Upcoming Prediction Market dApps: Flux and Helena. Interest and Niche-specific PMs.

May 29, 2019, 9:17pm

Advances in the domain of decentralized prediction markets and Ethereum-powered event derivatives as protocol overlays and composable services.

Prediction markets (also known as “event derivatives”, a category of “contingent claims”) are one of those concepts closely aligned with the decentralized, experimental nature of self-instituted crypto-economies since, in theory, they appear to provide the necessary base pre-conditions for realizing such efficiently operating markets. Augur was the first such project to launch on a public blockchain and one of the very first projects to be built on the Ethereum blockchain (whose main innovation is the upgrade of the blockchain with a simple run-time environment, the EVM). As the successor of the legendary Intrade, however, Augur has so far seen limited success compared to the Dublin-based web exchange popular among Wall Street traders and political junkies.

A number of Augur protocol overlay dApps have been launched over the past few months, however, which provide a more stripped-down and user-friendly protocol variation with a more streamlined user experience, featuring fast market resolutions and curated lists of markets to focus trade on. These dApps include Veil and Guesser, which I have previously written about. (The latter is focused on offering the simplest possible, most stripped down and easy to use front-end, limited to four binary options markets at a time.)

Companies building on @AugurProject are making the same mistakes they made when building on 0x. Short term greed as opposed to long. The only one that isn’t that I’ve seen is @guesserio. And I’m not an investor in any of them atm, so this is my own viewpoint #Ethereum #Augur

— Joey Krug (@joeykrug) May 15, 2019

Joey Krug from Augur comments on the tendencies of building on top of Augur and 0x.

Recently some other interesting developments have further taken place in the domain of decentralized prediction markets (PMs). Two new dApps have been announced: Flux and Helena. With Flux still in Alpha testnet while Helena already running on the Ethereum mainnet. Both platforms are focused on and specializing in event derivatives to do with the cryptosphere and/or the tech startups scene (whether crypto or not). But while one builds on the Augur infrastructure and contract shares making use at the same time of 0x relayers, the other is powered by tools developed by Gnosis.

Flux: Derivatives on Startups

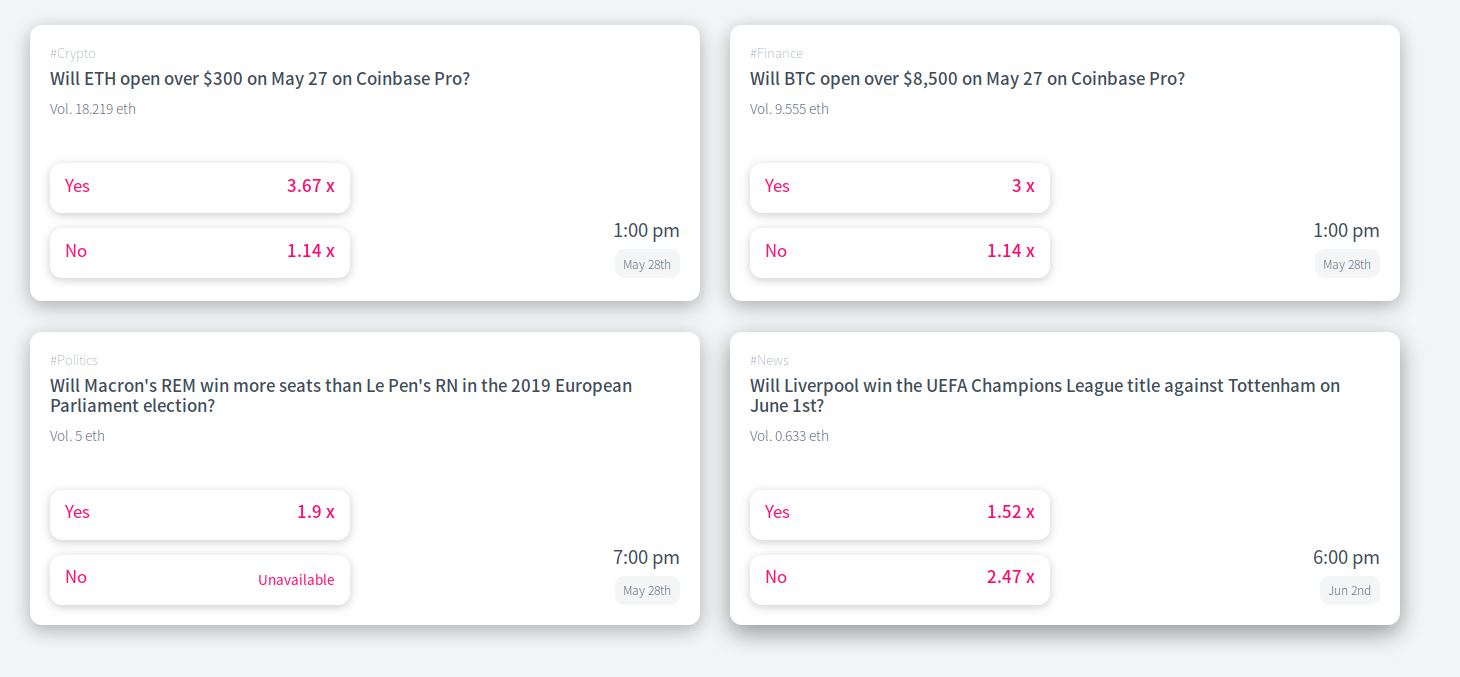

Flux is an attempt to channel the hyperactive surplus energy of #CryptoTwitter along market lines that builds on Augur, integrating 0x relayers and off-chain order books functionality with the MakerDAO-managed stability of the Dai stablecoin. In that respect, it follows the tendency of user-friendly Augur overlays that abstract away complexity in favor of usability and adoption that was started with Veil and Guesser. Flux narrows down the category of derivatives it would focus on to those based on topics related to tech startups, whether crypto-related, VC funded (Ycombinator, etc.), or otherwise. That implies betting “on startup milestones, funding, products, or even scandals.” Scandals are obviously a big thing in crypto nowadays, especially in the realm of social media.

Flux is a refreshing idea overall, one that has been around for some time and that could potentially live up to the status of a favorite new Ethereum toy. It could also serve as an instrument for maintaining some much-needed ethics and intellectual and regulatory hygiene in the space as a whole, possibly serving to abort various misunderstandings and transient mutations before they manage to reach a billion dollar market cap and start poking everybody in the eye with aggressive marketing campaigns, lambos and moons, and sleazy Twitter theatrics.

Conversely, Flux could be harnessed to incentivize other kinds of behavior. For instance, betting on developers as if they were racehorses at the track, (a fitting prospect given the size of some of their salaries these days), or moving disputes from Twitter into their respective markets, meaning predictive statements would be measured in terms what the tweeter is willing to back his position with (“putting one’s money where his mouth is”). Directly associating the risk with the individuals taking that risk is one of the core ideas underlying prediction markets and the broader notion of market efficiency.

The provocative nature of such a prediction markets platform would also likely attract the likes of 4chan‘s infamous /biz culture and other such mischievous trolls always looking for the loopholes and weak spots (often just for the lulz or simply to make “normies” feel stupid and ridicule “plebbit”, a modest but noble cause in itself, IMHO). In any case, it would be interesting to see how things pick up and go on to develop for that particular flavor of an Augur relayer dApp and the kind of activity it would turn out to generate and become a conduit for.

Flux is slated to officially launch on mainnet in the next month to two. Currently, access has been granted to only a handful of individuals who have shown early interest.

Helena: Industry Insight Provider. Built on Gnosis and Incubated at ConsenSys.

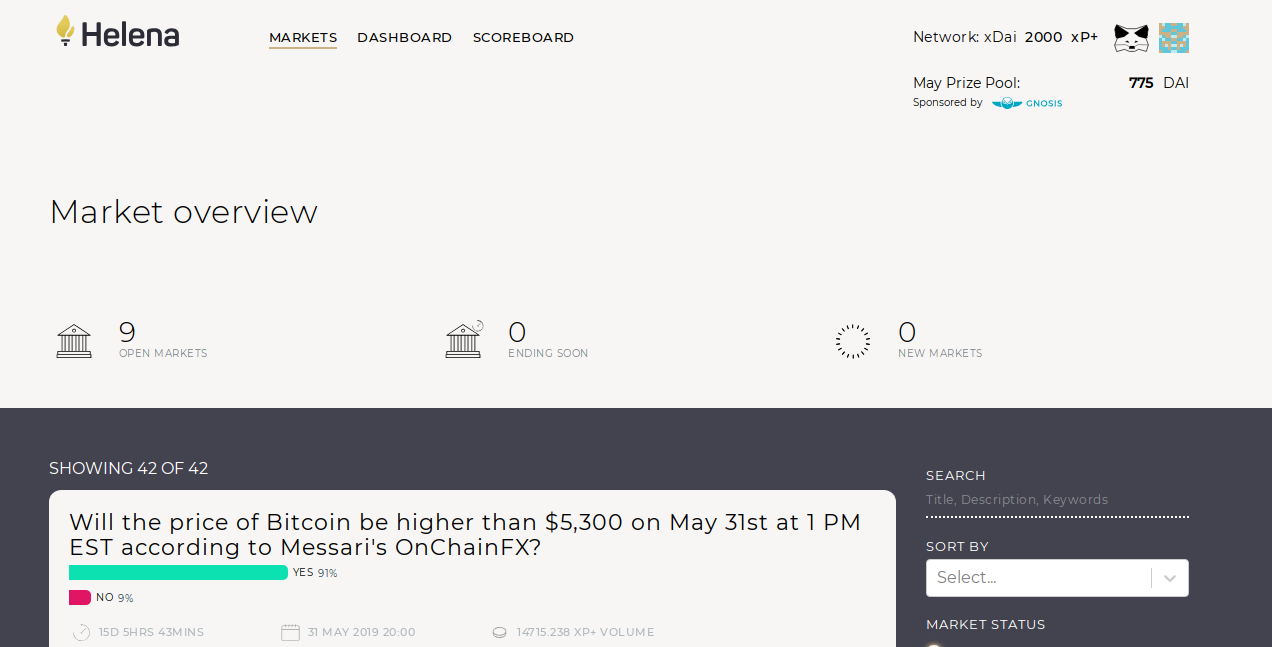

Helena is an altogether differently structured PM. Incubated at ConsenSys and powered by the Gnosis prediction markets protocol and tools. It is nonetheless still centered around things cryptosphere-related and geared towards extracting crowdsourced insights relevant to the industry. Upon signing up and being approved as a platform “insight provider”, one is issued 2000 xP (proton) tokens and 1 xDai (to pay fees with, as Helena is the first dApp to go live on the xDai sidechain, massively reducing transaction fees and confirmation times at 5 seconds block time and gas fixed at 1 Gwei – paid in xDai). One then uses the tokens to bet on the markets, which are predominantly Ethereum and Bitcoin oriented (whether related to technical fundamentals, system metrics or market price valuations).

Active markets are set for until the end of the last days of the month and current ones include options on subjects like the Lightning Network capacity by that time, the probability for SEC approval of the yet another upcoming Bitcoin ETF, completion of security audits related to key protocol upgrades and others in a similar vein (of “a prediction markets platform delivering real-time quantified forecasts about fundamental blockchain events, trends, and projects”).

The basic idea, similar to the one intended with the Flux dApp, is to extract from #CryptoTwitter and social media reliable and conclusive assessments relevant to the industry. (Twitter undoubtedly being the main arena for broadcasting opinions, exchanging casual insults and joining in on the regularly reoccurring instances of inter-tribal warfare between feudal clan leaders and financial techno-shamans.)

Helena is based on Gnosis Apollo, a collection of contracts that can be used in setting up prediction market tournaments and includes a play token contract and an address registry of participants. The betting play tokens are essentially non-transferable zero-value reputation tokens used to track the performance of registered addresses in the markets . Rewards are distributed (in either Dai or ETH from a bounty pool) on a monthly basis based on the participants’ overall performance. Using “play money” or zero-value tokens instead of “real money” or money denominated assets also bypasses gambling laws and restrictions in many areas and jurisdictions, especially the US.

The Helena team is curating the available markets, selected from the current most popular and/or interesting topics in the space, but is also open to suggestions. Helena is running on mainnet and while it seems well put together and it offers a slick web interface, the available markets at present seem anywhere from a bit trivial, if not banal, to insubstantial and arbitrary (to me anyway).

Potential Issues and Protocol Interoperabilities Within the Ethereum Ecosystem

In our view, derivatives are financial weapons of mass destruction carrying dangers that, while latent, are potentially lethal.

/Warren Buffett

Predictions in prediction markets could, of course, be employed as a means for actively facilitating the probability of events taking place and for provoking particular reactions as much as for forecasting them. The weight a market statement carries is articulated in the amount of value at stake which is in turn also the currency purchasing collective attention and guiding collective decision-making.

While actively seeking market inefficiencies, this also introduces a dimension in itself and one that could obviously lead to controversial and perverse incentives in some instances, as well as cases of Keynesian beauty contests that add no new information to the system. Additionally, the effects of bias and manipulation are other internal challenges to deal with in some instances, particularly when there’s a lack of liquidity which may distort market probabilities. PMs may also be subject to speculative bubbles.

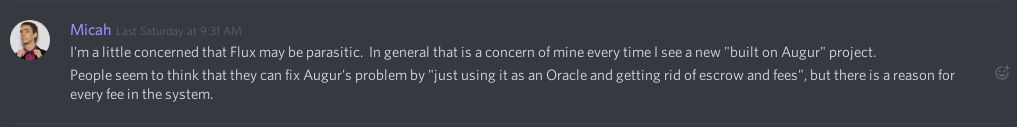

As for the particular implementation on the Ethereum blockchain, integrations of Augur with the 0x protocol (as in the case of most Augur protocol overlays like Veil, Flex and the like) can help improve the liquidity of Augur, while reducing trading fees and eliminating the need for trust among users wishing to interact with any ERC20 compliant token on one hand, but also end up leeching off the system by taking advantage of the Augur oracle while bypassing the fees necessary to provide its service as an oracle.

While Augur is considered the de facto prediction markets protocol on Ethereum and constitutes a sophisticated protocol serving the double function of both a PM framework and an oracle for specific events, Gnosis is a project that has taken the approach of providing the tools for building customized forecasting applications with. These include market making dApps, decentralized exchanges (e.g., DutchX, which operates on the Dutch Auction principle) and others.

While Augur is considered the de facto prediction markets protocol on Ethereum and constitutes a sophisticated protocol serving the double function of both a PM framework and an oracle for specific events, Gnosis is a project that has taken the approach of providing the tools for building customized forecasting applications with. These include market making dApps, decentralized exchanges (e.g., DutchX, which operates on the Dutch Auction principle) and others.

While far from ideal or perfect, it seems that at present only Ethereum’s infrastructure fits the criteria necessary for conditioning a sufficiently decentralized and censorship-resistant prediction market as envisioned in Friedrich Hayek‘s conception in his famous 1945 essay, “The Use of Knowledge in Society”. Hayek describes PMs as “mechanisms for collecting vast amounts of information held by individuals and synthesizing it into a useful data point”.

The theory of complete markets also underpins the abstract economic machinery of prediction markets — that is, markets where negligible transaction costs are a condition for perfect information and in which there is a price for every asset in every possible state of the world. This means that given the sufficiently global and decentralized reach of actively priced-in information, any given asset has a different value according to the current state of affairs in an uncertain world (e.g., an umbrella tomorrow, if it rains, is a distinct outcome from an umbrella tomorrow if it is clear).

Augur v2.0

The first major upgrade to the Augur platform lays out a detailed plan for resolving some of the more persistent issues and protocol vulnerabilities that have been revealed since Augur’s official mainnet launch. These include making a tradable outcome “invalid” rather than resolving for equal amounts of value per share (as in the current implementation where this point has become a focus of exploitation by bad actors), which would enable traders to hedge the risk of invalid outcomes and gauge their likelihood via market forces.

Dai integration and denomination is another key component to be introduced, satisfying the single biggest request (from community and users) and roadblock to wider adoption – the ability to trade in a stablecoin fixed to a commonly accepted and agreed upon financial convention (i.e., the US dollar), making trading more acceptable and a whole lot less volatile. Dai, as the stablecoin of the Ethereum ecosystem, is rapidly becoming an integral component of Ethereum dApps with financial applications.

Another important upgrade is the moving of the token standard (of Augur’s native REP token, the utility of which assigns the role of accurate outcome reporting, receiving small fees for the provided service) from an ERC20 to the expanded and backward-compatible ERC777. The latter includes some additional fallback functions that minimize friction and costs for apps interacting with Augur. Other than that, a “use it or lose it” mechanism will be implemented in the REP token’s logic such that will give REP holders a 60-day time frame to participate in the resolution of a disputed outcome and migrate to one of the forked Universes, otherwise they lose their REP holdings.

A more detailed overview of all the upcoming 2.0 changes is published in the official Augur blog.

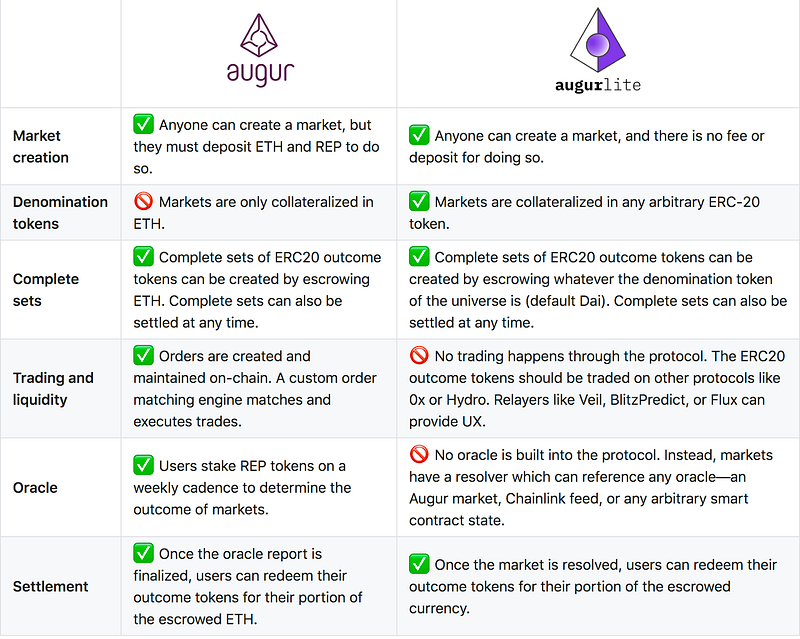

Veil and AugurLite

Veil has announced its own simplified fork of Augur, AugurLite – an implementation of Augur and its contracts suite that has much of the oracle functionality and native token (REP) removed. The reason for this, Veil has announced, is the launch of Augur v2.0 later this year and users being discouraged from creating markets on the current version of Augur that may expire after Augur v2.0 launches. And since long-running political markets and particularly the ones centered around the upcoming 2020 US presidential election are heavily requested on the platform, this temporary fix was suggested for the time being.

As a rule, only vetted Augur markets show up on Veil, which is built as a matching relayer, allowing users to submit and cancel orders without incurring gas costs. This, combined with the fact that Veil structures their market shares as 0x orders while Augur uses their own custom schema, means liquidity is not shared between Augur and Veil.

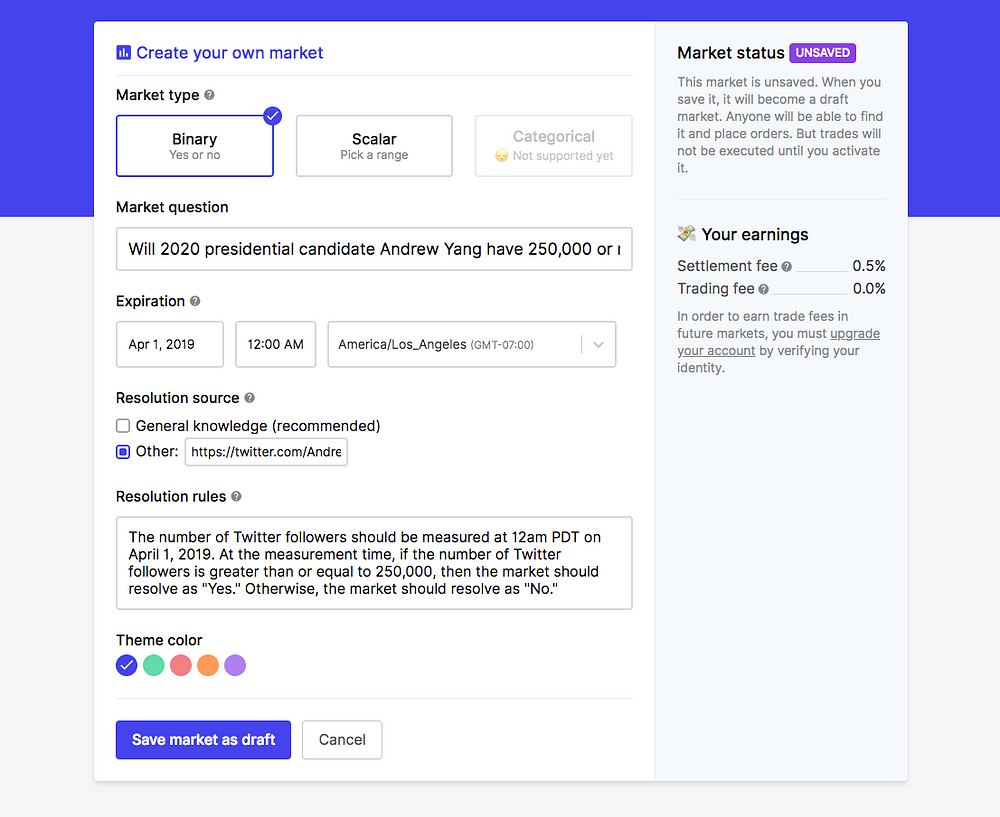

Veil’s market-making interface.

Markets can be binary options (two mutually exclusive possibilities) or scalar (in degrees or range of). Categorical (multiple concrete choice) options are not yet supported. The three categories exhaust a wide range of possible articulations of market statements and potential financial instruments.

Conclusion and Summary

“Derivatives are a huge, complex issue.”

While early forms of prediction markets existed as far back as the 16th century when people would bet on the papal successor, decentralized prediction markets that run on permissionless public infrastructure are a powerful new concept paving the way for open access to the financial value of information. The above platforms are intriguing recent developments in an area of experimentation where crypto-economics, economic theory, social sciences, and software and financial engineering intersect. As such, they are one of those domains most relevant to the cryptosphere, since by definition an efficiently functioning prediction market that generates reliable economic signals requires the necessary pre-condition of decentralization, censorship-resistance, and diversity of opinion (“the wisdom of the crowds”). So, in that sense, crypto-based PMs are really a historical experiment which, given wider adoption and increased pools of aggregated information and market liquidity, could develop into the powerful forecasting meta-tool they were intended to be.

PMs are also in themselves the subject of academic interest and research and there’s a good deal of academic involvement in Augur’s Forecast Foundation (notably Robin Hanson, known for overcomingbias.com and the idea of futarchy governance, among other things), making it one of the few projects that give rogue crypto-economic networks of circulating value (a.k.a. “crypto-currencies”) some much needed legitimacy. And while to some this may on the surface seem just like “a glorified betting platform”, it must be remembered that it was only relatively recently in history that a difference between market speculation, trading, investment, and gambling was made (the history of finance as such being remarkably mad and irrational in itself).

When considering the weight of the global derivatives market (to the tune of a quadrillion dollars from below a trillion in the late 1970s) and that derivatives as such are the epitome of the age of financial capital that we live in today, the potential and significance of such experiments cannot be overstated. Especially as the financial engineering of PMs is geared towards re-calibrating markets with the first-order reality of facts in the world. As a generic framework and a contract template, Ethereum-based crypto-derivatives generalize the basic underlying logic of derivatives across the board, affording the opportunity to correlate blockchain economies with real-world assets, capital flows and events, offering a fruitful ground for creative tinkering and innovation.

One emerging tendency, as shown above, is the differentiation of market making platforms along domain and niche-specific derivatives, focused on particular industries, interests, and areas of expertise and knowledge (e.g., sports betting, biotech and pharma, foreign politics and geopolitical affairs, etc.) or even those geared towards regional or local affairs, tailored to the corresponding language(s) of that area (e.g., Eastern European, Middle Eastern, etc.). After all, the purpose of PMs is to cast a decentralized epistemic net as far and wide as possible in order to absorb as much information, as diverse as possible (e.g., local knowledge, domain expertise, angles of interpretation, etc.) relevant to the market in question.

Derivatives as such are a highly abstract form of capital that reaps profits from uncertainty, risk, and volatility (as a measure of instability), which in traditional finance and options trading is referred to as “convexity”. That is, the duration from market creation to market expiry in which the contract’s price fluctuates in relation to the more or less unpredictable variables that it is derived from – and the optionality therefrom, for seizing the best possible presented opportunity as it befits the statement of the contract before its expiration.

Policies that turn their back on the wealth that derivatives are capable of producing are counterproductive in an age of diminishing resources. The derivative moves in a direction opposite to debt by giving everyone a common stake in a future that all must acknowledge is volatile and uncertain. Revaluing the social implications of derivatives may give us a way not to fear the future we confront. What are the policies that would allow us to harness the potential of financial capital for larger social benefit?

The derivative taps into and makes more explicit the fundamental role of volatility, risk, and uncertainty in our lives; its financial form is merely the monetary realization of social processes in which future volatilities and uncertainties are transformed into present assets of all sorts.

Could we fashion a social system of derivatives that not only taps the wealth of the future for present use but invests much of that new abundance according to a revalued understanding of social wealth’s capacity to create the futures we need to flourish?

Emphasizing with the above citation the opportunities presented by making prediction markets and their financial engineering open source and publicly available and the prolific ground for experimentation and innovation provided by the pushing of such endeavors.

Useful Links and Other Resources

PredictIt is a popular centralized prediction market based in New Zealand, offering prediction exchanges on political and financial events. PredictIt’s office is located in Washington, D.C. and the platform has secured a no-action letter from the Commodity Futures and Trading Commission (eliminating the risk for of prosecution for illegal gambling and the like). There are limits wherein each question is limited to 5,000 traders, and there is an $850 cap on individual investments per question. PredictIt has over 50 university partnerships. Some universities include Harvard University, Yale University, Duke University, and University of Pennsylvania.

“Using Prediction Markets to Enhance US Intelligence Capabilities: A Standard & Poors 500 Index for Intelligence”, a Center for the Study of Intelligence publication at the CIA public library.

The peer-reviewed Journal of Prediction Markets, published by the University of Buckingham Press that collects the available research literature on the matter.

Augur’s official site and Github repository.

Augur’s StackExchange.

The Augur Discord is the go-to channel to discuss and inform oneself on all things Ethereum PMs. And really just overall one of the better, more intelligent and civil crypto chat channels/Discords.

Predictions.global, a list of all Augur-based markets (including those on Veil, etc.) and their details.

Augur.casino, a third-party hosted Augur dApp. To try out, but not advisable to actually use with actual ETH/REP (run/host your own Augur stand-alone instance for the purpose).

Reporters.chat, tracking REP and markets stats.

Blitzpredict.io is another Augur-powered 0x relayer focusing on sports and e-sports (games).

Augur.guide is a friendly user guide to the Augur prediction market protocol.

Helena Github repository.

Guesser official site.

Gnosis official site.