology or financial markets in general, employing in the process the same familiar cheap tricks and ploys to appeal to people’s emotions and lower instincts rather than their informed judgment as investors. In their “presentations” and on social media, OneCoin mostly just copy/pastes (often even literally) fragments and cliches from elsewhere in the crypto world and compares itself to Bitcoin, pulling arbitrary or made up numbers and charts, explaining how their enterprise will overshadow Bitcoin as a second-generation crypto coin, but never touching upon any hypothetical technicalities, goals or roadmaps, utility or purpose.

On 17 and 18 January 2018 Bulgarian police finally raided OneCoin’s office in central Sofia, Bulgaria, at the request of the prosecutor’s office in Bielefeld, Germany (the OneCoin logo had been proudly displayed in front of that office for a very long time despite the common knowledge that their “operations” were shady). German police and Europol took part in the bust and the investigation. Also, 14 other companies tied to OneCoin were investigated and 50 witnesses questioned. OneCoin’s servers and other material evidence were seized but apart from some promotional pens and notebooks, barely anything of much use as evidence in court appears to have been found, at least by initial reports.

Over the past couple of months, more and more juicy details about OneCoin and Ruja Ignatova’s operations have been coming to light in Ignatova’s native Bulgaria – herself of Romani (“gypsy”) origin and having lived in the Northern Province of Pleven until the age of 10 when her family relocated to Germany. Some time in the 2010’s, Ignatova and her dad ran into trouble when they were “convicted of 24 counts of fraud in Germany, stemming from the 2012 bankruptcy of Waltenhofen Steelworks” where they are said to have stolen over 1 million EUR which could have provided the initial capital necessary for such large scale operation across a number of jurisdictions around the globe.

According to the tech blog questona.com, Ignatova’s name is listed in the Commercial Register of Bulgaria as the executive of at least 30 companies and as the sole owner of the capital of at least 5 companies. Some of the companies Ignatova is related with, had been a representative of or participated in the board of directors of, are part of the CSIF (Clever Synergies Investment Fund), a private investment company set up in 2005 and run by Tsvetelina Borislavova, former girlfriend and spouse of Prime Minister Boyko Borisov, whose shady background and involvements with organized crime are not a secret.

Borislavova describes herself as,

a supporter of the esoteric, spiritual approach to money felt through the prism of personal growth, because we can not use as an opportunity for personal growth something we have not gained by our own efforts and we do not treat it with care and love.

Another curious detail is “doctor” Ruja’s tactics for creating the illusion of legitimacy around her. In 2015 she was among the speakers at The Fourth EU-Southeast Europe Summit organized by the prestigious magazine, The Economist.

Interestingly, then President Rosen Plevneliev (who, according to many, had been “hired” by Borisov to help deliberately sabotage the elections and mobilize his cronies, secretaries, and minions) was also present among the speakers. Plevneliev is also nowadays acting in the role of “advisor” for shady ICOs. (He can also be found proudly presenting himself on the cover of Forbes Bulgaria as an early Bitcoin pioneer and entrepreneur).

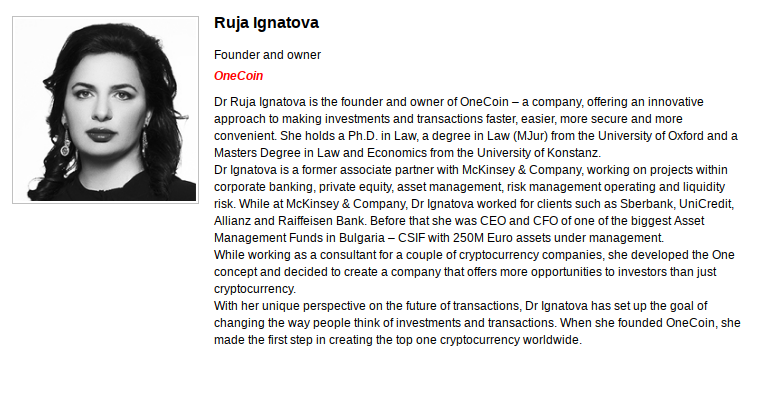

The event gives the following bio of Ruja on the site:

Ruja’s biography according to a 2015 event organized by The Economist. The financial and banking sectors in Bulgaria have always been dubious and shady (most recently witnessed in the scandal that followed the sudden collapse of Corporate Commercial Bank in 2014, the country’s fifth largest bank at the time. The case was eventually taken to the United States District Court for the City of New York since the country’s own judicial system seems powerless and dysfunctional to deal with anything apart from protecting the private interests of oligarchs behind the curtains).

Ruja’s professional background, which on the surface seems somewhat impressive, really tells a different story upon closer inspection. While we can’t know what her real competencies are, if any, they certainly aren’t in any way related to IT, cryptography, or cryptocurrency. A talk of hers from two years ago (reminiscent of events organized by Bitconnect) delivers nothing but repetitive borrowed cliches and big promises for success and wealth. The white paper for their ICO says nothing about anything technical or gives any even hypothetical details about the workings or purpose of their enterprise, and is instead just a short list of promises, followed by legal clarifications and disclaimers.

So, it is hard to imagine what kind of speech Doctor Ruja must have given to an audience of the political and business elites of the country and the region.

A PDF for the event spread around among “investors” attempted to dispel any “rumors” that OneCoin was a crudely put together fraud. Another tactic of hers is focusing on spammy press-releases and what appears to be paid advertorials, such as the one in Forbes magazine Bulgaria (the case with The Economist remains a mystery, but in all likelihood it was also paid for with money stolen from gullible investors wanting to get in on the “crypto” hype in the greed frenzy of the bubble).

Among Ruja’s co-conspirators, there’s the name of Mark Scott, a US attorney who has dual German citizenship and whose role in the scheme was to form international hedge funds with accounts in the Cayman Islands, a well-known haven for things of that nature. (As a side note, EOS also operates its finances from the Caymans, as did Tether.) In order to do that, Scott had to misrepresent the source of the funds and lie to banks and administrators. In exchange for assisting Ruja with stashing stolen OneCoin investor funds, Scott was allegedly rewarded with $15.5 million in fees (used to buy properties, luxury vehicles, and luxury watches, among other things).

Scott (above in pink) was indicted in August 2018 on charges relating to his laundering of over $400 million in stolen Onecoin investor funds and was released on a $2.5 million bond later that same month.

The Atlantic Takes Notice

The Atlantic mentions OneCoin in a May 2017 article (which was at the beginning of Bitcoin’s suspicious meteoric rise which was later called into question as having been partially a result of suspected frauds such as the printing of tokens by USDT/Tether which seemed too directly correlated to Bitcoin’s market price surges). The article, entitled “The Rise of Cryptocurrency Ponzi Schemes”, diagnoses the source of the problem:

And yet, OneCoin attracted hundreds of millions of dollars more than Gnosis. The company seems to have targeted a global category of aspirational investors who noticed the breathless coverage and booming valuations of cryptocurrencies and blockchain companies, but weren’t savvy enough to understand the difference between the real thing and a sham. Left unchecked, this growing crypto-mania could be hugely destructive to one of the most promising technologies of the 21st century.

This danger exists in large part because grasping even the basics of blockchain technology remains daunting for non-specialists. In a nutshell, blockchains link together a global swarm of servers that hosts thousands of copies of the system’s transaction records. Server operators constantly monitor one another’s records, meaning that to steal money or otherwise alter the ledger, a hacker would have to compromise many machines across a vast network in one fell swoop.

The Bulgaria Factor

Cryptocurrency took hold in Bulgaria due to the affordability of electricity for Proof-of-Work mining, on the one hand, and on the other, the capacity of cryptocurrencies for facilitating black market business, money laundering, and cybercrime. At Bitcoin’s peak in December 2017, Bulgarian officials are said to have seized, in a single anti-corruption operation, enough Bitcoins to pay off a fifth of the country’s national debt at the time. The Balkans have always been an area prone to black market business and a bridge between Asia and Europe for the trafficking of illicit goods. (It’s enough to mention the so-called “Balkan route” for trafficking heroin and supplying the lucrative European market. A history which goes quite far back in history. Neighboring Macedonia has even put opium poppies on their national emblem and coat of arms.

Bulgaria’s banking and financial sector has often been utilized as the transit point for money laundering before siphoning funds to offshore accounts – something founder Ruja Ignatova seems to know a lot about. What is perplexing is that, given that Bulgaria is an EU member state, this practice has been left to go on for as long as it has. It’s not a secret that when a corrupt state catches a fraud of massive proportions, it tends, more often than not, to just take its cut. Bulgaria seems to be especially corrupt, even by Eastern European standards.

Conclusion

Technological innovation is always followed by bubbles and speculative gold rushes which give rise to the proliferation of scams and frauds, especially in crypto, but the case of OneCoin stands out due to its deep connections to the state government as well as to officials in the supposedly regulated financial sectors of the European Union. It is also often said that after the collapse of the Soviet Union, Russian organized crime acquired a new global reach and became much more difficult to tackle and deal with. In all likelihood, there’s a lot more boiling underneath the already ugly surface of the OneCoin scam, especially given Bulgaria’s current political environment.

And to add to all of that, OneCoin seems to have surfaced again on Coinmarketcap.