The Cryptocurrency Market Slides into a Massive Decline

Jun 12, 2018, 11:06pm

As predicted, last week's flat market activity has turned into a wholesale correction with prices crashing sharply over the weekend.

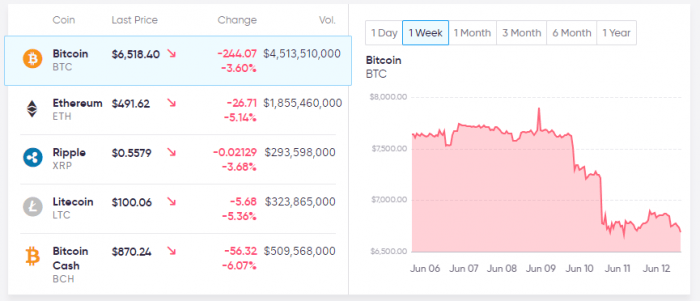

As predicted, last week’s flat market activity has turned into a wholesale correction with prices crashing sharply over the weekend. The slide continues today with most of the major assets down by single-digits on relatively stable volume. Interestingly, the price correlation between the top 10 assets remains unusually strong despite the volatility in the market.

Further down the line, several smaller coins buck the trend of the market with double-digit appreciation in the last 24 hours.

The total cryptocurrency market has now fallen below $300 billion for the first time this year, and further declines are an almost certainty. So far, the correction disproportionately affects Ethereum and the altcoins, and as a result, Bitcoin dominance has risen to 39.6% of the total market.

Bitcoin and Ethereum

Bitcoin prices have found support around $6,400 – $6,500, and prices are currently hovering around that level. The technicals remain bearish and further declines are likely in the next 24 hours. A similar pattern has formed for Ethereum as both assets remain highly correlated.

Positive Movers

Several assets are bucking the trend of the market today, posting double-digit gains in what has otherwise been a red day for crypto.

Big movers include several cannabis-based coins such as Hempcoin (THC) and Potcoin (POT) – both up by around 13% – along with more mainstream assets like Ethereum Classic (ETC). Ethereum Classic is up by around 20% to a per unit price of $14.88 and a total market cap of $631 million. This rally comes after the announcement of the Annual Ethereum Classic Summit to be hosted in Seoul, South Korea.