Wrapped Tokens, Crypto-Derivatives and Candidate Ethereum Standards (ERCs).

Feb 20, 2019, 8:52pm

Introducing Ethereum wrapped tokens, managing DAO institutional/regulatory bodies, Ethereum standards and their specifications.

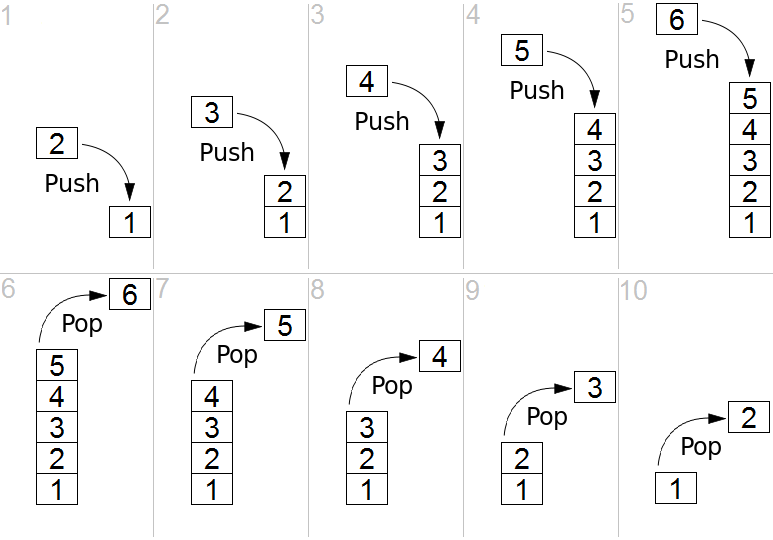

Architecting an open permissionless financial system has been one of Ethereum’s main ambitions, which is why it came about as implementing the blockchain paradigm (of a “a transactional singleton machine with shared-state”) in a generalized fashion, capable of accommodating a wider range of applications on a single platform (compared to the somewhat strangely primitive, steampunk character of Bitcoin). For that purpose the Ethereum blockchain is coupled with a simple stack-based virtual machine (the EVM, Ethereum’s general-purpose replicated “world computer”) as the network’s runtime environment for executing code residing on the shared ledger (carried out as blockchain transactions that use the ledger to globally synchronize the current state of the system across the network).

These persistent scripts, so-called “smart contracts”, are triggered to execute when a transaction calls their account address. They can be thought of as stateful objects or automata that contain some custom logic exposed through API functions within the distributed peer-to-peer network and its address space, that way capable of serving the role of anything from a virtual safety deposit box, a pawnshop or an exchange, to a vending machine, a certificate registry or a notary of some sort, to a formalized pyramid scheme, a game or a money sucking trap of some sort or another. So, within the Ethereum ontology, one deals with designated objects identified through their public key or address – be those wallets or contracts.

These components together give the necessary base conditions for articulating more complex value statements in an open permissionless peer-to-peer network, allowing for building protocol overlays, composing specific dApps and refining interfaces that target particular audiences and interest groups as going further across the different levels of abstraction – from low-level bytecode to back-end contract logic and web application front-ends. Trying to extend Bitcoin with protocol overlays in efforts to accommodate the representing of other kinds of assets proved insufficient or inadequate based on that foundation. (A protocol overlay is similar to how HTTP, for instance, runs on top of the TCP/IP stack in the application layer of the Internet protocol suite, i.e. is an overlay on top of it.) Well-known efforts to formalize useful Bitcoin overlays and associate real-world assets with Bitcoin addresses were mastercoins and colored coins, the limitations of and frustration with which had also been one of the motivations driving the creation of Ethereum.

Ethereum took the basic premise of Bitcoin at the time, advancing the general concept a step further, beyond primitive UTXO coin payments (the state of the Ethereum blockchain is defined by record-keeping of accounts and their balances, rather than keeping track of unspent transaction outputs) and into something that could possibly lay the foundations for supporting an entire financial system, capable of expressing more sophisticated financial products and instruments, financial and crypto derivatives and catalyzing experimental crypto-economies (which had until then been either practically impossible or difficult and prohibitively expensive to implement within the constraints of the more conservative Bitcoin protocol). Inevitably, this also comes with its own set of problems along its path of trial-and-error (most notably, the catastrophic DAO hack which cooled everybody’s enthusiasm for a long while), but a commitment to non-stagnation and continuous experimentation/innovation has also been a defining trait of Ethereum’s ethos and community.

As Ethereum matures to develops into a decentralized, open financial system, parallel to the traditionally existing structures, advanced mechanisms and means for abstracting various kinds of assets and reliably capturing value from ‘outside’ (e.g., tokenizing commodities and precious metals, pegging to fiat currencies and currency baskets, etc.) become necessary, with various formulas and protocols proposed and discussed, some of which eventually getting implemented and gradually adopted across platforms and applications within the growing ecosystem.

Cross-chain interoperability and exchangeability of diverse crypto-assets across different systems and bridging between platforms is among the list of priorities in the present state of crypto-economic affairs and doing that via stablecoin mechanisms is one tendency right now which, combined with open standards and common protocols (such as the 0x protocol for decentralized off-chain exchange) together bring a set of primitives and engineering tools, easily integrated with all kinds of applications in more sophisticated structures which gradually contribute to organic growth and increased liquidity, accelerating network effects (though, as they say, Rome wasn’t built in a day).

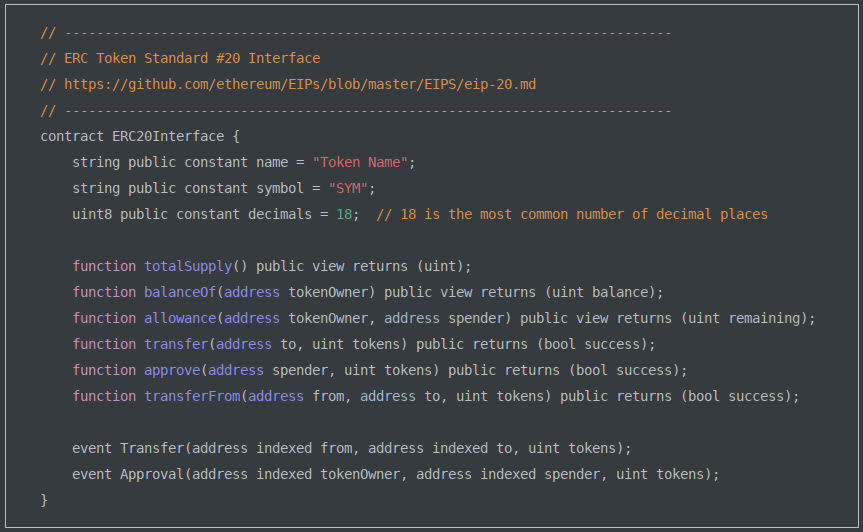

Established technical standards and commonly recognized conventions and routines are also essential to codifying universally agreed upon formats and procedures, and some such as the ERC-20 specification of a token contract have been tremendously successful (at the cost of triggering a wave of scam-in-a-box ICOs throughout 2017-2019, as nobody would deny), while others, such as the ERC-721 standard for non-fungible tokens and collectibles might have been a bit premature, considering the subsequent clogging of network capacity as a result of the somewhat bizarre Cryptokitties mania. (All of which highlight the necessarily experimental nature of the project – in both the technical and societal sense of an experiment.)

Another up-and-coming mechanism for representing asset-backed tokens was introduced with so-called “wrapped” tokens. Which basically means converting an asset to an ERC-20 compatible token (and thereby, integrating it within Ethereum’s crypto-economy), usually carried out in two ways:

- Algorithmic, partially or entirely controlled by smart contracts and autonomous feedback mechanisms (e.g., locking an amount of collateral and issuing an equivalent amount of some other token or asset or automatically diluting the supply of some DAO governance tokens to re-calibrate a stablecoin’s peg when market value falls below a certain critical threshold, as the case with MakerDAO, etc.), or

- Semi-centralized/Federated by a consortium DAO of involved institutions and relevant bodies, trustworthy agencies and reputable parties which vote on decisions, proposals and system parameters and, importantly, operate transparently with verifiable proofs of reserves, registered and observable on the blockchain.

Obviously, this isn’t a completely trustless arrangement where automation and algorithmic enforcement perfectly substitute for trusted third parties, system operators and an administrating bureaucracy (if it were that, it would quickly slide into inertia). What it tries to develop and institute instead is a regime of operating and an environment naturally conductive of healthy, beneficial market and governance behaviors via game theoretic alignments pulling the right actors and expertise where they naturally belong. While at the same time weeding out and discouraging other undesirable behaviors and ensuring there are no glaring, immediate technical or other loopholes to exploit so that one could relax assumptions under some clearly defined circumstances.

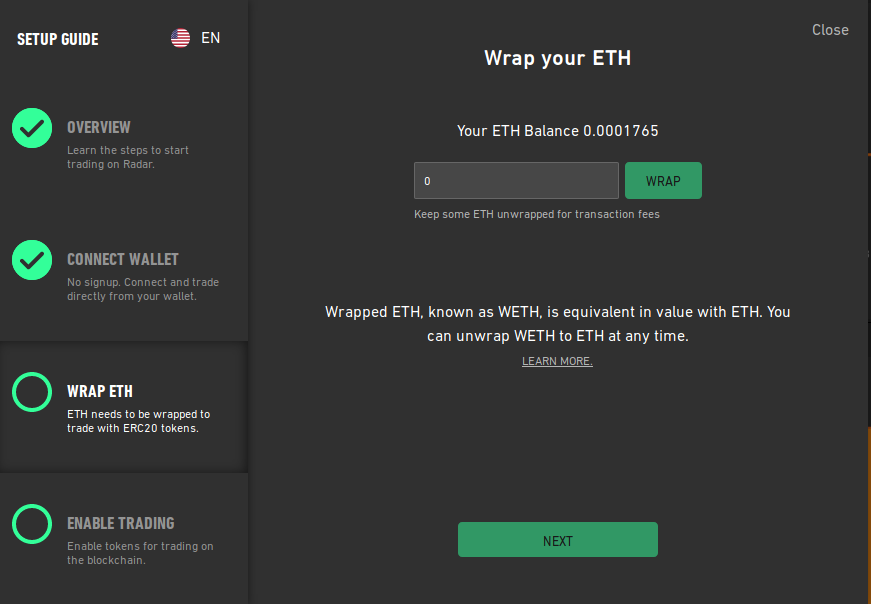

WETH: Wrapped Ether

Wrapped Ether or WETH is an ERC-20 compliant Ether. Since Ether (ETH), Ethereum’s native proto-currency, does not itself conform to the ERC-20 standard specification (that defines how Ethereum tokens, or Ethereum-derived meta-currencies, are to be transferred and exchanged between one another while keeping a consistent record of the interactions within the Ethereum network), wrapping Ether as an ERC-20 eliminates the handling logic specific to ETH, allowing for directly trading it with other tokens on decentralized platforms within the ecosystem (such as Radar Relay). Technically, it’s a stablecoin pegged to the price of Ether and implementing the standard token interface for the purpose of building more efficient and performant dApps, introducing standardization across them and establishing safer contract coding conventions.

“Wrapping” ETH really means exchanging it for an equivalent amount of WETH via a smart contract, while “unwrapping” it back to plain ETH means exchanging it back again (the smart contract instituted on the immutable ledger acting as a sort of back and forth vending machine). WETH is usually acquired via Radar Relay or 0x Portal through the provided interfaces there. Wrapped Ether (WETH) and its contract code can be seen on-chain on etherscan.io and a version of the Solidity code is also available on Github.

Sending ETH to the contract with the CreateToken function sends back the equivalent amount of “wrapped” ERC-20 ETH while calling the withdraw function with the number of tokens to redeem destroys them, sending back the ETH deposit. In a word, WETH makes Ether behave and transact like a token, which may be practical in the case of many applications (such as decentralized exchange). Eventually, WETH may become replaced by some Ethereum standard or another (something along the lines of ERC-223) or made obsolete after some upgrades to the codebase and the EVM itself.

WBTC: Wrapped Bitcoin

WBTC is a fully Bitcoin-backed (in 1:1 ratio) DAO-managed ERC-20 that officially launched on January 31st (now available for trading on several platforms). Tokenizing Bitcoin on Ethereum allows for much faster and cheaper Bitcoin transactions, enabling a whole host of Ethereum dApps to integrate and begin using it, that way giving both Bitcoin and Ethereum additional exposure and liquidity (most decentralized exchanges have only ETH/token and not BTC/token pairs, a gap WBTC is meant to bridge). One can think about it as an Ethereum certificate for ownership of bitcoin.

Wrapped BTC is governed by a consortium of institutions (below) performing different roles in the system. BitGo is the custodian that holds the assets (Bitcoins) and the keys to minting WBTC tokens. Kyber and the Republic Protocol are the authorized merchants who purchase the minting of tokens and from whom tokens are burnt as bitcoins enter into and exit out of circulation in Ethereum exchanges.

Each merchant has a key for initiating minting and burning of wrapped tokens. After acquiring wrapped tokens, users can transact them like any other ERC-20. Contract changes, adjustments and additions or removals of custodians or merchants are controlled by a multi-signature contract, the keys to which are held by institutions that are part of the managing DAO.

Custodian: BitGo

The custodian provides reliable, institutional-grade security for the tokenized ERC-20 Bitcoin and all WBTC in circulation is fully-backed, verified through on-chain proof of reserves. As the world’s largest processor of on-chain BTC transactions (handling around 15% of all Bitcoin transactions globally), BitGo specializes in providing cryptocurrency financial services and regulatory compliant custodial solutions with high-security guarantees.

In 2018, BitGo launched the BitGo Trust Company introducing BitGo Custody as the first qualified purpose-built custodian for storing digital and crypto-assets. For WBTC, BitGo provides a pooled cold wallet (using off-line multi-signature keys) for supplying merchants and performs the minting (creation of WBTC) and burning (reducing the supply of WBTC when “unwrapping”) operations that can be tracked by anyone through the public blockchain explorer.

Essentially, WBTC holders hold BTC by proxy via BitGo and on-chain contract arrangements. Upon redemption of BTC claimed by the ERC-20 coupon, the tokenized WBTC is burnt out of circulation. Making sure of the content of reserves is easier than, for example, with the notorious Tether (USDT) stablecoin since the accounting of both blockchains is public and open for audit and analysis at any time.

Merchants: Republic Protocol and Kyber Network

Merchants are the parties authorized to request minted WBTC tokens from the custodian. They are the institutions to which wrapped tokens are minted to and burnt from, in possession of the keys initiating either operation. Merchants play the important role of distributing the tokens, in this case, taken up by Kyber and Republic Protocol. Decentralized exchanges like these seem to be increasingly positioning themselves as Ethereum institutional and regulatory agencies, working to utilize the full potential of what Ethereum can offer.

Kyber’s on-chain liquidity protocol enables instant token swap services that could be integrated into any application, while Republic Protocol provides dark pool exchanges for trading large volumes of assets via hidden order books, leveraging secure multi-party computations and zero-knowledge proofs (zkSNARKs). The Ren Project evolved from Republic Protocol as a separate virtual machine (RenVM) built around zero-knowledge protocols and strong privacy and security guarantees. When acquiring wrapped tokens through an authorized merchant, KYC’d users can atomically swap their bitcoin (via Kyberswap) for an equivalent amount of WBTC.

Other DAO Members

WBTC launched with a total of 26 partners and 15 DAO members. Among them are MakerDAO, Dharma, Gnosis, OmiseGO, Set Protocol, Kyber, BitGo, AirSwap, Blockfolio, Compound, Hydro, and others. DAO details such as member addresses can be seen here and the applications to join is open to all that wish to apply.

MakerDAO’s address for WBTC Dao Membership: 0xd5d4aB76e8F22a0FdCeF8F483cC794a74A1a928ehttps://t.co/eflCGm5BFd#WBTC #WBTCDAO

— Maker (@MakerDAO) January 30, 2019

Overall, this introduces another important metric of measure in the crypto-economy given Bitcoin’s status in that landscape. It must be reminded that the same thing is always much easier to implement in Ethereum than it is in Bitcoin, but sidechains as such are accountable to the main chains they derive from. Some decentralized exchanges can be conceived of as sidechains. And so-called Bitcoin maximalism appears to be a strange, supposedly radical expression of the crypto-libertarian ideology which claims influence from Austrian economics. One couldn’t help but sometimes wonder, what would Hayek do/think about all this?

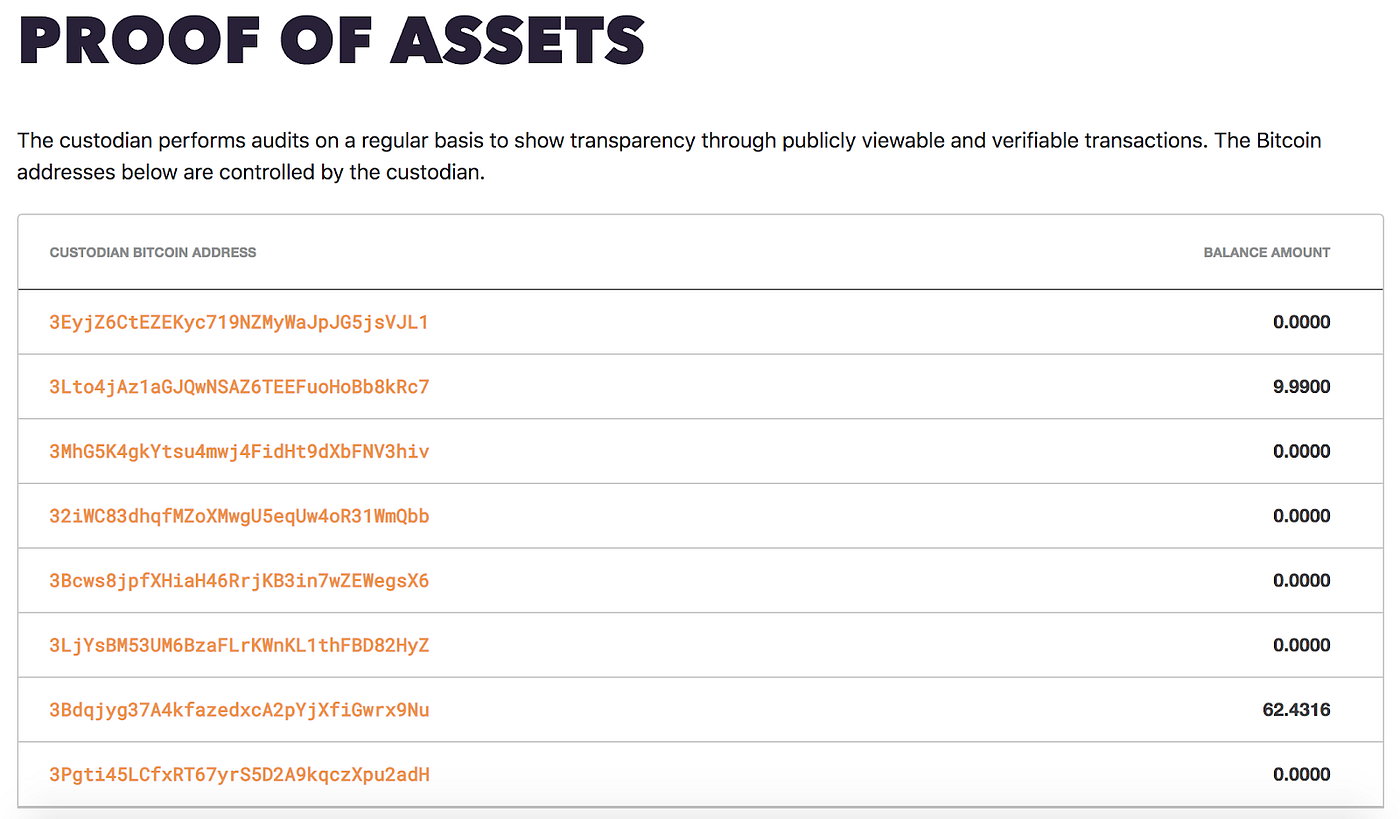

Wrapped Bitcoin Proof of Assets and Reserves

Bitcoin reserves backing WBTC can be publicly verified by opening the WBTC network order book. The “on-chain validation” link leads to the proof of asset page at wbtc.network/dashboard/audit. The token contract link on Etherscan is found here. All associated contracts have been audited by established firms including Solidified Technologies, ChainSecurity, Coinspect, and are publicly available. Any ERC-20 compliant Ethereum wallet can interact with WBTC by adding the token address: 0x2260fac5e5542a773aa44fbcfedf7c193bc2c599.

Public accountability and transparency are what is of critical importance in that context, not forgetting the original motivation and raison d’être of distributed crypto-economies and so-called crypto-currencies post-2008. But no less important is the issue of reconciling traditional structures and institutions with this newly emerging socio-technical paradigm of institutional technology and socio-economic coordination. Particularly given how the two are in many fundamental ways different in nature (as originating from and building upon an already globally distributed technology whose character is defined by open access and hyper-connectivity, or is otherwise rhizomatic).

DigixDAO and the DGX Token: Tokenized and Notarized Gold Assets on Ethereum

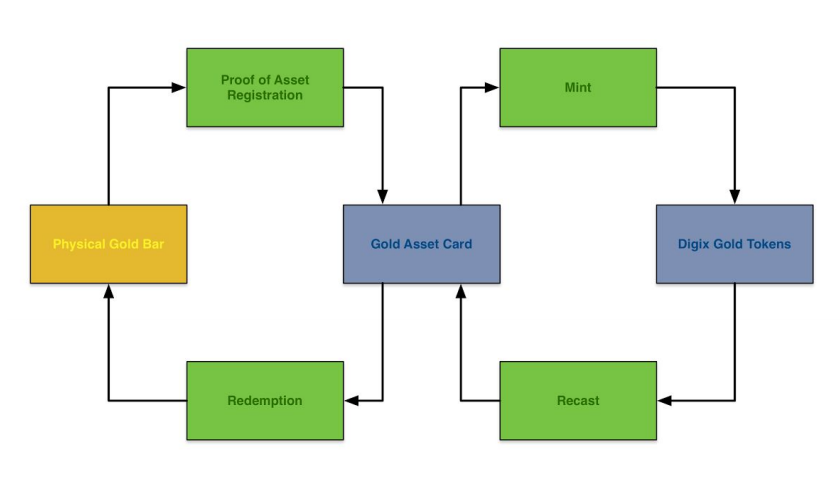

Digix is a Singapore-based early Ethereum DAO dedicated to tokenizing gold and precious metals within Ethereum via yet another Proof of Assets (PoA) protocol. At each step of the PoA process, proof records and audit trails are published permanently with IPFS and Ethereum. DGX tokens are divisible units representing one gram of gold redeemable from the custodian vault (The Safe House, located in Singapore).

PoA asset cards are stamped with the digital signatures of the entities involved in the chain of custody (and further validated with proofs of purchase and depository receipts, parmanently uploaded onto IPFS), namely Vendor, Custodian and Auditor. The Vendor, ValueMax Singapore, is a publicly listed company that sells London Bullion Market Associate certified gold bullion bars. The independent Auditor, Bureau Veritas Inspectorate, a recognized world leader in testing, inspection and certification services (with a 180 years history), checks the quality and quantity of the gold every quarter.

The participating Custodian Vault, The Safe House, is located in Singapore. Their vault can store up to 30 tons of gold, but in the future, Digix will look to include more vaults around the globe for regulatory redundancy. The Safe House takes full advantage of Singapore’s jurisdictional and counterparty risk protections, particularly focusing on and specializing in providing such safe haven storage vaults.

Similar to the Maker DAO, the Digix DAO operates via two distinct tokens – a governance token (DGD) that grants holders the rights to vote on how the DAO allocates funds and allows them to make “active managerial decisions to any proposals submitted to DigixDAO.” And the DGX token, the actively managed product which the DAO ensures it represents a gram of redeemable gold (which can be purchased from Kyber or directly from the Digix marketplace app).

The big advantage tokenized gold has over traditional ways of trading it is the divisibility of the token without incurring any additional costs and “premiums”. Also, it introduces a valuable kind of stablecoin to the Ethereum ecosystem, one which is not too correlated with the ‘crypto’ market overall and which the Maker DAO has planned integrating into its multi-collateral system (allowing to create CDPs, collateralized debt positions, with DGX and other kinds of assets).

sETH: Wrapped Short and Leveraged Positions via dY/dX Protocol

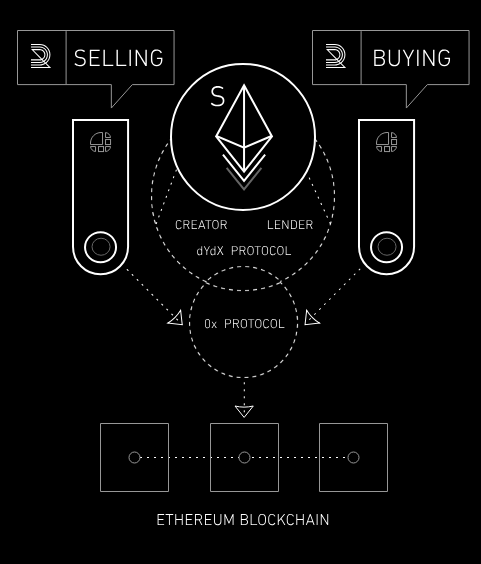

The dY/dX protocol is an Ethereum protocol for expressing crypto-derivatives (asset classes that derive their value from some underlying blockchain-based asset) and enabling margin trades. Derivatives are considered factors increasing market efficiency for the underlying asset by facilitating price discovery and allowing individuals to express more complex statements on price and volatility. As such, dY/dX consists of a set of protocols specifying the operation and execution of different types of financial products.

The “dY/dX” notation (also called Leibniz’s notation) is known as the derivative operator, the basic rule of financial derivatives and formula for generally expressing gradients of difference (implicit differentiation) mathematically. If dY denotes the rising gradient (change in Y), dX is the lower bound or run gradient (change in X), and dY/dX is really (dY2 - dY1)/(dX2 - dX1) – the remainder from the difference. The dY/dX protocol makes use of 0x channels for decentralized off-chain exchange. Lenders sign a message in which they offer loans which are aggregated and listed on other platforms (both on-chain and off-chain).

A trader can open a margin position by sending a transaction to the dY/dX margin smart contract that contains the offer and locks in the deposit sent for issuing the market position contract. The on-chain contract autonomously mediates the exchange and issuing of margin trading short and long positions (as Nick Szabo first gave the example of the vending machine as the primitive precursor of smart contracts – they execute some instructions upon being triggered by what they’ve been programmed to react in response to).

Short Tokens and Margin Trading

In a margin trade, a trader borrows an asset and promptly trades it for another asset. The asset must be repaid to the lender, usually along with some interest, at some later specified date. Margin trading includes both short sells and leveraged longs. In a short sell, an investor borrows an asset and sells it for the quote currency, making money should the price of the asset decrease (as rebuying the asset to pay back the lender costs less than what it was originally bought for). The investor loses money if the price of the asset rises, since, vice versa, rebuying the asset to repay the lender would now cost more than the original sell-price.

That considered, a Short Token is a short position wrapped in an Ethereum token. Short tokens can be directly traded via Radar Relay like any other ERC-20. When holding a Short Token, one’s return depends on the inverse price movement of the underlying token. In sETH/Dai for example, when ETH goes down, the price of sETH goes up (Dai, the MakerDAO managed stablecoin, is used to fund, buy and sell the token). Short tokens are useful in hedging risk and gaining upside in a downtrend, adding another market lever to Ethereum and the crypto-economy.

Short token positions are opened via the dY/dX protocol and last for 28 days. By the end of the 28th day the token expires and locks to the market price. Every short token is labled by the asset being shorted and the expiration (e.g., sETH 6/11). Short tokens can be either sold on Radar Relay or paid out upon expiration at expotrading.com.

dY/dX along with projects like the Dharma protocol for tokenized debt issuance are important developments for Ethereum and exemplify the possibilities of what could be accomplished within such distributed framework of decentralized exchange unbound from cultural and geopolitical constraints and state-governmental and bureaucratic regulatory limitations.

Universal Ethereum Standards and Contract Form Templates

Universally accepted technical standards that set a commonly accepted frame or format of how particular assets and objects are represented, registered and accounted for in the shared ledger are obviously an important component in ensuring frictionless flows of value, exchange and ease of interaction. EIPs (Ethereum Improvement Proposals) become ERCs (Ethereum Request for Comment) upon community approval. The informal governance process of Ethereum is similar to the well-known RFCs (Request for Comments).

An RFC is authored by engineers and computer scientists that may come from many different agencies and bodies such as the Internet Engineering Task Force (IETF), the Internet Research Task Force (IRTF), the Internet Architecture Board (IAB). They take the form of a memorandum describing methods, behaviors, formal procedures, research or innovations applicable to the workings of the Internet and Internet-connected systems. Ethereum takes the same approach to standardizing protocols, methods and formal specifications within its infrastructure.

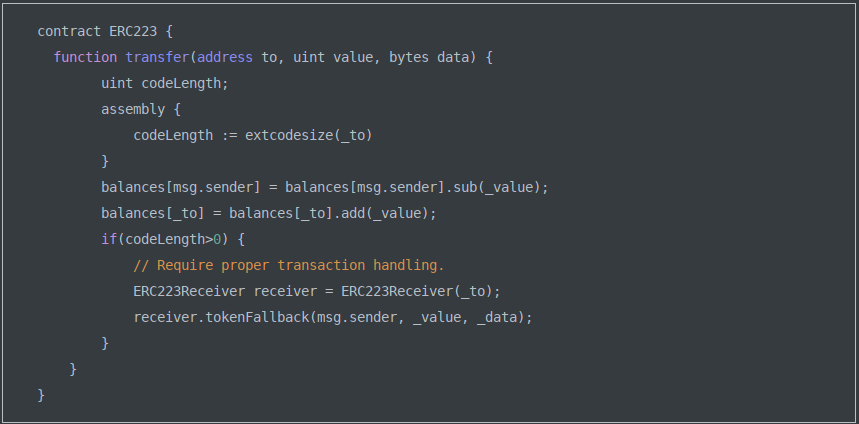

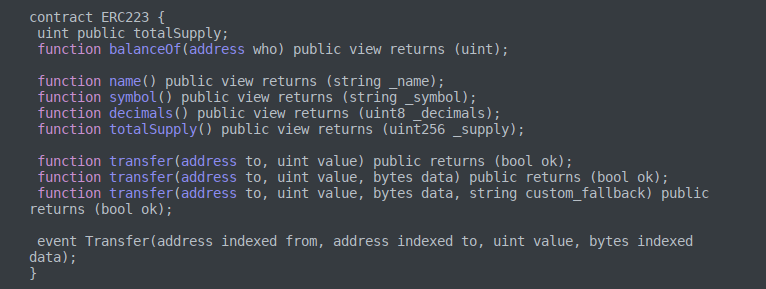

ERC-223: Token with Transactions Behaving like Ether Transactions

Originally proposed by an Ethereum Classic dev (Dexaran), ERC-223 defines the inverse of what WETH does – it makes token transfers behave like Ether transactions and offers a solution to losing tokens when mistakenly sending them to contract addresses. ERC-223 utilizes event handling that prevents tokens from being lost in unhandled transactions, making the transfer function throw an error on invalid transfers and canceling the transaction so no funds are lost, irreversibly locked in contracts that do not support/recognize them.

The economy of ERC-223 is such that users can send tokens to both contracts and wallets (both represented by public addresses on Ethereum) with the same function in a single step (instead of two, as commonly done in ERC-20), thereby increasing efficiency and lowering gas expenditure. At present, however, most Ethereum wallets don’t support ERC-223 tokens.

Instead of abstracting away at the user interface level of an application (with the ERC-20 approve + doSomething) and therefore needing to trust the UI/UX developers, ERC-223 follows the Ethereum Classic reasoning of “code if law”, implementing security on the lower levels.

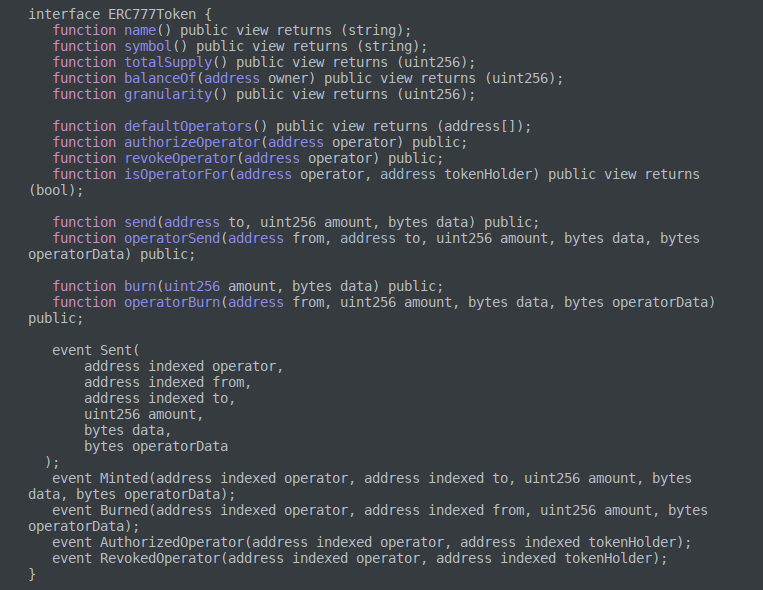

ERC-777: More Transaction Handling Mechanisms, Token Registry and Event Hooks

Another fungible token aiming to improve upon and solve the issues with ERC-20 that relies on the ERC-820 (also backwards compatible with ERC-20). ERC-777 is focused on providing a wide range of transaction handling mechanisms and advanced features for interacting with tokens. It is highly customizable, allowing people to build extra functionality on top of tokens (such as a mixer contract for improved privacy or an emergency recovery function for bailing out upon loss of private keys).

ERC-820 uses a central registry of smart contracts on the Ethereum network. ERC-777 takes advantage of the same central registry to make contract functions easy to verify and instead of the 'transfer' and 'approve' functions it uses a 'send' function for transferring Ether itself (similar to the ERC-223 'transfer'). Another aspect of ERC-777 is allowing for ‘approved operators’ – parties that can approve smart contracts to move tokens on their behalf.

Both contracts and regular/external addresses can control, accept and reject which tokens they send or receive via the tokensToSend and tokensReceived functions (also that way avoiding the double call approve/transferFrom required in ERC-20). Wallets that do not contain the tokensReceived function can be backwards compatible via a proxy contract deployed for the wallet.

A Solidity reference contract is available on Github here. The EIP describing all the methods and rationale in more detail is found here.

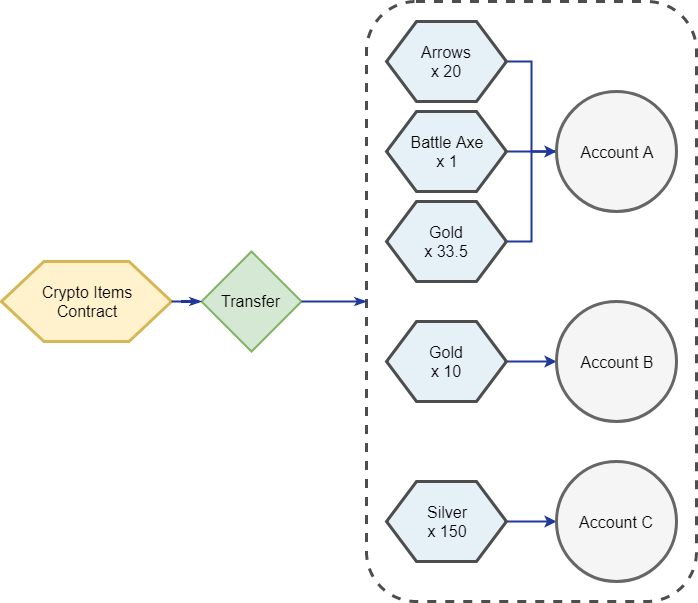

ERC-1155: A Multi-Token Standard

The ERC-1155 was announced by Witek Radomski, the CTO for the video gaming company Enjin. ERC-1155 takes a new method to describing tokens (non-fungible and otherwise). Items are stored in a single contract with the minimum possible amount of data necessary to distinguish one token from another. The contract state contains configuration data per token ID and all the behavior governing the collection.

In ERC-1155, one can send any number of items to one or multiple recipients in a single transaction, reducing gas costs and congestion on the Ethereum transaction pool (as was the case with Cryptokitties and ERC-721). The transfer, approve, melt, and trade functions all take arrays as parameters, which lets one perform between 100–200 such operations packed in a single transaction.

An ERC-1155 minting service is available here, with tokens compatible with and supported by the Enjin wallet.

Summary and Conclusion

All the above should give one a good idea of the present state of development and maturity of Ethereum, as well as the explored avenues and areas of ongoing research. The direction Ethereum has taken significantly differs from the philosophy of Ethereum Classic, where a slower, more gradual and conservative approach to development and innovation is taken (one closer to the philosophy of Bitcoin). Regardless, one cannot deny that the entire space has been learning from the mistakes and mishaps of Ethereum, and while some never missed the chance to jump on the bandwagon of critique and tireless efforts to discredit and even disseminate aggressive, self-serving disinformation, others have quietly been taking notes on the side and yet others exploited opportunities to launch yet another “Ethereum killer”. Either way, the value Ethereum has brought to the space – in experience and knowledge (the value of well-documented failures is more valuable than that of accidental success and the following desperate attempts by others to replicate it or improve upon it) is undeniable.

And while nobody can know for sure how things will unravel in the future ahead, continuous experimentation and active community discussion and debates in the long road ahead are fundamental prerequisites to the possibility of success. The incubation and hype periods seem to have cooled down beginning 2019, entering a more mature, stable phase and one more critical, self-reflective and less ideologically driven. And in the historical juncture we seem to find ourselves at, this critical phase transition characterized by rapid loss of confidence in governments and public institutions and eroding trust in traditional structures and even capital itself, paralel structures and institutions that we could transit to or fall back on are of fundamental importance in preventing a possible collapse and disintegration down to simpler levels of organization and operation, or in other words, an entering into a period of a dark age. As such, frameworks like Ethereum seem to offer a possible safety net of security, as when things get too unstable and unpredictable capital tends to flee to safety. Stablecoins and the volatility insurance institutions like the MakerDAO seem to actively work on developing could prove tremendously important (with the introduction of multi-collateral Dai and support for a wide range of assets to hedge risk with), but we mustn’t forget that they are still in a way laboratories that need the parameters of reality and observing how assets behave and correlate in different circumstances. The periodic failures that take place are the price we pay for learning the way forward.

System-wide standardization and widely adopted simple mechanisms for smoothening friciton and paving the roads for capital flows are just as critically important, but we must also consider the levels of possible centralization they may in some circumstances introduce and what degree of centralization is acceptable in any particular circumstance. The Ethereum community has so far proven honest and genuine in their intentions, efforts and ethics and as such is self-regulating (despite the often unintended consequences), but we must always maintain a healthy and sober critical thinking attitude and extrapolate the effects of given set of conditions to their possible extreme manifestations, because as history has shown (for example), republics always tend to eventually develop into oligarchies just as stagnation (political, intellectual, economic) tends to allow corruption and rot to creep in. We must not forget our original motivations, neither allow them to turn into empty slogans of repetitive cliches. Instead of seeking opportunities to exploit quick profits in the rigged casino of the market, we should better consider investments and trading as making statements and pulling towards desirable futures to be. By making an effort to gain better understanding and not be cheated by people with questionable ethics, we contribute to the overall health and well-being of the system and by setting an example with what we do, we help trigger a cascading ripple effect across the system. We should consider things like Ethereum as toolkits and frameworks for building institutions – whether local, regional or international or commerical, financial, academic, professional or political. The rest is the creative efforts of our collective imagination and desire.

Links and Additional Resources

WETH website.

WBTC network official site.

Short tokens and dY/dX white paper.

Ethereum EIPs sorted in lists of categories.

Ethresear.ch, the official discussion forum for all things Ethereum.

The EVM specification known as the Ethereum yellow paper

The MakerDAO Medium and Rocketchat.

The OpenZeppelin repository of audited and secure Solidity contracts/implementations.

Kyber network (decentralized exchange) and the Kyberswap dApp for quick ERC-20 swaps.