Social Media’s Role in Making or Breaking Cryptocurrency

Jul 30, 2018, 10:47am

Whether it is Telegram, Twitter, Reddit or any other channel, social media platforms are to a large extent shaping the present and future stature

Cryptocurrencies present very low barriers to entry and are highly liquid, unlike any historical financial asset class. The nature of social media allows for an exponentially larger volume of information, discussions, opinions, positions, and strategies to be shared at a devastating pace. This strengthens social media’s foothold on the crypto-market and facilitates crypto’s volatility. A single tweet from a social influencer can massively shift demand for a particular cryptocurrency in a matter of minutes.

Over 66% of adult Americans get some form of news from social media, which, like the crypto market, is a 24/7 operation. Studies indicate that there are over 2000 mentions of ‘Bitcoin’ every 30 minutes on Twitter, and over 500 new discussion posts per day on the r/CryptoCurrency subreddit that has over 701k followers. Reddit and Twitter, by far the two largest crypto communities, have seen their fair share of drama, whether in the form of news, discussions, rumors, attacks, support, or something different.

Crypto’s relationship with social media has had its bumps, being kicked out of Facebook, Google and Twitter, then brought back to some, or completely banned in others. It can’t live with it, can’t live without it. What follows is a comprehensive SWOT analysis of crypto and social media’s love-hate relationship.

Strengths

Telegram, Slack, Reddit, and Twitter are used by the crypto teams to communicate updates, announcements, roadmaps, partnerships etc. with the rest of the community. Developers and executives can take community inputs into consideration as they chalk out future plans. It leads to debates and discussions (potentially leading to forks and scalability issues), which not only helps newbies learn more about the technology but is essential for retaining the integrity and essence of a noncentralized entity.

Social media also affords communities a platform to rally behind individuals and raise legitimate concerns in a manner that cannot be ignored.

Take WaltonChain’s fake Twitter winner gaffe, for example, which was ridiculed across social channels and cost them $30 million in market share overnight.

Reddit has been brilliantly used to call out and put pressure on exchanges like Coinbase and Bittrex that have held back customer money for months over unresolved issues and provided a lack of customer support. The Reddit community has also gotten together to demand lower withdrawal fees from Binance as well as to force BitGrail to backpedal after their RaiBlocks (Nano) scam.

Most crypto projects have a very responsive Telegram channel where users can discuss doubts and other queries directly with developers and concerned project personnel. Through Youtube and Twitter, cryptocurrencies can cast their web as far and wide as possible for potential users and investors.

Weaknesses

On the flip side, the rapidly moving information and highly vocal opinions on social media, including the spreading of FUD and negative stories, can often become detrimental to the reputation of certain cryptocurrencies, and to the proliferation and adoption of the field in general.

For instance, when news spread about Hong Kong-based exchange Bitfinex getting hacked and losing nearly $72 Million worth of Bitcoin, its price plummeted by 20% in a day. Users on social media platforms often share stories from sites that lack proper vetting of sources and facts, or that provide shallow analyses of complex situations. We have even come across widespread rumors about plans to ban cryptocurrencies in country X, only to legitimize it a few months later.

But while fake news is arguably harmless, ICO and crypto scams, frauds, and deceptions are also rampant across social media. In a market where an overwhelming majority of investors lack an understanding of the underlying technology, crypto influencers have a huge impact and sway on the less informed users. The greed perpetuated by constant claims of ‘lambo’ and ‘moon’ leaves them vulnerable to being manipulated by the influencers for pump and dump schemes.

The infamous BitConnect Ponzi scheme saw many people lose a fortune thanks to the constant shilling by a 17-year-old highschooler ‘CryptoNick’ who had no domain expertise of cryptocurrencies or financial markets.

Phishing and spoof website attacks of crypto exchanges are also common across social media as hackers try to catch the less tech-savvy users off guard. Twitter is full of scams where the tweets of verified influential users have a comment section with users impersonating the author’s avatars and names to dupe unsuspecting people.

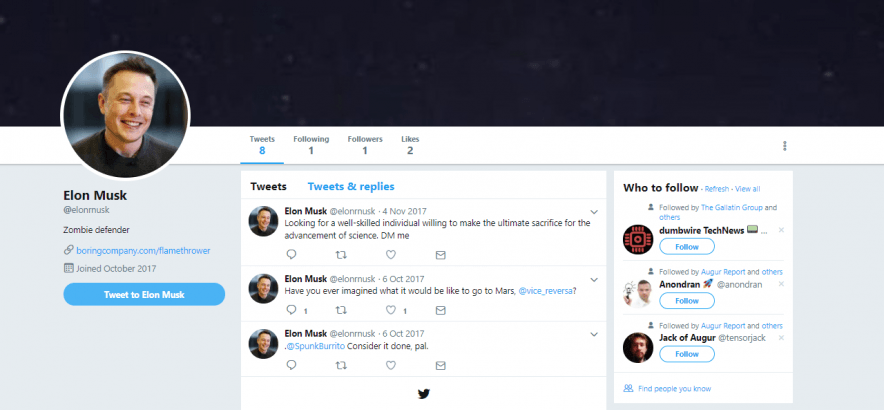

For instance, @elonrnus replies to every @elonmusk tweet posing as the latter to scam people with the classic ‘Send us 1 ETH and we will send you 10 ETH’. That Vitalik Buterin himself, alongside others, added “Not Giving Away ETH” as his Twitter middle name goes to show the gravity of the situation and influence of internet con artists.

Opportunities

The global interconnectivity of social media makes it possible for cryptocurrencies to keep developing new partnerships and innovative solutions. It may even force banks into lowering their fees and charges to stay competitive and save face.

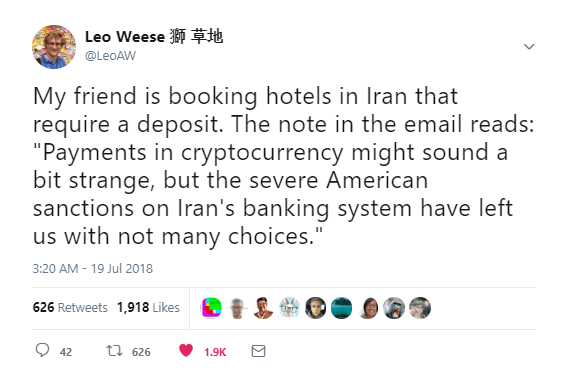

Social media coverage of the benefits of cryptocurrency also makes it possible for people living in countries with political turmoil and a heavily inflated currency to find alternative modes of payment. Venezuela, the poster child of currency crisis, has already seen large segments of the population turn to Nano and Bitcoin for purchasing groceries and other necessary items, and Iranian hotels are apparently joining the game.

The recent Facebook Cambridge Analytica scandal perfectly illustrates the privacy shortcomings of the centralized social media companies. It has given a tremendous opportunity to blockchain based decentralized social media platforms to usurp Twitter and Facebook from their long-held throne. With everything to gain, can the likes of Steemit, Sapien, Obsidian, Dtube, Sola, and Props fill this privacy shaped void?

Threats

Social media poses a concerning threat to the adoption and growth of cryptocurrencies.

The battle of the 2 biggest bitcoin subreddits r/Bitcoin and r/btc has been extensively covered in the media. The three biggest Bitcoin forums on the internet (r/Bitcoin, bitcoin.org and bitcointalk.com) are all moderated by the same person who goes by the pseudonym u/theymos. Theymos has been known to abuse his power and censor content that does not fit his narrative or is critical of him.

Those on the other side of the Bitcoin scaling debate make similar accusations of propaganda against Roger Ver who runs r/btc and bitcoin.com. A lot of paid shills are hired to spread misinformation, harass opposition supporters and spread propaganda. There is constant trolling and hate wars going on between different camps, coins, projects, and personas in the crypto sphere. This inevitably results in blowback in the form of brigading, astroturfing, and more censorship.

The endless shilling, herd mentality and zero-sum ideology has resulted in a cult-like attitude around projects which cripples adoption of cryptocurrencies.

On top of all the infighting, plenty of new projects seemingly overpromise on what they can deliver.

Some promise to resolve major issues without even having a single line of code written yet. Others willingly sacrifice decentralization for greater scalability/speed. A lot of these projects will fail to live up to their hype and underdeliver.

Nevertheless, uninformed investment-centric discussions on social media can effectively turn into an echo chamber full of manipulative shilling (*cough* John McAfee) with buzzwords thrown around devoid of any technical or informative explanation, often made by self-proclaimed Technical Analysis (TA) experts.

Boon Or Curse?

Everybody hates capitalism till they get the chance to be rich.

One possible way to reduce manipulation and price volatility and increase stability is by refraining from indulging in conversations regarding ‘investments’ on the more popular social channels (Twitter, Reddit, and Facebook) and instead focusing on the philosophies, visions, and benefits of different projects and technologies.

An informative approach to using social media will be far more efficient than one based purely on incentives of speculative investment. That means losing the cult ideology around projects and being more inclusive of other, even competing, projects. No more HODLs, lambos, moons.

Compartmentalization of information is one of the biggest areas for improvement when it comes to cryptocurrencies and social media. Fundamental analysis and technical analysis based discussions and predictions should be moved to more curated and specific channels (such as discord and trading view). This way only those who are seriously interested and want to devote time and energy resources to figuring out investment strategies for themselves will be exposed to the technical world.

Social media based crypto communities should make as much effort as possible to expose the underhand tactics of Wall Street and political personas who not only manipulate the crypto market but also leave no stone unturned to criticize cryptocurrencies. Old-money backed media jumps the gun on every opportunity to attack cryptocurrencies but we rarely see stories that address the incentive behind their actions. Why does WEISS ratings reflect poorly on cryptocurrencies? Who stands to gain off it? Crypto-based online publications should bring such manipulative practices into light and question at every given opportunity the deeper reasons for such hostility towards cryptocurrencies.

Brad Sherman, who criticized cryptocurrencies in Congress, was recently found to have as his biggest campaign donor a credit card payment processor which would stand to lose business to cryptos. This company was even busted for illegal gambling. JP Morgan bought over 3 Million Euros worth of Bitcoin shortly after CEO Jamie Dimon had labeled the cryptocurrency a ‘fraud’ and caused a massive slump in the market. Under pressure from Swedish financial authorities who were on the verge of reporting him for market abuse, Dimon soon backpedaled from his earlier statement.

Becoming familiar with such stories can help layman social media users understand why the traditional banking sec, as well as top political brass, has a crypto averse outlook.

Social media communities are a powerful tool, for better or for worse. To promote the positive, users and moderators should seek to foster an environment that is oriented towards free discussion and learning.