Ethereum Falls Again as Shorts Hit Record, DOGE, DASH and XMR Sep.10

Sep 10, 2018, 7:29PM by Kevin George

by Kevin George

Ethereum trades under $200 as shorts hit an all-time high, warning of a possible short squeeze rally ahead. DOGE and DASH primed for gains.

ETH

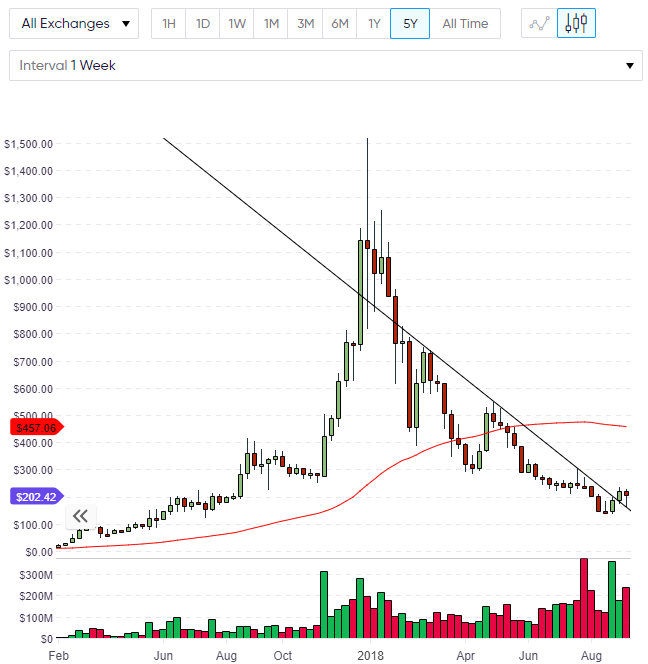

Ethereum’s failure to hold the $300 level led to a brisk sell-off in the middle of last week, with price falling $100 to trade below the $200 mark. A bearish close for the week means that Ethereum may see lower prices as it seeks to find the ultimate bottom, however I would expect that the worst of the selling has happened for now. Ethereum has been on a rollercoaster ride since the April lows, with a rally to $800 and now the crash to $200. Despite the disappointing price action, ETH did double from the April lows in just four weeks, so the potential is always there to outperform on the upside also.

Ethereum is approaching an important time with the upcoming “Constantinople” hard fork upgrade scheduled for October. ETH developers have been struggling to reach a consensus on the changes ahead of the hard fork. A Bitrates writer commented on an approaching “difficulty bomb” in late 2019, when ETH will become harder to mine. Some developers are worried about the pending upgrade, which includes a decision about the rate of block rewards. It was argued that leaving the block reward at $3 would only make ETH mining profitable for large operations, yet reducing the reward too much may dramatically alter the price of ETH.

It’s likely that the hard fork issues have been a large part of the drag on the price, whilst the comments from Vitalik Buterin over the problems facing ETH also hurt. Regardless of these issues, Ethereum believers can now invest at 25% of the May price. ETH is at a strong support level and may dip through, however getting back above the $200 level can open up a move higher with the $300 level being the next resistance on the road back to $500. Short positions in Ethereum have reached a record high of 208,000 on the Bitfinex exchange, so it’s possible that we could see a short squeeze in ETH, which would fuel another rally higher.

DASH

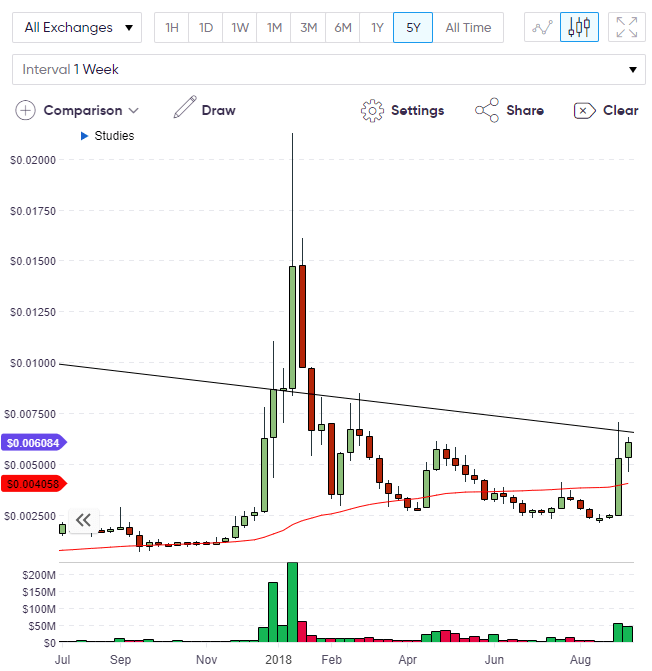

The price of DASH is up over 8% in the last 24 hours and this is a positive sign for the week ahead. DASH had seen two bullish weeks on large volume and those gains were not damaged with last week’s selling in the overall cryptocurrency market as DASH still trades above $200.

The price has rallied after figures showed a further ramp in business adoption of the DASH coin. With 3,000 merchants supporting the coin, this was a surge from the 2,300 reported 15 days ago. Many of the businesses supporting DASH were in Venezuela, which I wrote about in a previous article.

DASH is currently the number 11 coin by market capitalization with a value of $1.68 billion, however, a place in the top ten is a possibility with Cardano holding ninth on a value of $1.95 billion.

The next target for DASH is the $300 level and if we see that level taken then the moving average at the psychological $500 level would prove a more stubborn resistance level.

DOGE

The price of DOGE has managed to hold onto the strong rally of the week and has produced a bullish close, which may hint at further gains this week.

DOGE blasted higher on the week with news of a bridge between Dogecoin and Ethereum in a development which was tagged “Dogethereum”. News of a listing of Dogecoin on Yahoo Finance was also a surprise with DOGE being the only other coin rubbing shoulders with the industry standards of BTC, ETH and LTC on the world’s leading financial website. Yahoo allows trading through a partnership with “Tradeit” and this could be a game changer for DOGE with the coin now being offered to Yahoo’s 70 million unique monthly visitors and being the cheapest coin available.

XMR

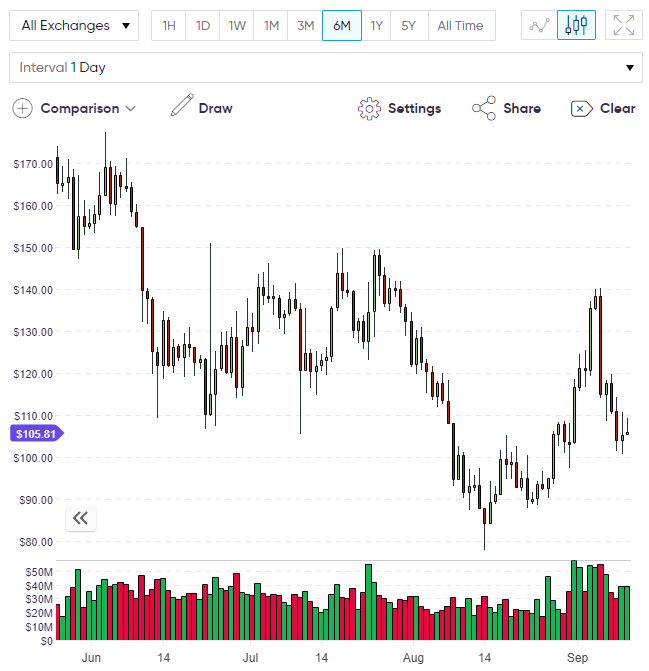

The price action in Monero has been disappointing with the coin failing to hold onto its recent bull run. XMR had managed to rally from a low of $80 in mid-August to test $140 at the beginning of September. The last five days have seen a pullback to trade above the $100 level, however, this is still in contrast to many coins that have lost value in recent weeks.

Monero was boosted by a report from Satis Research which saw a one-year price target of $1,476 in XMR due to the privacy aspects of the coin, with the company also seeing a 10-year target of over $2,900. These are very bullish numbers and may be a marketing ploy by the research company, however, the 10-year Bitcoin target of $143,000 is reasonably low compared to other high-profile cryptocurrency bulls.

The move in XMR was likely driven higher by large investors and this explains the rise in volume, followed by a pullback closer to daily trading volumes. The recent highs of $140 will be the next resistance for a move higher.

Disclaimer: information contained herein is provided without considering your personal circumstances, therefore should not be construed as financial advice, investment recommendation or an offer of, or solicitation for, any transactions in cryptocurrencies.