PoWH3D & FOMO3D: Flawed Behavioral Economics Wrapped in Highly Secure Smart Contracts

Sep 20, 2018, 1:00pm

After a series of failed attempts, 4chan's /biz/ has come up with clever Ethereum implementations of troublesome game theory scenarios.

One of the most popular innovations running on Ethereum lately is a series of demonstrative crypto-economic games capturing some problematic instances of behavioral game theory and sealing them in what appear to be highly secure and transparently auditable (i.e., written to be easy to read and not mislead) smart contracts. PoWH and FOMO3D by Team JUST undoubtedly classify as a uniquely provocative and curious phenomenon.

Origins and the Team

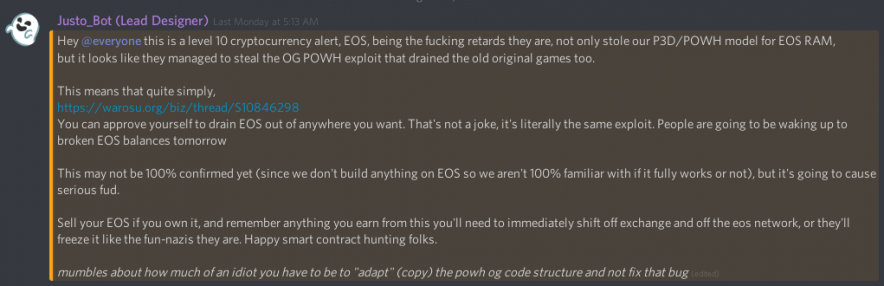

The PoWH3D (Proof of Weak Hands) and FOMO3D games originally started as a kind of a caricature of the farce surrounding crypto culture with the biting sarcasm characteristic of the spirit of 4chan. The idea was incepted and put together by 4chan’s /biz/ as a money grab, or “an open source simulation of what Bitconnect said they were doing” as the official site explains. Both games are conceptually a play on human greed. The first iterations, the first being EthPyramid, were amateurishly coded and quickly aborted. One early such incident involving what has by now become a proverbial Solidity programming mistake is the omission of the SafeMath library causing integer overflows. These early attempts were likewise surrounded by all kinds of absurdities, including one investor putting a bounty on the head of one of the developers.

EthPyramid was at the time promoted as “the pinnacle in affordable, repeatable, unreliable pseudo-investment opportunities for the gullible and over-rich”, and the team portrayed themselves in their “white paper” as

composed of approximately a dozen of the most enthusiastically greedy and unhinged code monkeys that happened to be around at the time.

Following the first few failed buggy attempts, a developer going by Mantso arrived on the scene, the earlier developers were let go and PoWH expertly revamped from scratch. The anonymous group that formed behind PoWH and FOMO3D became known as team JUST, composed of four members – Justo, Mantso, Inventor and Sumpunk. Many have assessed and remarked on the professionalism and skill of the manner in which the Solidity contracts have been written. A commentary from ethresar.ch, where FOMO3D has become a popular topic of discussion, says:

I’m someone who has been watching this team closely as I think they have some of the best Solidity developers in the world. In the grand scheme of things, I have not seen many multi-billion dollar projects do what this team has done with virtually nothing but time and diligence.

An Irrational Social Experiment

PoWH3D and FOMO3D combine the algorithmic enforceability of smart contracts with behavioral game theory and psychology to fashion a kind of social experiment that is intended to capture and bring to the surface all the follies and irrationality of the cryptocurrency frenzy in a single multi-faceted proof of concept playground for designing “games” fueled by human greed.

Justo from team Just says in an interview,

The P3D contract itself was our intention to game-ify cryptocurrencies as a whole, and all the joking mainstays of everything they brought to the table. Mining, Staking, Masternodes, you can see we make fun of all these concepts and we have features that effectively perform the same functions, yet don’t work anything like cryptocurrencies actually do.

The games represent a stripped down, bare statement about collective irrationality and the extent to which markets are primarily driven by impulses of greed and fear. The tokens (P3D and F3D) offer no real purpose, utility or service – they serve to demonstrate that these implicit assumptions are more than sufficient to stir considerable volume and liquidity (which is what generates dividends for P3D token holders). Which in this case is perhaps much more than considerable, given that both PoWH and FOMO3D tend to gravitate in the top 5 most popular DApps ranked by DAU (daily active users) and the contracts often holding head spinning amounts of Ether (to date, the official wiki claims that nearly 342,000 Ether in volume has passed through P3D, including more than 34,000 ETH paid out in dividends).

Due to the nature of those games (interaction with irrational and unpredictable forms of human behavior, i.e. FOMO, weak hands, etc.), there is no smart contract, program or algorithm that can resolve them. In addition, the nature of blockchains and distributed systems immortalize them, as the contracts will perpetuate themselves for as long as Ethereum exists.

These are in a way known defects in human rationality (from the standpoint of assuming rational actors in a situation) that decentralization will, in any case, have to sooner or later face and deal with.

PoWH3D: Proof of Weak Hands

Advertised as “decentralized passive income until Ethereum dies”, categorically not a Ponzi or a pyramid scheme since there are no promises and everything is transparent, Justo describes PoWH/P3D so:

We’re already changing the crypto space with our economic model, the world is a little tougher to crack but I assure you the things we are doing with smart contracts are not being ignored. You can consider P3D a prototype of a trustless ICO model in which the volatility and volume of trading on a currency pays the development team for example. ICO models right now are completely trust based and as a result 95% of them vanish overnight with a wallet full of Ether never to be seen again.

POWH3D also derives from the work of Dr. Jochen Hoenicke, a computer scientist and research assistant at Albert-Ludwigs-University of Freiburg, Germany who casually came up with the idea of what he described as Ponzi Token, summarized in the following way:

Tl;dr: Don’t invest in this token 🙂

This is a Ponzi Token. Early investors are paid by the fee later investors pay. All in all it is a zero-sum game. This means, if you make money using the token, then somebody else loses money. If you don’t understand this, it is much more likely that you are the one who loses money, in the worst case, your whole investment.

It is also a highly speculative token, as the price may rise or fall according to the amount of tokens issued. Don’t invest more than you can afford to lose. Note that the 80 % reserve doesn’t mean that 80 % of your money is safe. If the price is driven down, when people start selling tokens, you may only get 80 % of the lower price back.

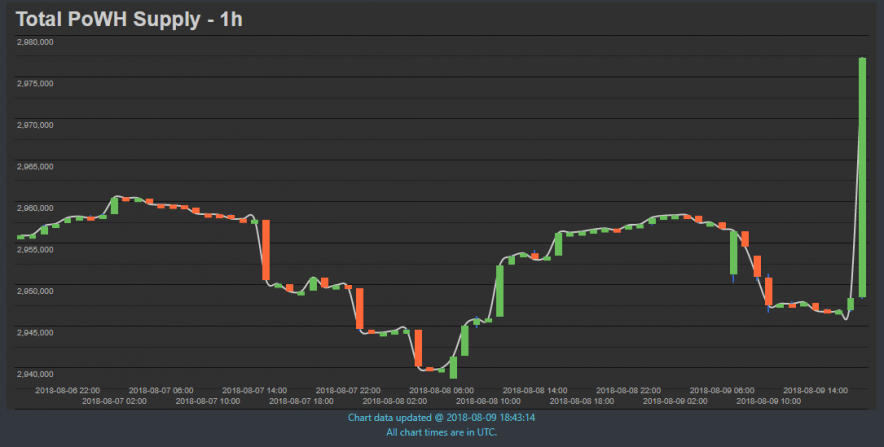

PoWH is in effect a decentralized exchange that lets you swap ETH for P3D tokens. These ERC20’s serve one purpose – paying out dividends depending on volume of exchange. When you buy in or sell out, either way you pay 10% in ETH which gets distributed among token holders. Tokens cannot be bought off anyone or anywhere else – the smart contract generates and burns them as buys and sells take place. As a result, total supply constantly fluctuates with each token bought and sold (see chart below).

There is no single authority in control of the contract and no promises about anything. The contract logic is such though that, for example, if a whale were to cash out, this would bring proportionately massive dividends to the rest of the players. Essentially, the premise is that for as long as one holds on to his P3D tokens, one is continuously accumulating “free” Ether distributed with every transaction based on the number of tokens one holds on the exchange.

As a game of “weak hands”, you enter at immediate 20% disadvantage. The only way to win is to hold and collect dividends from the ongoing activity. There is no estimated ROI, average profits, etc. The only thing one can estimate is how much they stand to gain or lose based on how much ETH is held in the contract at any given time proportionate to the number of tokens one holds (a handy chart to extrapolate expectations based on these variables can be found here). Regardless, this still is a great example of how good ideas could potentially come out of bad ones and at the same time also an example of well thought through tokenomics, especially when contrasted with most other “business” enterprises and tokens (something team JUST seems to take pride in).

The contract code can be found here.

FOMO3D: Fear of Missing Out

A follow-up on PoWH is FOMO3D which is accessed through exitscam.me. FOMO3D has people purchasing keys, and with each time somebody buys a key, multiple actions are triggered; the duration of the game increases by 30 seconds; the price per key is raised by a small amount; the overall pot size increases; and dividends get paid out to both key holders and P3D token holders (as the games are designed to mutually sustain each other).

The last person to purchase a key before the timer hits 0 successfully “exit scams”, draining the contract – or more precisely, as per the contract, receiving 48% of the active pot with the rest of the proceeds re-distributed depending on which of the four teams the player has chosen to associate himself with.

Far from simply gambling, FOMO3D is likewise a critique of the cryptocurrency hype, demonstrating just how far the absurdity can go in possibly the first ever such large-scale crypto economic social experiment. Justo describes it as “just a trick of human psyche”. When asked if it really is a scam, he responded,

I mean, if it was an actual exit scam, it would be great too, right?

FOMO3D is actually a variation of an old game in economics/game theory known as the Dollar Auction (also taught in many business schools). The game, designed by economist Martin Shubik, is a non-zero sum sequential game that is designed to demonstrate a paradox based on traditional rational choice theory. By this paradox,

players are compelled to make an ultimately irrational decision based completely on a sequence of apparently rational choices made throughout the game. The setup involves an auctioneer who volunteers to auction off a dollar bill with the following rule: the bill goes to the winner;

In every game, there is an auctioneer who auctions off a dollar bill but under one rule- that the bill goes to the winner. However,

the second-highest bidder also loses the amount that they bid. The winner can get a dollar for a mere 5 cents, but only if no one else enters into the bidding war. The second-highest bidder is the biggest loser by paying the top amount they bid without getting anything back. The seemingly rational decisions during the game are in fact clearly irrational once one realizes that they are nothing more than a greedy algorithm, which is of course not guaranteed to give a globally optimal solution.

Reminding also of the “war of attrition“, the strategy of wearing down the opponent simply due to being outnumbered and having much more resource at disposal. A war of attrition differs from other forms of war in that it is deliberately wasteful (e.g., the scorched earth tactics of the Cossacks against the advancing French) and if the sides are approximately evenly matched, the outcome of a war of attrition is most likely to be a Pyrrhic victory (a victory that inflicts such a devastating toll on the victor that it is tantamount to defeat).

Possible Scenarios and Outcomes

Vitalik Buterin commented on the negative outcomes these games could eventually lead to if ETH simply continues to accumulate and consequently increases in value,

If the ETH inside it does get to multimillion levels, then the natural two concerns are (i) someone finally wins, and gets all the money all at once, leading to market instability, and (ii) it gets hacked, with similar consequences.

Justin Drake, an Ethereum foundation researcher working on Ethereum’s sharding implementation adds that

As I understand the winner of the jackpot is the last player. Because miners as a group decide who the last player is, my guess is that the jackpot will be won by one or more miners.

The size of the jackpot is already, after a couple weeks, large enough for large mining entities (in particular, mining pools) to attempt to win the jackpot. The game is designed to take a long time to conclude, so mining entities have time to strategise and write custom software implementing their strategy.

- If there’s 1M+ ETH at stake my guess is that we will see dirty tactics being played out, such as:

- DoS attacks to temporarily take down mining entities (this could be networking level DDoS, transaction spam, exploiting a 0day, etc.)

- Transaction censorship to prevent changing the last player (e.g. mining empty blocks)

- Deviations from the canonical fork choice rule (block orphaning attacks, 51% attacks)

- Block withholding

- Renting out of mining power (see nicehash.com)

- Bribing contracts and/or collusion among the mining pools

The design space for bribing contracts is quite interesting and under-explored. One could imagine someone setting up a meta contract that breaks the winner-takes-all dynamics with a scheme that trustlessly divides the jackpot winnings among the miners that opt-in to do transaction censorship.

In any case this is uncharted territory, possibly with systemic risk, and it should be interesting to see it play out.

To better understand how the pot distribution is performed, readers are advised to visit the official FOMO3D wiki page. It seems that concerns about the games are mostly focused on market instability due to one winner eventually receiving all ETH, as Vitalik Buterin warned. However, Drake clarifies that this is not true,

upon receiving a pot, 48% of the sum of funds is sent to the winner, 2% to the community fund, and a varying amount to the next round, FOMO3D key holders, and P3D tokens which comprises the remaining 50%.

The jackpot payout of ETH, therefore, will in fact take place but it will be proportionate to the total amount of ETH that is redistributed at the end of each round. Moreover, key holders receive ETH “dividends” and airdrops (relative to their holdings and buys throughout the game itself) so that there is a redistribution of ETH even before the game is completed. Concerns such as Buterin’s regarding market instability are, therefore and according to Drake, nothing more than a whale creating a new position in ETH.

Recently, a player who cleverly managed to outmaneuver the bots took the pot of around 3 million USD at the time. During the week before, the player had been sending transactions to the bots, measuring their reactions. Then going on to buy all the gas filling a block in a stepwise manner.

Ethorse

Ethorse is said to be the first DApp to integrate P3D in its inventory. An hourly betting game on how badly a coin or a token will perform. Justo describes the relationship (of HORSE) with P3D in an announcement as:

It also runs its own HORSE token, which acts as the house. Giving every holder of the token quarterly dividends off the project. This new integration will dedicate 30% of the house edge towards purchasing P3D tokens and holding them to pay out those HORSE token holders at a later date. It’s quite a cool system, and is the first integration where we’re seeing a secondary token grant two sources of dividends by using P3D!

Ethorse basically amounts to a kind of quick binary options market and is intended for crypto traders. One of the main supporting components is Oraclize for external data feeds (from Coinmarketcap and others).