New Study Scapegoats Tether for Bitcoin’s Bull Run

Jun 14, 2018, 11:19am

A recently published study ties the price of Bitcoin to the issuance of Tether tokens, indicating the likely manipulation of crypto markets.

A recently published study has once again tied the price of Bitcoin to the issuance of Tether tokens. The new study uses “algorithms to analyze blockchain data, [and finds] that purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices [and other major cryptocurrencies]”.

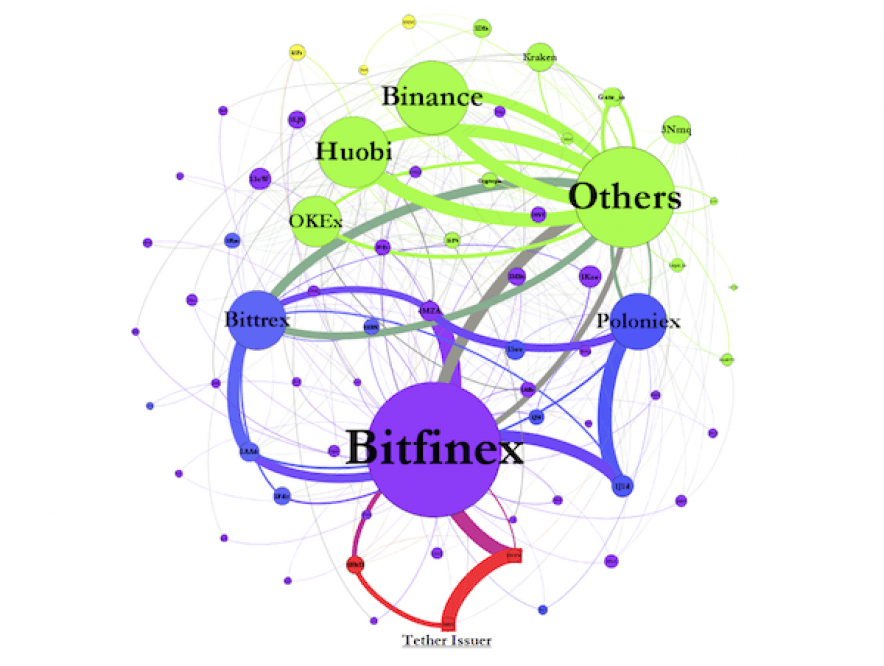

Compiled by John Griffin, finance professor at the University of Texas, and graduate student Amin Shams, the study paints a picture of the flow of Tether from its origin address to all major players in the crypto market, with the majority of volume filtering through the Bitfinex exchange.

By mapping the blockchains of Bitcoin and Tether, we are able to establish that entities associated with the Bitfinex exchange use Tether to purchase Bitcoin when prices are falling. / John M. Griffin & Amin Shams

Through an admirable amount of data analysis, the study concludes Tether issuance is purposefully timed and executed in a suspicious manner, and this has allowed the operators of Bitfinex (and Tether) to buy cryptocurrencies on other exchanges when prices are low.

Overall, our findings provide substantial support for the view that price manipulation may be behind substantial distortive effects in cryptocurrencies. These findings suggest that external capital market surveillance and monitoring may be necessary to obtain a market that is truly free. More generally, our findings support the historical narrative that dubious activities are not just a by-product of price appreciation, but can substantially contribute to price distortions and capital misallocation.

Bitfinex and Tether have been the central focus of a growing suspicion in the crypto community since they were subpoenaed in January by the CFTC. While the two companies claim that all Tether (USDT) tokens are backed by USD reserves, neither has provided proof of their claims. Additionally, the companies did not initially divulge the fact that they were created and run by the same people, something that was leaked via the paradise papers, leading many to speculate the two entities are working together towards some sort of collusion.

The new data provided by Griffin and Shams does not hinge on hard evidence or admissions of guilt in order to draw its conclusions, but rather thorough data analysis and a systematic approach to hypothesizing market movements in the cryptosphere. This means that the study does not prove that Bitfinex and Tether are manipulating markets, it simply provides indication that collusion is a likely scenario. Yet, many believe studies such as the above are just more reason to believe there is a web of corruption at the center of crypto markets, and Bitfinex and Tether are the fuel used to give the crypto-elite an unfair edge in today’s crypto markets.