Crypto Dragged Lower by Broad Market Sell-Off, ETH, ZRX, ZEC, LTC Analysis Oct. 12

Oct 12, 2018, 2:03pm

Cryptocurrency markets have been dragged lower by market fear spreading through the stock markets and bonds. Coinbase moves ahead with 0X listing

A sell-off in financial markets spread fear amongst investors this week and led to a lack of buyers in cryptocurrency markets, dragging prices lower in the major coins. The U.S. Dow Jones Index was down after 2.7% intraday and had given up 1800 points on the week before a rebound. A move higher in the futures contract this morning implies that Friday will open higher and this has seen a return to green in the cryptocurrency markets, with much of the top ten coins up 4-7%.

A report into hedge funds has seen a rise in cryptocurrency funds launching in 2018. Crypto Fund Research showed a decline in traditional hedge funds and a strong rise in crypto funds. This also highlights the mood in the traditional finance world, where stock-picking is becoming harder at elevated valuations and many funds are struggling for positive returns with emerging markets and BRICs countries (Brazil, Russia, India, China) being hit. The recent stock sell-off is reflecting the many risks that are on the horizon with inflation, trade wars, and low-interest rates.

The fund research noted,

Though about half of the crypto hedge funds launched this year are based in the US, the rise of the crypto fund is a global phenomenon. Australia, China, Malta, Switzerland, The Netherlands, and the United Kingdom have all seen multiple crypto hedge fund launches in 2018.

The cryptocurrency market is still hovering at the $200 billion market cap level that has provided a safety net in recent months. This is still a key area to watch in the coming weeks.

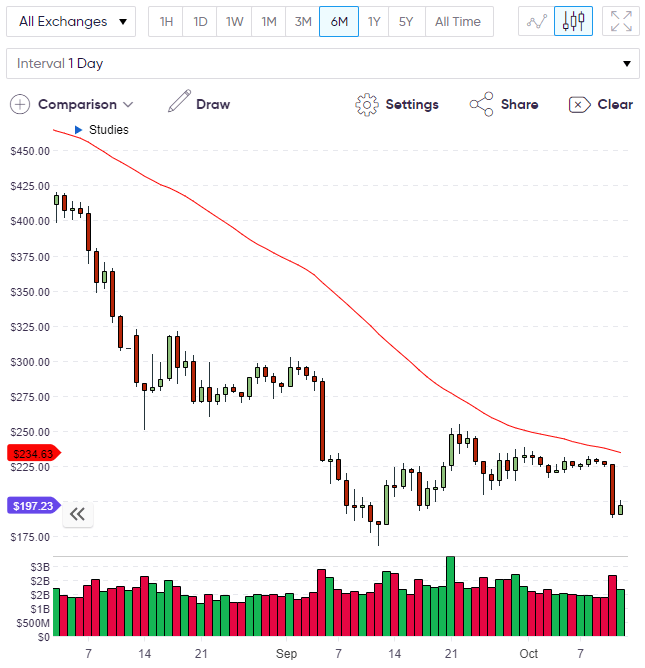

ETH

The price of Ethereum was hit by a sell-off on Thursday which shows the spread of panic that is unrelated to the fundamentals of ETH. The price has bounced this morning and is testing the $200 level as the market still finds it hard to create meaningful gains. The 50 moving average around $225 would be the first target for an upside move but that may not be possible until next week.

ETH got a boost from news that Coinbase would be listing 0x on its Coinbase Pro trading platform. The move represents the first time that the exchange has supported an ERC-20 token which run on the Ethereum network. ZRX is not yet available on the standard Coinbase exchange but that move is closer with the Pro addition.

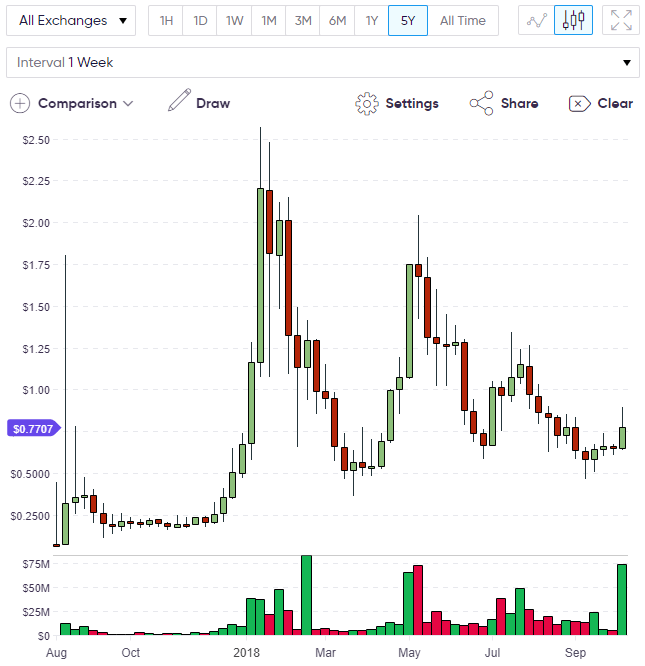

ZRX

The Coinbase news has boosted the price of 0x with the market up 13% for the second-largest gain on the day. The Coinbase rumors and the confirmation have seen continued strength this week and 0x is trading at $0.77, where some weekly resistance sits. The chances of a move to the $1.00 level is increasing and a strong weekly close would set that up. ZRX has 540 million coins in circulation so the move higher may not be as sharp as expected with the listing news close to being priced into the market. However, the listing on Coinbase will still bring some new volume to ZRX.

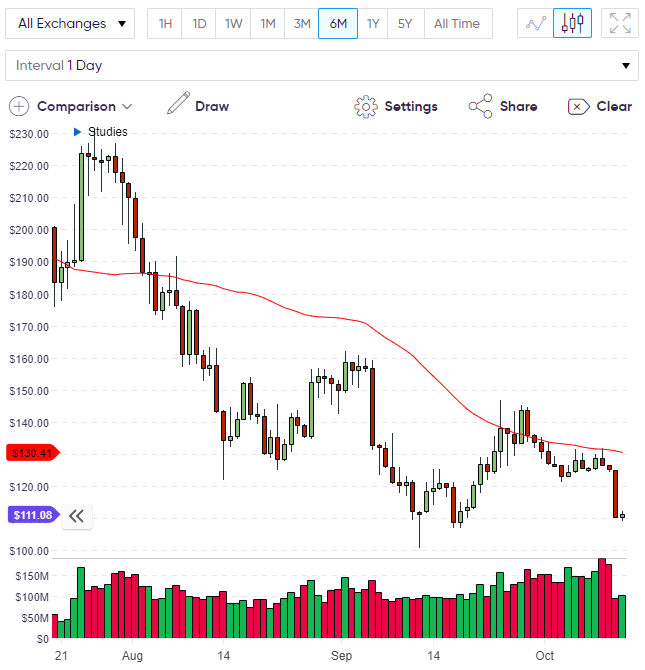

ZEC

The price of ZCash looks a lot like Ethereum and the sell-off yesterday is identical, which highlights the “group-think” of markets. The crypto market is hovering at the same support levels which probably reflects the fact that “whales” are propping up coins like Bitcoin at key support but we are not getting follow-through to the upside due to the lack of news over regulation and the lack of new buyers seeing this as a good opportunity right now. This could change soon and the continued support may be a base for an upside move.

ZEC dumped to the $111 level and will need a few days to repair the damage. It’s maybe possible that these coins are simply retesting support for a potential double bottom. The 50 moving average is at $130 and this is the first target for a move higher.

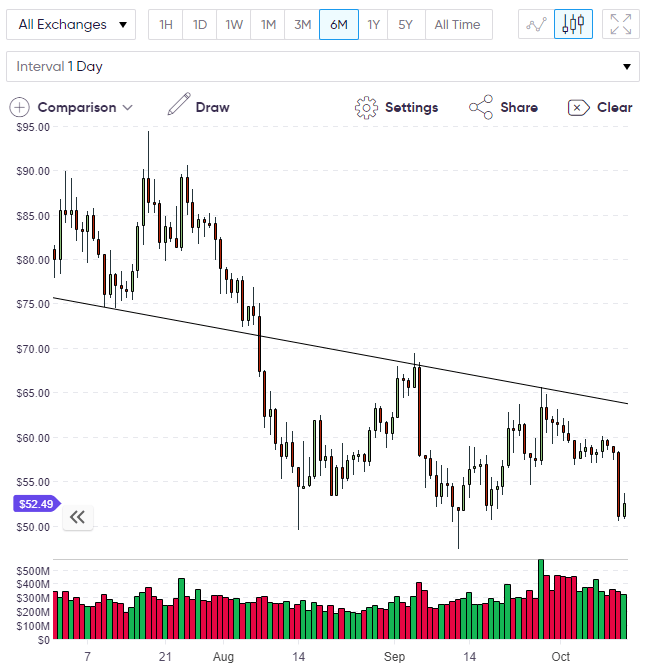

LTC

The bearish moves this week have taken Litecoin lower but the price is still above the key $50 level and this will be important as we move towards the weekend close. If we hold the $50 level again then we will have resistance up at $65 again so the moves required in LTC would need to see some news catalyst to create a strong rally.

The stock markets are looking to stabilize this week. The S&P500, however, closed under its 200 day moving average and there is still a lot of risk in the market with the US/China trade war for example. Although crypto markets were dragged lower, this could change if the panic escalated as Bitcoin would be used as a safe haven once more. An article I read this morning highlighted gold’s changing dynamic where it is not the go-to safe haven that it once was due to problems with storage and transfer. Crypto would provide a digital store of value as I have mentioned in the past.